Crypto Prices Decline as Trump Eases Tariffs on Canadian Metals

Donald Trump has chosen not to impose additional tariffs on Canadian aluminum and steel, easing concerns in the US stock market. This decision followed Canada’s announcement to refrain from retaliatory measures, including a planned 25% tax on electricity sold to the US. A meeting is set for Thursday to reaffirm the trade agreement between the US, Canada, and Mexico. The tariff decision may positively impact the crypto economy, as previous announcements contributed to declines in cryptocurrency prices.

The Crypto Market Is Currently in a Correction

Glassnode reported that current selling pressure in BTC is driven by 'top buyers' who purchased at the $109K peak. Panic selling reflects typical market behavior following significant rallies. Long-term investors are accumulating despite short-term volatility.

- BTC shows strong support at the 50% Fibonacci level

- Support on the 50 EMA indicates bullish trends

- Formation of a hammer candlestick pattern suggests potential market bottom

Increased liquidity could position BTC as a hedge, similar to gold and real estate. Current conditions may provide opportunities to enhance crypto portfolios with fundamentally strong tokens.

Key Cryptos to Watch

1. BTC Bull Token ($BTCBULL)

Despite recent price declines linked to tariff discussions, historical corrections are expected. Anticipate accumulation zones to drive BTC higher.

2. Best Wallet Token ($BEST)

This native token of the Best Wallet app is growing rapidly, with projections to capture over 40% of the non-custodial wallet market by 2026.

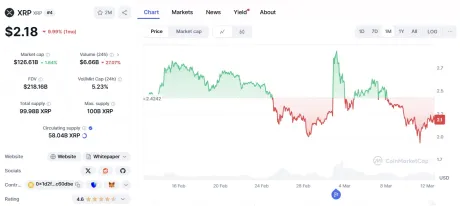

3. XRP ($XRP)

XRP may gain regulatory clarity following the SEC's removal of its lawsuit from public view. Increased institutional partnerships could lead to significant price appreciation.

Conclusion

Trump's tariff retraction signals potential shifts in economic strategy amid recession concerns. While the market presents buying opportunities, caution is advised due to ongoing volatility. Conduct thorough research before making investment decisions.