7 0

Crypto Markets Poised for Q4 Gains Amid Fed Rate Cuts and ETF Inflows

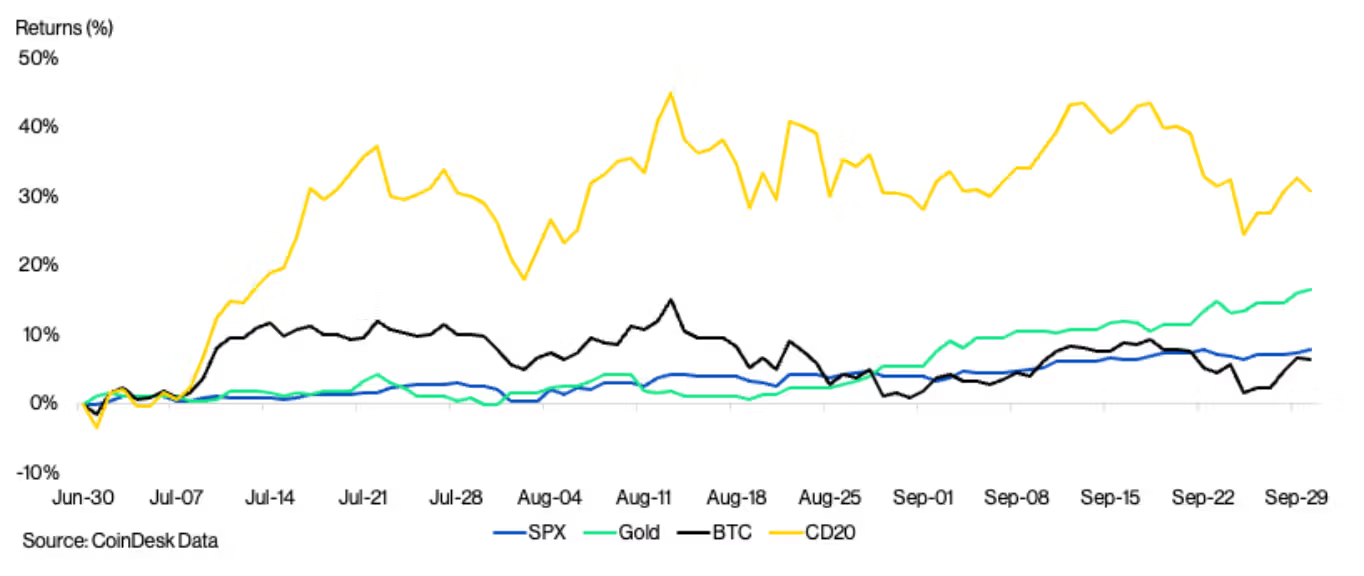

As Q4 2025 begins, crypto markets enter a historically favorable period, with bitcoin averaging a 79% return in previous Q4s since 2013. Key factors include:

- Monetary easing and the Federal Reserve's rate cuts to their lowest in nearly three years.

