6 1

Bitcoin, Ethereum, XRP Prices Fall Amid Market Maker Selloff and Rate Hike Fears

Recent analysis by Crypto Wimar highlights several factors contributing to the decline in Bitcoin, Ethereum, and XRP prices:

- Wintermute has offloaded 40% of its holdings, impacting BTC, ETH, and XRP prices.

- Continued selling pressure as Wintermute dumps millions on Binance.

- A potential Japan rate hike could further affect the market. Polymarket gives a 97.4% chance of a 25 basis point increase, influencing yen carry trade dynamics.

- BTC, ETH, and XRP have historically dropped after Fed rate cuts; a similar trend is observed following the recent 25 bps cut.

- Institutional demand for these cryptocurrencies is waning. Despite this, 117 new companies added BTC to their treasuries this year.

- BitMine continues to accumulate ETH despite the downturn.

Potential Drop Below $50,000 for Bitcoin

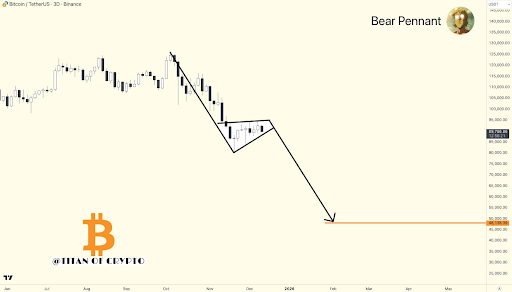

Analyst Titan of Crypto suggests Bitcoin might fall below $50,000, potentially affecting Ethereum and XRP as well. Observations indicate a possible bear pennant formation. This structure is not favorable in a bull market scenario.

The accompanying chart predicts a potential drop below $50,000 by February next year. Veteran trader Peter Brandt also supports this view, suggesting BTC is already in a bear market.