6 1

Digital Asset Products Draw $921M Inflows After September CPI Data Release

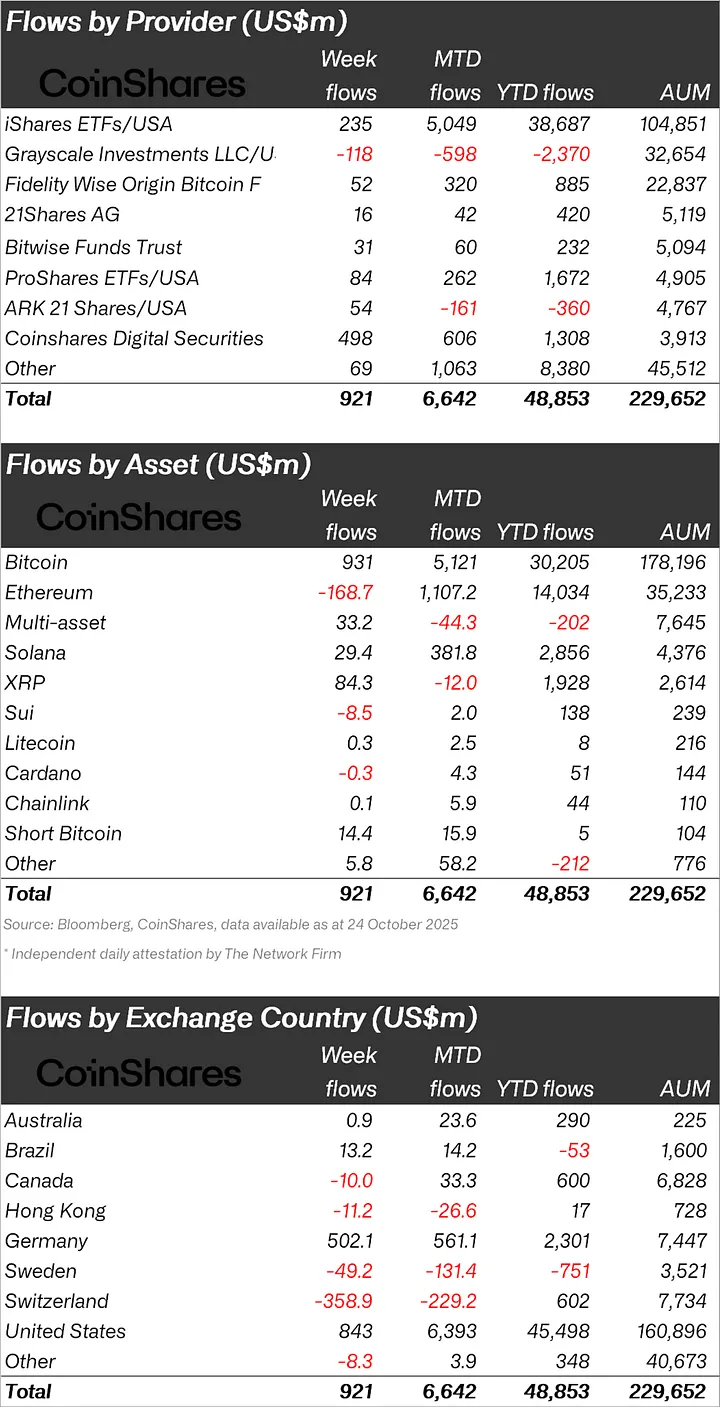

Digital asset investment products saw a $921 million inflow last week, reversing the prior week's $513 million outflow. This shift is attributed to investor confidence following September's inflation data showing slowed core price increases.

- Bitcoin led with $931 million in inflows, bringing year-to-date flows to $30.2 billion.

- Ethereum experienced its first outflows in five weeks, totaling $169 million.

- Global trading volumes remained high at $39 billion for the week.

Regional Flow Patterns

- The US led regional activity with $843 million in inflows.

- Germany saw significant inflows of $502 million.

- Switzerland experienced $359 million in outflows due to asset transfers.

Recent institutional flows contrast with exchange-level activities like Binance's Q3 milestone of $14.8 billion inflows. The current trends indicate recovering confidence post-mid-October volatility, where Bitcoin's price fluctuated significantly but has since stabilized above $113,000.