CryptoQuant CEO Warns Bitcoin Bear Market Likely Without Spot ETF Liquidity

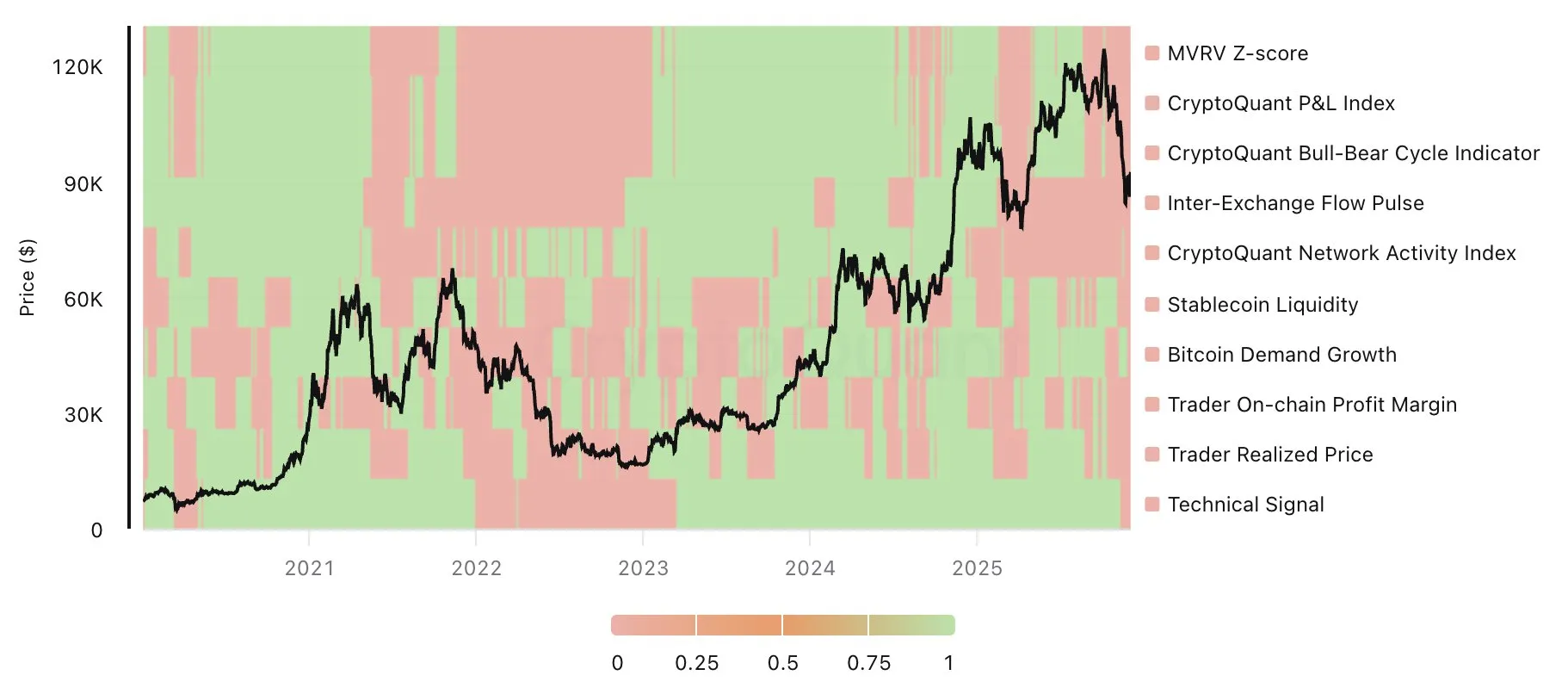

Bitcoin may be entering a bear market phase unless new macro liquidity, particularly through spot ETFs, returns to the market, according to CryptoQuant CEO Ki Young Ju. He highlights that:

- Most Bitcoin on-chain indicators are bearish.

- A composite chart shows historical regime shifts with clusters of bearish readings when BTC prices declined.

- Indicators include the MVRV Z-score, CryptoQuant P&L Index, and others.

Ju emphasizes that macro conditions and ETF flows are crucial for Bitcoin's next major move. New ETF inflows are seen as key to preventing further declines. In past cycles, rising ETF inflows correlated with strong price increases.

Despite the bearish outlook, Ju does not expect a repeat of the 2022 collapse due to factors like Michael Saylor's Strategy holding onto its BTC assets, which helps stabilize the market. He suggests that any bear cycle would likely result in a broad sideways range rather than a dramatic crash.

He advises long-term investors against panic selling, noting that while cyclical indicators are negative, the structural backdrop has improved with more liquidity channels such as ETFs.

At the time of reporting, Bitcoin was trading at $92,494.