3 0

Crypto Market Falls Below $3 Trillion as Undervaluation Signals Emerge

The cryptocurrency market is experiencing renewed selling pressure, with total market capitalization slipping below $3 trillion. This decline is partly due to the strengthening of the Japanese yen, which has caused risk-on assets like cryptocurrencies to decrease while safe-haven assets such as gold and silver are rising.

Crypto Market Undervaluation

- The crypto market has lost crucial support levels, with liquidations exceeding $670 million, over 85% attributed to long positions, according to Coinglass data.

- Santiment's analysis indicates a negative 30-day Market Value to Realized Value (MVRV) metric, suggesting potential entry opportunities as traders are holding at a loss.

- Major altcoins like Ethereum, XRP, Chainlink, and Cardano show MVRVs ranging from -5% to -10%.

- Bitcoin stochastic indicators are at low levels (15-16%), indicating oversold conditions, yet it continues to trend downward since peaking above $125,000 in mid-2025.

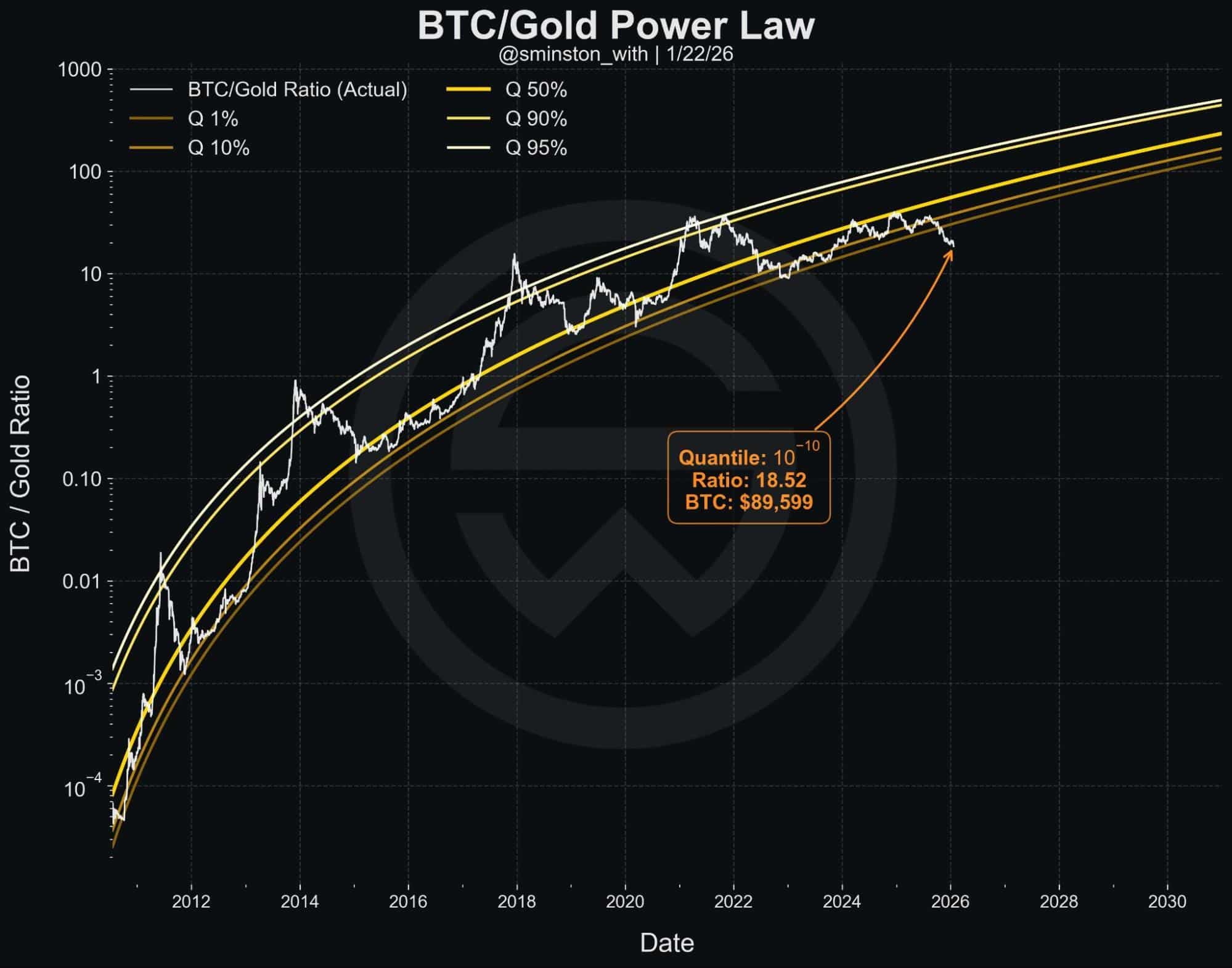

Potential Gold-to-Bitcoin Rotation

- A shift from gold to Bitcoin may occur, highlighted by a significant drop in the BTC-to-gold ratio, suggesting an imbalance between the two assets.

- Gold prices have exceeded $5,000 amid macroeconomic uncertainties, prompting expectations for capital rotation into Bitcoin to restore equilibrium in the BTC-to-gold ratio.