10 1

Crypto Market Value Drops Over $1 Trillion Due to Liquidity Issues

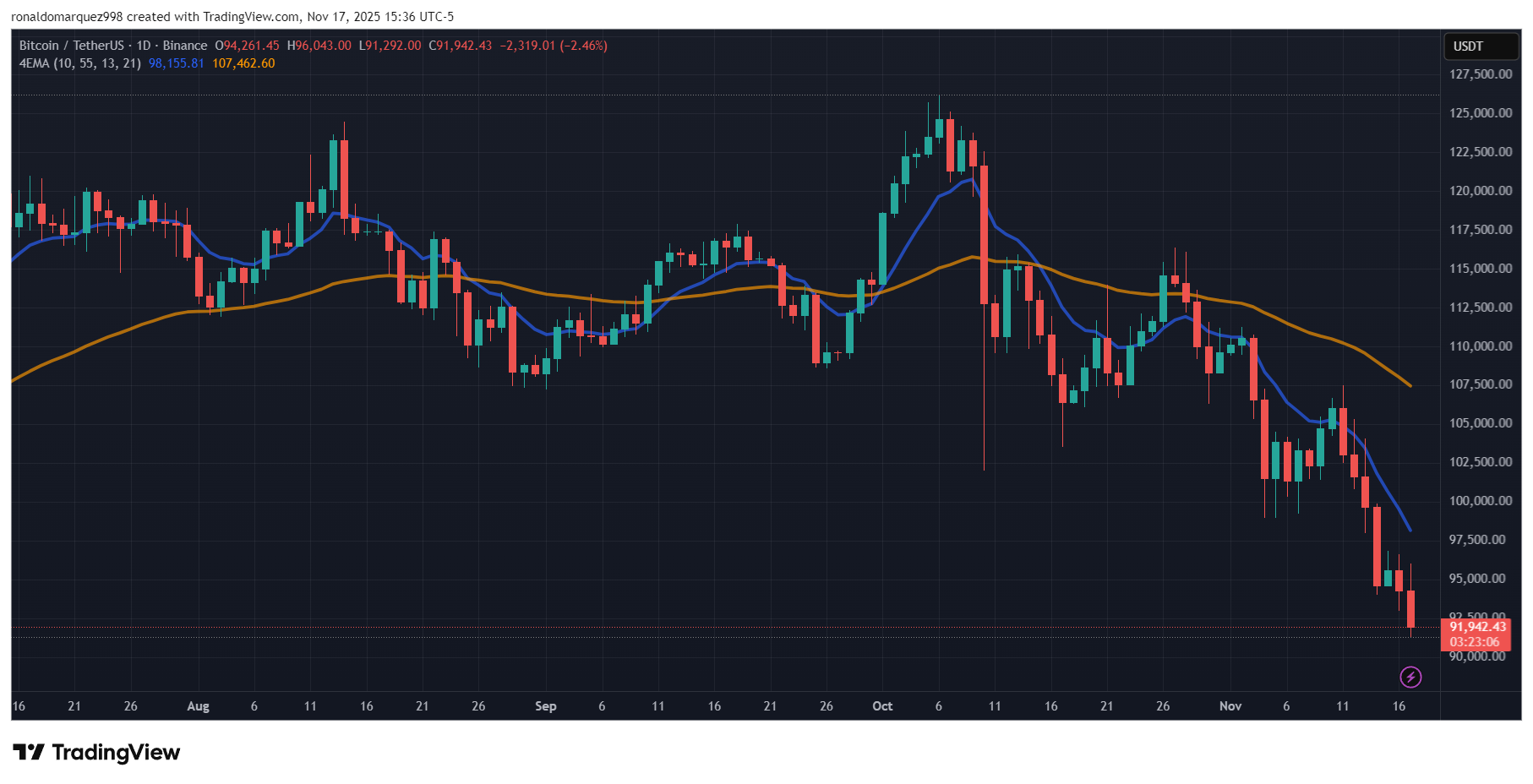

Since October 6, the crypto market has seen a significant decline, losing over $1.1 trillion in value. Analysts from The Bull Theory have identified key issues contributing to this downturn.

Key Factors Affecting the Market

- Liquidity Issues: A major sell-off on October 10 led to over $20 billion being liquidated, severely impacting market liquidity. This particularly affected altcoins, with losses ranging from 70% to 80%. Reduced liquidity allows for easier price fluctuations, making the market more volatile.

- Sparse Order Books: Major cryptocurrencies like Bitcoin and Ethereum have sparse order books, meaning small selling volumes can cause significant price drops.

- Market Makers' Behavior: One or two large entities may be facing substantial losses, influencing ongoing corrections.

- High Leverage: Despite previous liquidations, traders have returned with increased leverage, allowing market makers to trigger large liquidations with minimal price movement.

Sentiment and Indicators

- Fear Index: The Crypto Fear Index has dropped to 10, the lowest in over three years, indicating extreme fear in the market. This could suggest the market is near or at its bottom.

- Relative Strength Index (RSI): Bitcoin's RSI is at levels similar to January 2023, when Bitcoin was valued around $20,000, suggesting a stretched downside.

The analysts emphasize that despite current challenges, fundamental aspects of the crypto market remain strong, with a robust Bitcoin network, increasing hashrate, and institutional interest. However, future directions remain uncertain as market cycles do not follow straight lines.

Currently, Bitcoin leads the market drop, trading at $91,940—a 3% decline in 24 hours and a 13% decrease over the week.