7 0

DeFi Borrowing Demand Drops Sharply Following Crypto Market Turmoil

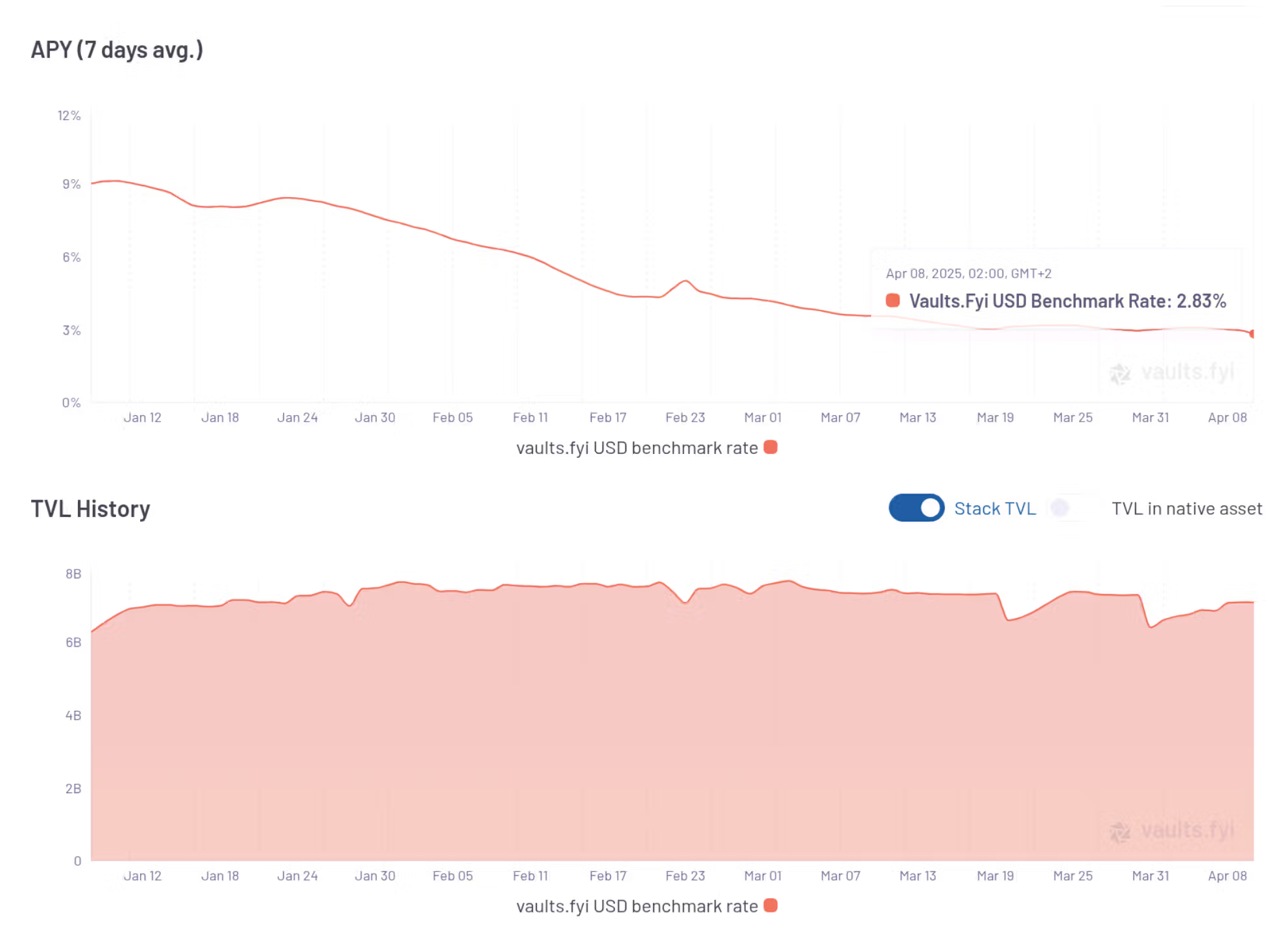

Borrowing demand in decentralized finance (DeFi) has sharply declined following recent market turmoil, indicating widespread deleveraging as investors unwind risky positions.

- Average U.S. dollar stablecoin yield fell to 2.8%, the lowest in a year, down from mid-December's peak of 18% and below traditional market rates of 4.3%.

- Ryan Rodenbaugh, CEO of Wallfacer Labs, noted significant decreases in borrowing across protocols due to a risk-off environment.

- Demand for borrowing decreased as users repaid loans and liquidations occurred amid volatile price swings, while deposits available for lending remained stable.

- Aave processed over $110 million in forced liquidations during the recent market decline, with Bitcoin and Ethereum experiencing 10%-15% drops.

- Sky liquidated a $74 million DAI loan collateralized by 67,570 ETH, reflecting similar trends among large lenders.

- Total borrowed assets on Aave dropped to $10 billion from over $15 billion since mid-December; Morpho's total fell from $2.4 billion to $1.7 billion.