18 0

Crypto Market Recovery Hinges on US Government Shutdown Resolution

Crypto Market Focuses on US Treasury and Liquidity Concerns

- Current crypto market discussions center on liquidity issues, linked to the US Treasury General Account (TGA) and Federal Reserve policies.

- Analysts suggest that the recent market downturn is primarily due to liquidity contraction rather than sentiment changes.

- The TGA is overfilled beyond its $850bn cap, affecting bank reserves and overall market liquidity.

- Bitcoin has shown resilience despite significant selling pressures and liquidity challenges.

- Future market recovery is expected once the US government reopens, triggering fiscal spending and potential unwinding of quantitative tightening (QT).

Anticipated Return of Liquidity

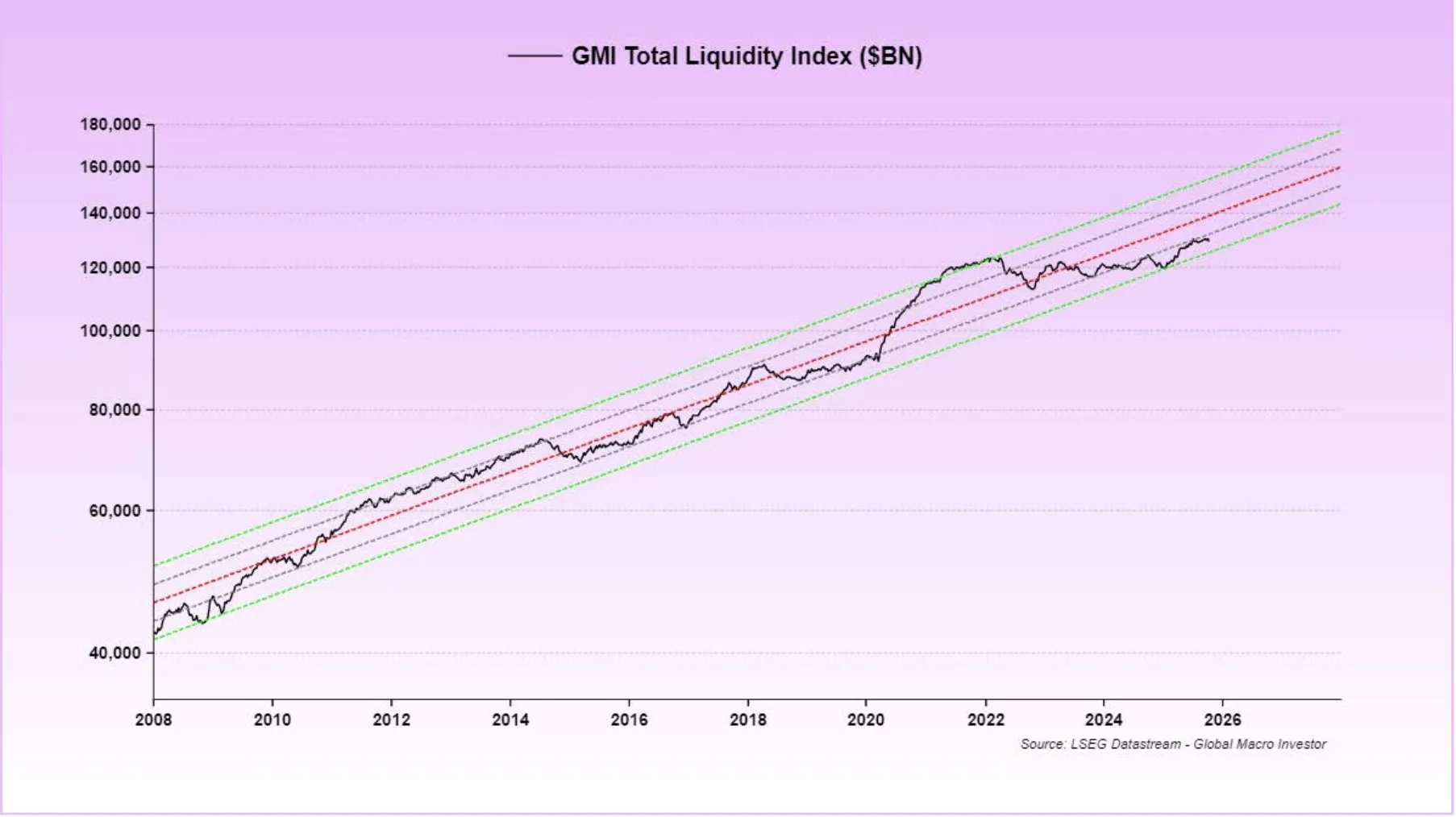

- Raoul Pal emphasizes global liquidity as a critical macro factor, with a focus on rolling $10 trillion in debt.

- The US government shutdown has tightened liquidity, impacting high-beta assets like cryptocurrencies.

- Once fiscal operations resume, increased spending and QT cessation are expected to restore liquidity.

- Regulatory changes, such as the CLARITY Act, could boost institutional crypto adoption.

The key focus remains on dollar liquidity dynamics, affecting high-beta assets like cryptocurrencies. The next market upswing depends on policy shifts in Washington, easing reserve constraints, and fiscal stimulus extending into 2026.

At press time, the total crypto market cap stood at $3.38 trillion.