Large Transaction Volume for Dogecoin Drops 36% Amid Price Decline

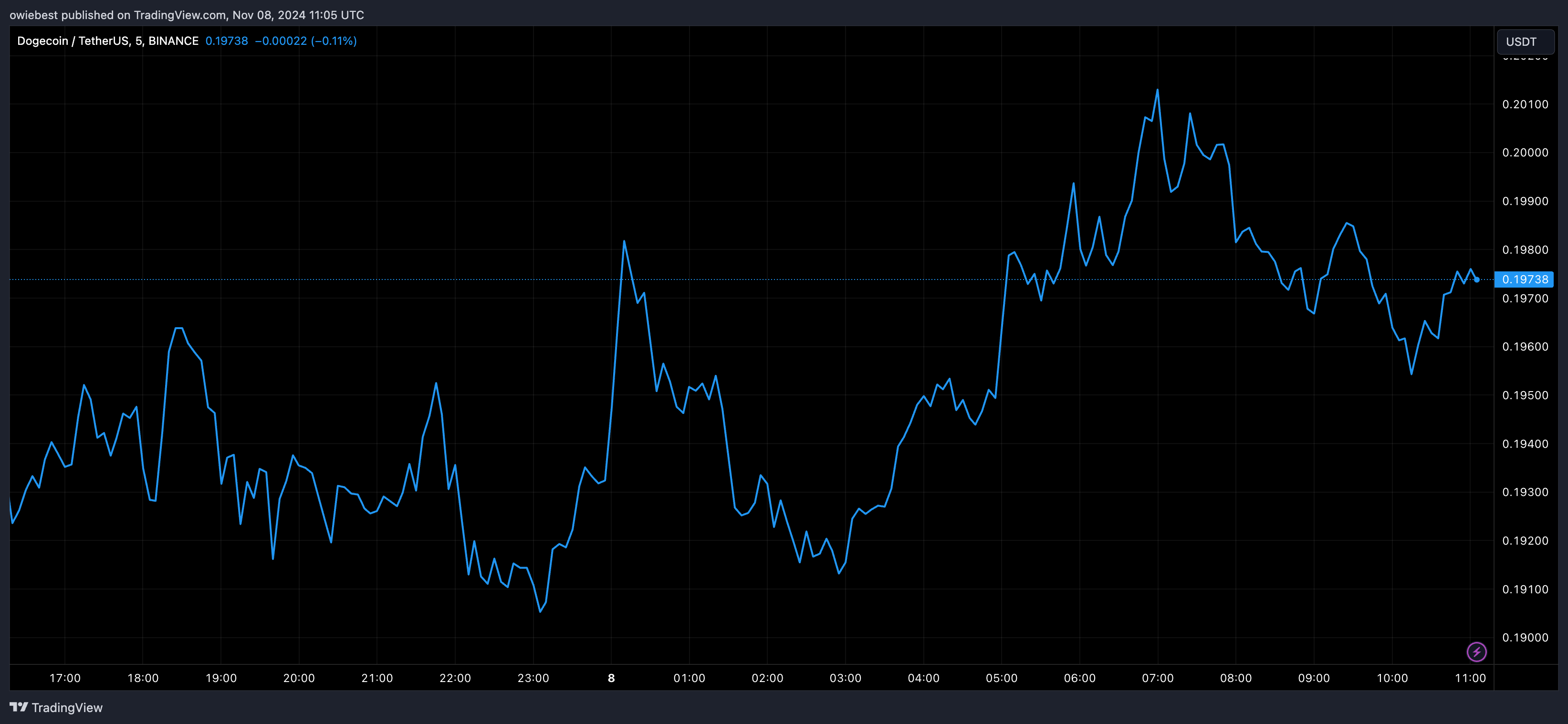

The recent Dogecoin price rally has shown signs of losing momentum after reaching above $0.21, marking a seven-month high. Following this surge, profit-taking by traders has led to a decline, with the price dipping below $0.20 again, raising concerns about potential further decreases.

On-chain data indicates a significant drop in large transactions among Dogecoin holders, reflecting decreased enthusiasm from major investors and suggesting pressure on Dogecoin to maintain its recent gains.

Large DOGE Transaction Volume Crashes: Are Dogecoin Whales Selling?

Data from IntoTheBlock shows a 36% decrease in the volume of large Dogecoin transactions over the past 24 hours, indicating that major holders may be reducing their exposure after capitalizing on recent price increases. The 'Large Transactions Volume in USD' metric reveals that the value of these transactions was $3.46 billion, down from $5.38 billion on November 6.

Additionally, the 'Large Transactions Volume' metric shows that 17.76 billion DOGE tokens were moved in 2.72 transactions in the past 24 hours, also representing a 36% reduction compared to 27.7 billion tokens in 4,150 transactions on November 6.

What Does This Mean For Dogecoin Price?

The decline in transaction volume and large trades may indicate a cautious sentiment among whales. However, it does not necessarily imply a widespread sell-off; it could reflect a pause in buying as whales anticipate a pullback. Currently, Dogecoin is trading at $0.1984, with the potential to attempt another rise above $0.20. Conversely, if momentum weakens, Dogecoin could retest support at $0.187.