9 0

Dogecoin Bargain Hunters Acquire 680M DOGE Amid Price Dip

Dogecoin's (DOGE) price has dropped nearly 5% to $0.26, attracting institutional investors who purchased 680 million DOGE tokens during the dip.

- Regulatory clarity is improving with the expected approval of the first U.S.-listed spot Dogecoin ETF.

- CleanCore Solutions increased its holdings by buying an additional 100 million DOGE, totaling over 600 million DOGE.

- The Rex Shares-Osprey Dogecoin ETF (DOJE) is anticipated to launch this week, offering exposure to DOGE without direct ownership.

Market Insights

- Institutional interest surged due to regulatory developments and ETF proposals.

- DOGE's volatility was recorded at 5%, with support at $0.26 and resistance at $0.27.

- Significant trading volumes established strong support and resistance levels, indicating corporate accumulation strategies.

- A technical breakout points to a $0.50 price target for DOGE.

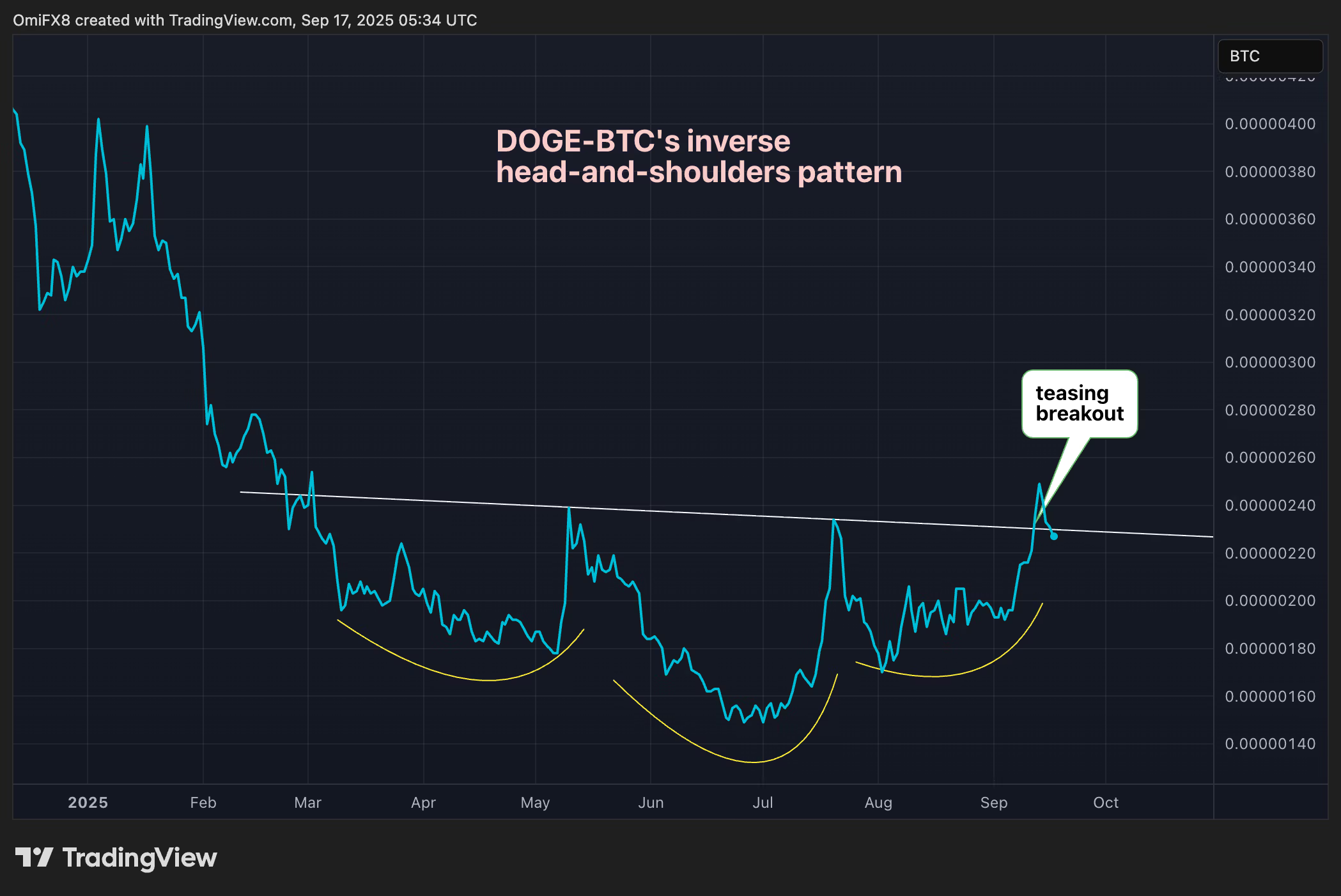

Focus on DOGE/BTC

The DOGE/BTC ratio shows potential for gains, forming a bullish inverse head-and-shoulders pattern, suggesting a possible DOGE rally relative to BTC.

The Federal Reserve is expected to cut interest rates by 25 basis points to 4%. This move is largely anticipated, shifting focus to future rate cuts. DOGE investors are hopeful for signals of aggressive easing from the Fed.