8 2

Dogecoin Rises 4% Amid Increased On-Chain Activity and Wallet Spikes

Dogecoin experienced a 4% increase, reaching $0.14 with a market cap of approximately $21 billion and a 24-hour trading volume near $1.6 billion. This rise is linked to increased on-chain activity.

Spike in Active Wallets

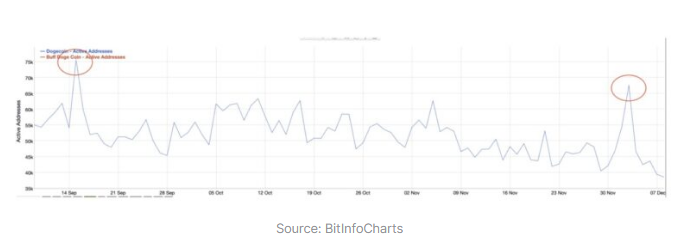

- The number of daily active addresses on the Dogecoin network surged to over 67,500 on December 3, marking the second-highest reading in three months.

- Increased wallet activity follows previous spikes in price, such as the one on September 15 when DOGE approached $0.30.

Support Holding Near $0.14

- Dogecoin remains above the critical support level of $0.138–$0.14, which has been repeatedly tested.

- Trading volume more than doubled recently, indicating growing buying interest.

- Short-term reports show varying figures, though longer-term data indicate a 60% decline over the past year.

Volume and Technical Targets

- Traders are focusing on $0.16 as the next resistance level.

- A breakthrough above this point could signal a shift in short-term bearish patterns.

- The 200-day EMA is considered a broader target for confirming medium-term momentum shifts.

Mixed Signals

- Spikes in daily active addresses may indicate rising interest but can also result from bot traffic or large holder transfers.

- Increased volume supports buyers, yet active-address readings alone are not definitive.

- Bulls and bears show heightened activity, suggesting significant short-term market movements ahead.

Fed Meeting Adds a Macro Angle

- This week’s Federal Reserve meeting introduces uncertainty, with discussions on a potential rate cut that could impact risk assets like cryptocurrencies.

- Changes in rate policy may influence broader markets beyond individual token metrics.