Crypto Wallet Launches Surge as Companies Compete for User Dominance

In the past year, centralized exchanges like Kraken, Coinbase, and Bitget, alongside NFT marketplaces such as Magic Eden and TradFi firms including Naver and CoinFlip, have launched new wallets. DeFi protocols like Osmosis’ Polaris Wallet, Uniswap, and Aave have also introduced wallets.

The increase in wallet offerings raises the question of their necessity. However, a more pertinent inquiry is why companies desire their own wallets. Owning a crypto wallet allows companies to engage directly with users, which can be financially beneficial.

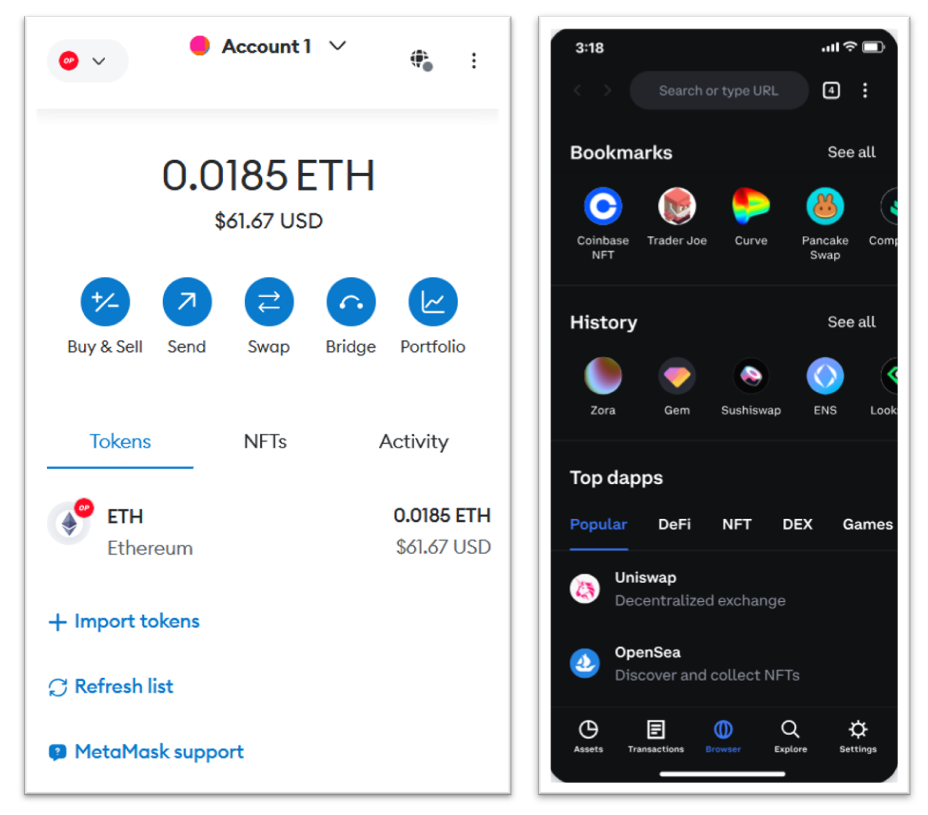

Wallets serve as the initial interface for new crypto users, positioning providers to leverage this relationship by implementing a take-rate. This is often realized through in-wallet swaps for less experienced users. For instance, MetaMask reportedly earns an average of $1.5 million weekly from wallet swaps.

Additionally, wallet providers have insight into transaction order-flow, which can be monetized by selling this data to block builders who capitalize on miner extractable value (MEV). Some wallets, such as MetaMask, may already engage in this practice, similar to Telegram trading bots like Banana Gun.

