Dogecoin Large Transactions Surge 41% with 35% Increase in Active Addresses

Dogecoin has experienced increased activity recently as its price rebounds after a weekend correction. In the last 24 hours, large DOGE transactions exceeding $100,000 have surged, indicating potential whale or institutional involvement in the market.

The rise in large transactions may reflect both selloffs and accumulations, yet the overall increase signifies a positive trend for Dogecoin.

Dogecoin Large Transaction Activity Intensifies

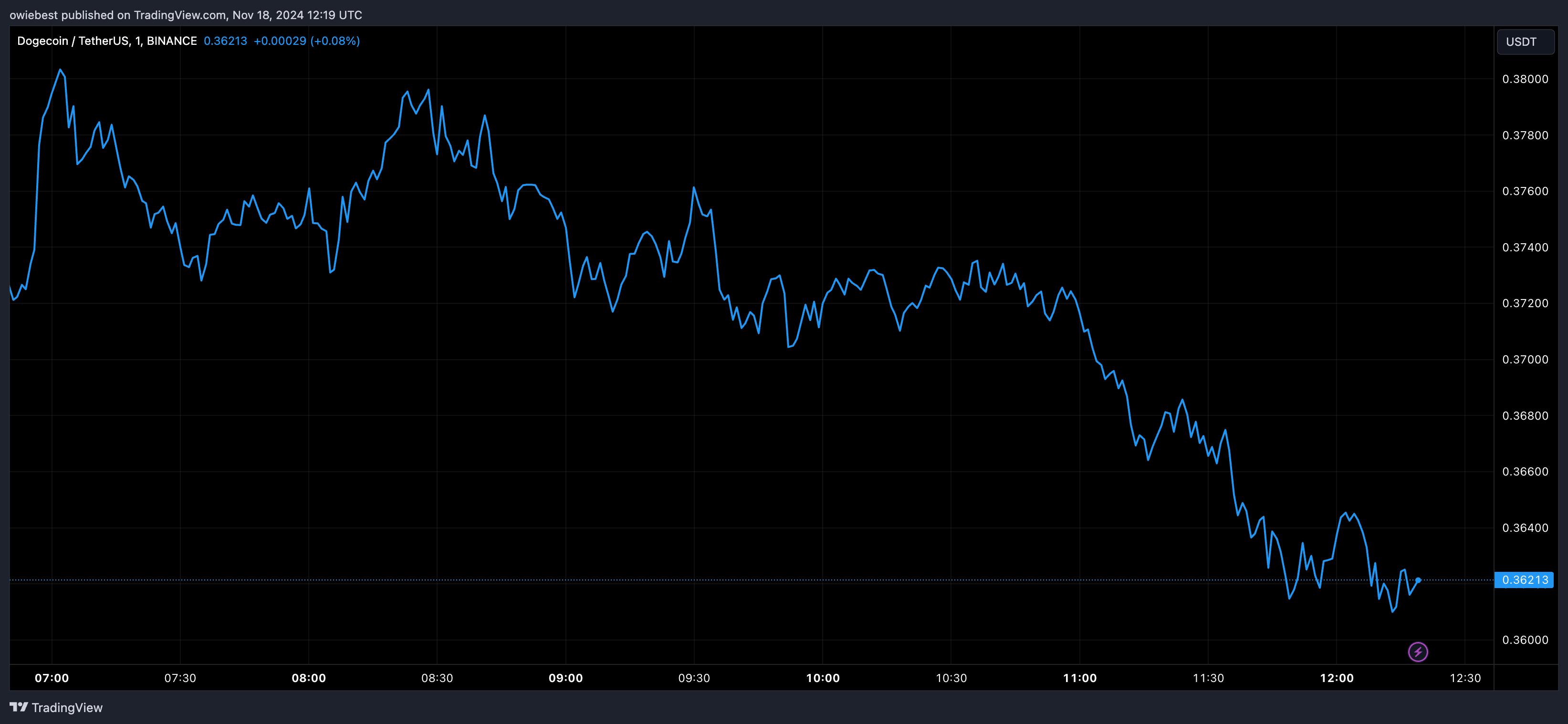

The recent rally in Dogecoin appears to be losing momentum after reaching above $0.42, marking its highest price since the 2021 bull market. A profit-taking trend among traders has led to a pullback, with the price dropping below $0.40 and hitting a low of $0.346 in the past 24 hours.

This correction raises questions about Dogecoin's sentiment among investors. However, on-chain data indicates continued activity on the Dogecoin blockchain. Analytics from IntoTheBlock reveal that Dogecoin recorded $23.35 billion in large transaction volume over the past 24 hours, reflecting a 41.12% increase from the previous day. Additionally, there were 157,190 active addresses during this period, a rise of 34.91%.

What Does This Mean For DOGE Price?

These metrics suggest strong interest in Dogecoin despite the price correction. The increase in large transaction volume and active addresses implies that large holders remain engaged with the coin.

This renewed interest has contributed to buying pressure, with DOGE rising approximately 4% in the past 24 hours and up 7.4% from its weekend low. Analyst Captain Faibik noted that Dogecoin is nearing a breakout above the upper trendline of a falling wedge pattern, which has formed since the price peak of $0.4265 on November 14. A breakout could lead to a further rally, potentially pushing Dogecoin’s price up by 25% to reach $0.47.

As of now, Dogecoin is trading at $0.38.