10 0

Dogecoin Bull Run at Risk Without Immediate Rally, Analyst Warns

Crypto analyst VisionPulsed highlights that Dogecoin needs a significant price movement in November to maintain its bullish setup. Failure to do so could shift focus to a bearish outlook by 2026.

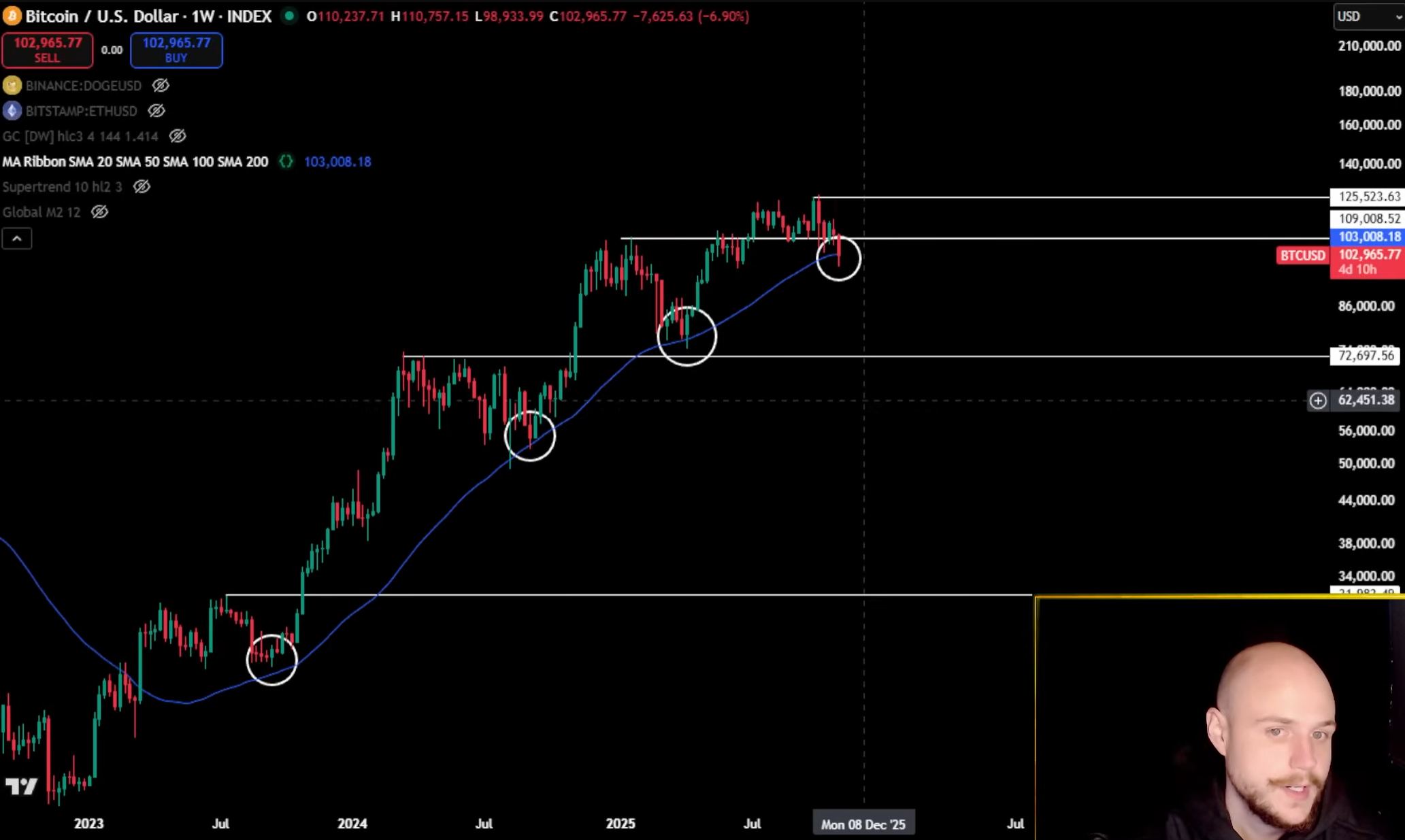

- Bitcoin’s weekly moving average is crucial for Dogecoin's short-term trend.

- If Bitcoin closes above $103,000–$104,000, it could trigger a Dogecoin rally.

- A close below $102,000 would signal a potential bear market phase.

Market Structure and Risks

- The market has retraced the alt season from 2021, nearing a mature advance stage.

- Momentum indicators suggest the market cycle might be nearing its end.

Dogecoin’s high-beta behavior to Bitcoin means quick shifts in trend impact its performance significantly. A decisive move below the moving average could negate the chance for an impulse rally.

- A potential peak was projected for January, but immediate upward movement is essential to sustain this view.

- The bearish scenario predicts Dogecoin's value could drop to $0.05-$0.06 if Bitcoin confirms a breakdown.

At present, Dogecoin trades at $0.16297, awaiting Bitcoin's direction to determine its next significant move.