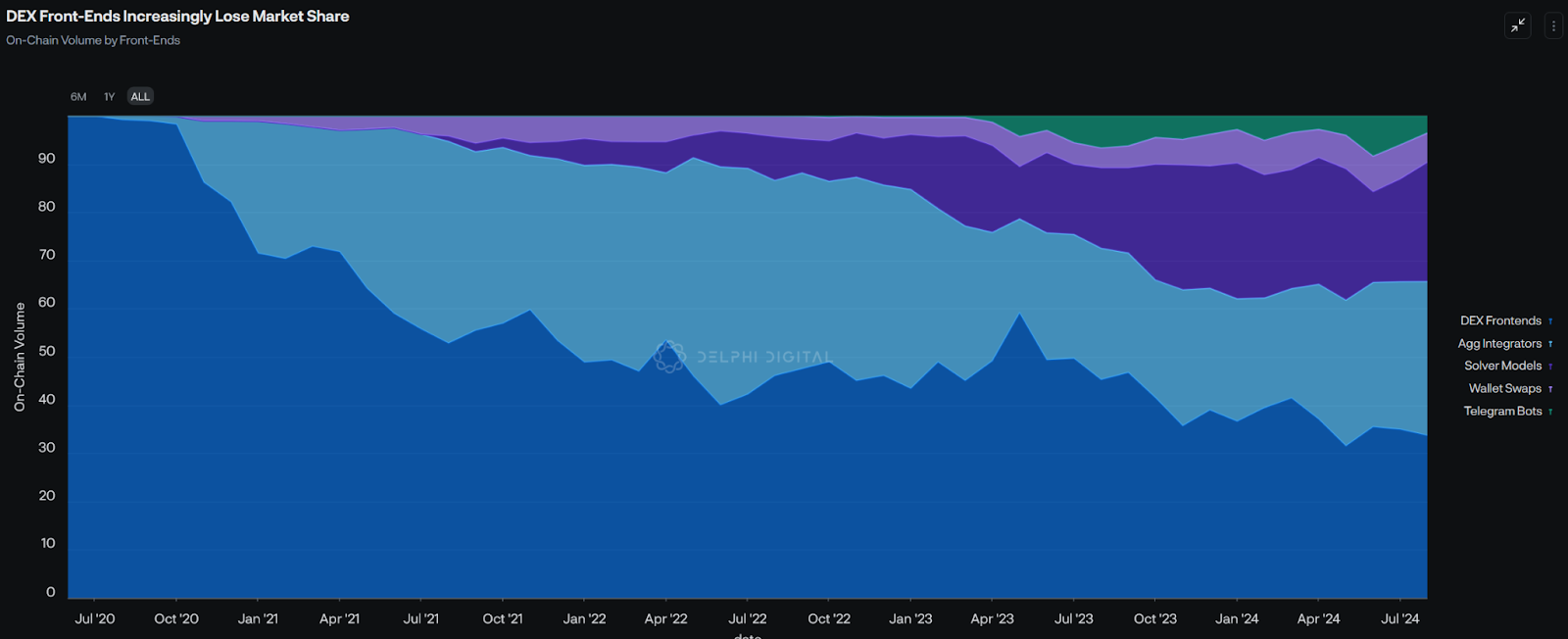

Wallets are increasingly favored for on-chain activities, as DEX front-ends lose prominence to wallets and DeFi aggregators.

This trend, known as the “Fat Wallet” thesis, suggests that wallets will find profitable monetization avenues as they evolve from basic transaction tools to comprehensive hubs featuring diverse dApps and services.

Wallets naturally align with B2B integrations, allowing for collaborations with payment services. Recent examples include wallets like Zeal and Fuse, enabling spending of DeFi yields via Visa.

The Fat Wallet thesis could face skepticism as a potential investment strategy, yet it explains the consistent emergence of new wallet launches.

As competition intensifies among hundreds of wallets targeting new users during bull market cycles, various strategies are employed. Coinbase Wallet offers a 4.7% APY on USDC holdings, while Magic Eden incentivizes users with claimable airdrops for using its wallet.

The race to capture users continues, but free market dynamics suggest no single wallet is likely to dominate the market.