Dogecoin Experiences Surge in Hashrate and Search Interest

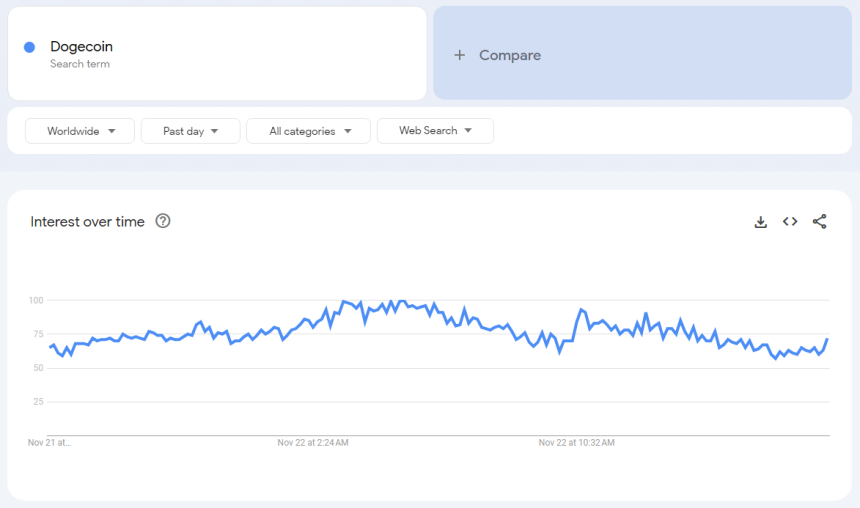

Dogecoin (DOGE) is currently attracting attention from crypto enthusiasts and analysts. Recent trends indicate increasing interest in the meme coin, though conflicting indicators create uncertainty about market direction. Search interest peaked on November 22, aligning with a price increase, but as public curiosity waned, so did the price, highlighting a correlation between attention and performance.

Mining Activity Reaches New Peak

Dogecoin's network is experiencing robust growth, evidenced by its hashrate reaching an all-time high. This enhances blockchain security and stability, making it attractive to miners and investors. Expert Master Kenobi suggests that mining DOGE may now be more profitable than Bitcoin due to consistent payouts, providing greater stability.

#DOGE hashrate on ATH

In the long term, I believe #DOGE mining could become more profitable and less stressful for miners compared to #Bitcoin mining, as it offers greater predictability without the disruptions caused by halving events. This stability would contribute to… https://t.co/SfjlyGS8Q5 pic.twitter.com/IOIkuK8mCe

— Master Kenobi (@btc_MasterPlan) November 20, 2024

The increased hashrate supports expanded infrastructure, enhancing the future outlook for Dogecoin. A stable mining environment ensures security and promotes ecosystem growth.

Traders Are Becoming More Optimistic

Expert Tardigrade identified a "Hidden Bullish Divergence" in Dogecoin's charts, indicating potential reversal or slowing of bearish momentum. His analysis has generated speculation about upcoming innovations for Dogecoin. The sentiment aligns with an "Extreme Greed" value of 94 on the Fear & Greed Index. However, notable volatility of 42.27% over the past month suggests caution for investors.

A Mixed Price Forecast

Despite optimism, forecasts for Dogecoin remain uncertain. Analysts predict a -6.83% decline, estimating a December 22, 2024 price of $0.369286. Although the Fear & Greed Index indicates positivity, historical patterns suggest possible temporary corrections following such sentiments.

The combination of enthusiasm and caution creates a complex environment for investors. Increased hashrate and technical indicators appear favorable, yet Dogecoin's unpredictable nature presents inherent risks. Market volatility continues to be influenced by community engagement, mining statistics, and social sentiment.

Featured image from WSJ, chart from TradingView