10 1

Crypto Market Penetration Expected to Exceed 10% in 2025

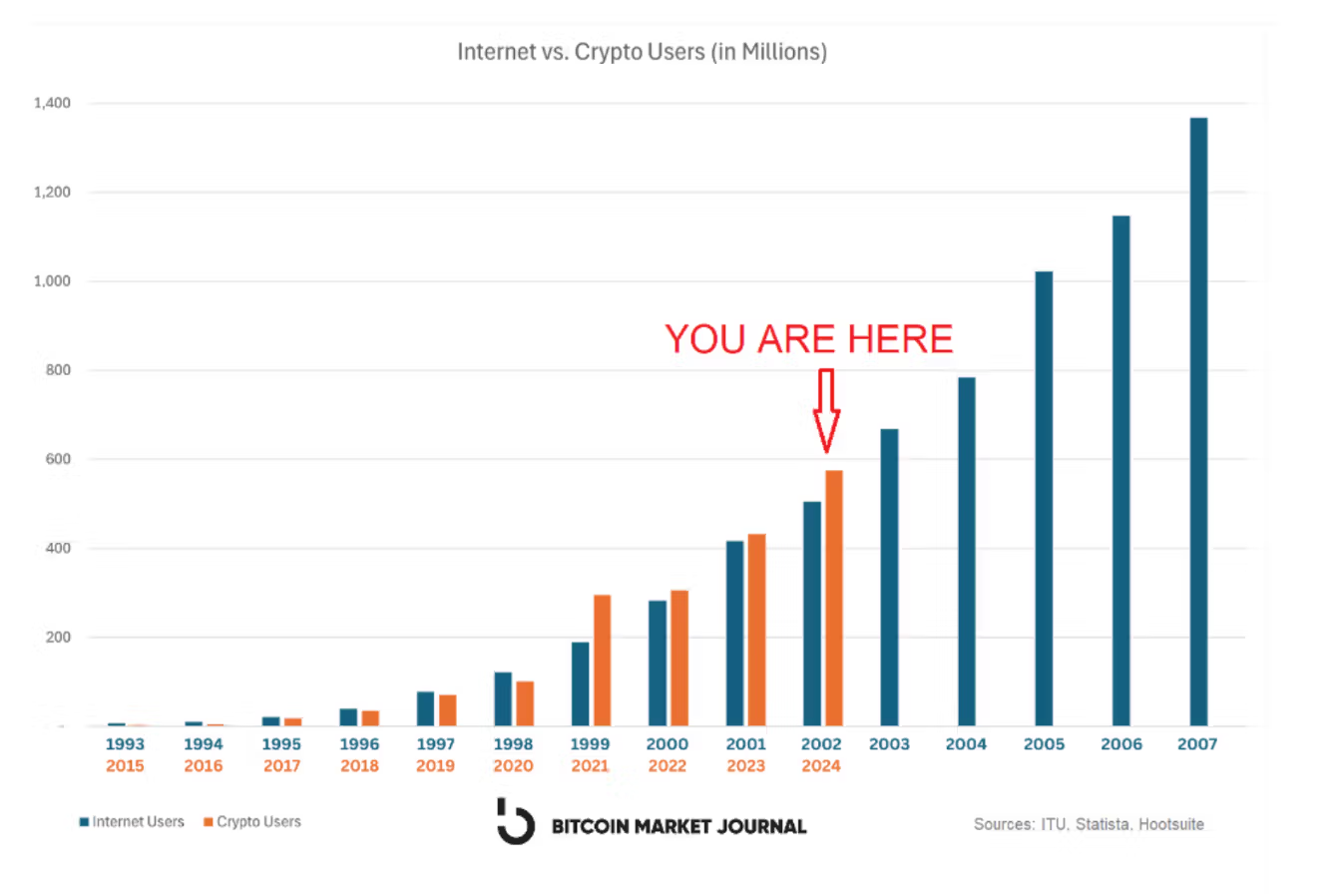

The digital assets market is projected to reach a value of $3.05 trillion by May 2025, mirroring the internet boom of the 1990s. Key highlights include:

Growth Trajectory

- Cryptocurrency user penetration is expected to surpass 10%, reaching an estimated 11.02% globally in 2025, up from 7.41% in 2024.

- The adoption curve indicates that crossing this threshold can lead to exponential growth driven by network effects and mainstream acceptance.

- In the U.S., 28% of adults (about 65 million people) are expected to own cryptocurrencies in 2025, nearly doubling from 15% in 2021.

Factors Driving Penetration

- Blockchain technology enhances transparency and security for transactions.

- Financial inclusion improves access for unbanked populations, especially in Africa and Asia.

- Regulatory clarity in regions like the UAE and Germany supports adoption.

- Integration of AI-based crypto tokens enhances blockchain functionalities.

- Economic instability drives demand as crypto serves as a hedge against inflation.

Institutional and Business Adoption

- Major financial institutions such as BlackRock and Fidelity are increasing their involvement with crypto services and ETFs.

- Businesses are adopting crypto payments to lower transaction fees and expand customer reach.

- DeFi activities are rising, particularly in Sub-Saharan Africa and Eastern Europe, where DeFi accounts for over 33% of total crypto received.

Challenges Ahead

- Volatility remains a significant concern for institutional investors.

- Security issues, including hacks and lost private keys, create uncertainty.

- Regulatory scrutiny varies across jurisdictions, impacting adoption strategies.

Despite these challenges, positive momentum persists. The combination of bullish sentiment, supportive regulations, and payment integrations suggests that digital assets could experience rapid growth similar to previous tech revolutions.