7 3

Crypto Stocks Drop as Bitcoin Falls Below $90k Amid Market Sell-Off

On Nov. 18, Bitcoin broke below $90k due to uncertainty over rate cuts, affecting crypto-related equities.

- U.S. BTC ETFs experienced significant outflows in mid-November, with $1 billion withdrawn in a week.

- The hashprice hit multi-month lows as Bitcoin prices softened and mining difficulty remained high.

- Major crypto miner stocks were severely impacted, alongside firms investing in cryptocurrencies.

Coinbase and MicroStrategy Impact

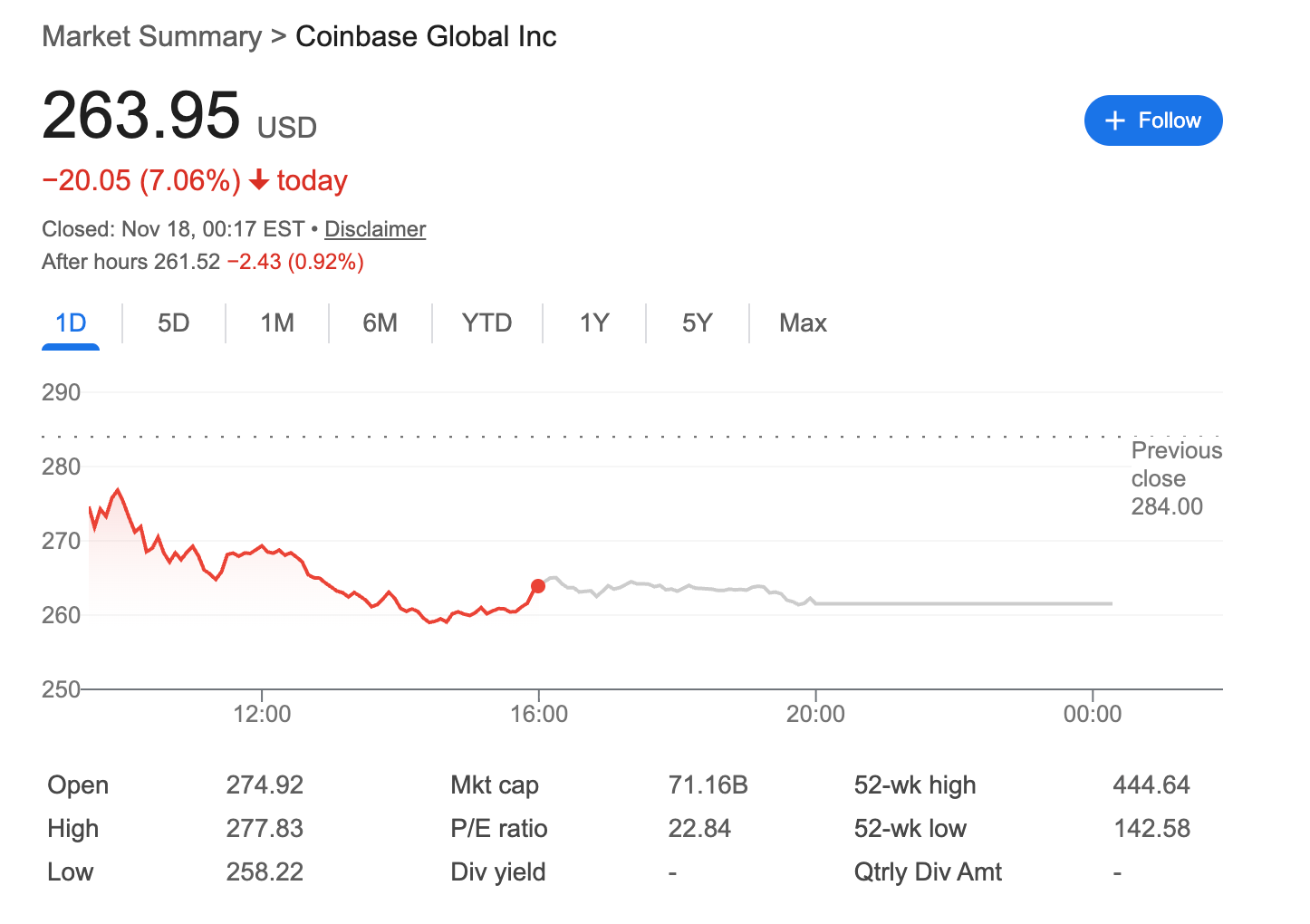

- Coinbase (COIN) fell by 7.06%, closing at $263.95 on Nov. 17, amid broader selling across crypto-exposed tech.

- MicroStrategy (MSTR) saw a 2.17% decrease, closing at $195.42, yet continued its Bitcoin acquisitions.

BTC Mining Stocks Performance

- Marathon Digital (MARA): $11.51, -4%

- Riot Platforms (RIOT): $13.88, -0.5%

- CleanSpark (CLSK): $10.61, -3.19%

- Hut 8 (HUT): $37.7, +2%

- IREN (IREN): $47.41, +1.04%

Overall, the market reaction varied among major mining stocks, influenced by factors such as power costs and diversification strategies.