Crypto Stocks Expected to Surge in 2025 Due to Upcoming IPOs

When examining crypto stocks, a discussion with Dan Weiskopf, co-portfolio manager of the Amplify Transformational Data Sharing ETF (BLOK), reveals insights into future opportunities. He expresses increased optimism for 2025 compared to the end of 2023.

A key factor is the potential for BLOK investors as more pure-play crypto companies plan to go public. Notable candidates include stablecoin issuer Circle and Figure Technologies.

While several bitcoin miners may enter the market, this sector is becoming crowded. However, BLOK is considering investments in cloud-computing firm CoreWeave, a major client of mining giant Core Scientific.

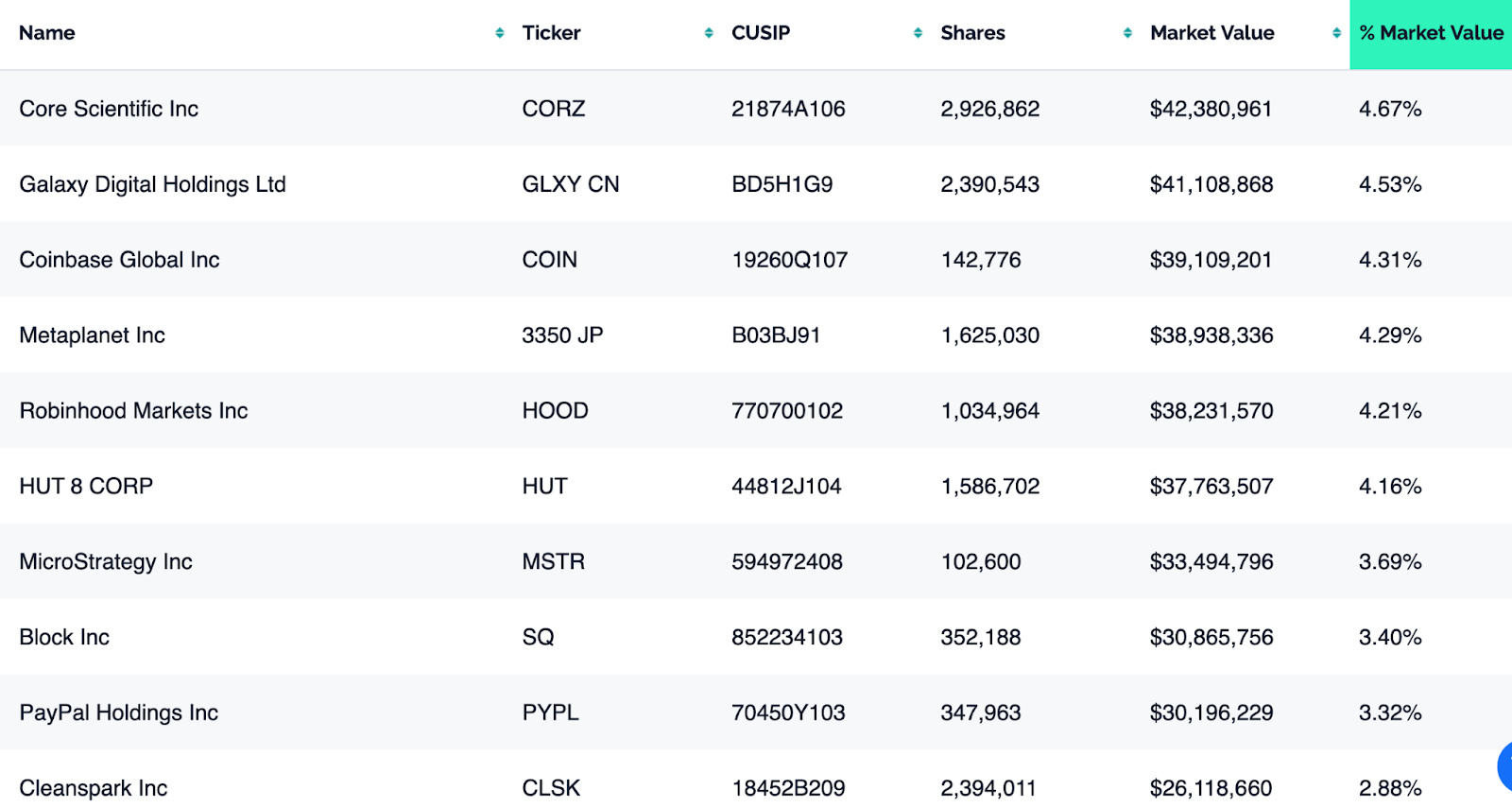

Core Scientific, up approximately 320% year to date, is BLOK's top holding at 4.67%. Another significant investment is Hut 8, ranked sixth at 4.16%. Weiskopf notes their strategy effectively diversifies into AI-related sectors among miners.

Hut 8 slightly surpasses MicroStrategy, which will join the Nasdaq 100 index soon. BLOK began acquiring MSTR shares in August 2020 at $14; current trading is around $350, reflecting over 400% growth year-to-date. Analysts recently raised MSTR's price target to $650 following an increase in Bitcoin holdings to 439,000 BTC.

Weiskopf and Venuto have reduced BLOK’s stakes in MSTR and CORZ due to stock rallies exceeding their weight limits, aiming to reinvest in other promising assets.

As they anticipate more IPOs in 2025, BLOK has started acquiring Japan-based Metaplanet. Approximately 60 companies are adding BTC to their treasuries, but many are classified as "zombie companies," lacking viable recovery strategies, according to Weiskopf.

Metaplanet, committed to substantial BTC purchases, announced plans to issue 5 billion yen in bonds for this purpose, indicating a serious approach akin to MicroStrategy's strategy.

For those tracking crypto stocks, BLOK's holdings present noteworthy options amid emerging opportunities in a potentially transformative year for the sector.