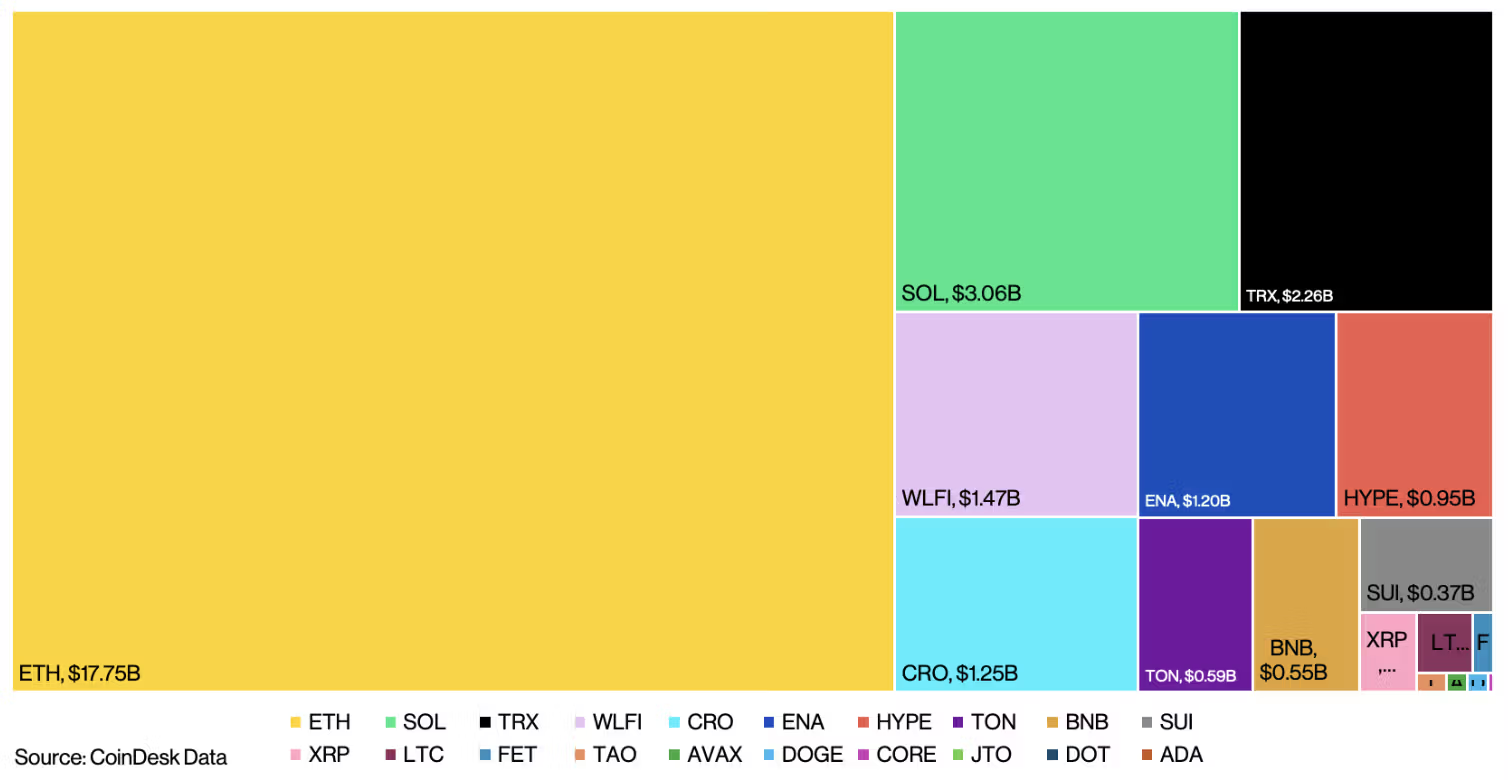

- Surging institutional adoption with U.S. spot bitcoin and ether ETFs seeing $18 billion in inflows.

- Increased regulatory momentum in the U.S.

Bitcoin ended Q3 up 8% at $114,000, driven by public company treasury adoption. Expectations for further rate cuts may sustain this momentum.

- Ethereum surged 66.7% in Q3, nearing $5,000, with future gains potentially linked to November’s Fusaka upgrade for scalability improvements.

- Solana gained 35%, backed by corporate purchases and ecosystem revenue, with new products and upgrades enhancing its appeal for decentralized applications.

- XRP's 37% YTD gain follows legal clarity, with stablecoin RLUSD expansion possibly boosting DeFi protocol interest on its ledger.

- Cardano rose 41.1% in Q3, driven by stablecoin use, derivatives volume, and DEX activity growth, with pending ETF decisions impacting future institutional adoption.

The CoinDesk 20 Index, tracking highly liquid digital assets, outpaced bitcoin with over 30% Q3 gains, reflecting broad market interest. Future catalysts include generic crypto ETF standards and multi-asset ETPs, promising deeper institutional engagement and renewed altcoin interest.