2 0

Dollar Index Declines 7% as Investors Consider Bitcoin Hedge

The US dollar index has dropped 7% year-to-date, raising concerns about its long-term strength amid rising trade tensions.

Bitcoin Gains Investor Attention

- Investors are increasingly viewing Bitcoin as a hedge against fiat currency failure.

- Venture capitalist Tim Draper suggests Bitcoin could appreciate significantly as confidence in fiat diminishes.

- Draper stated Bitcoin "might be worth an infinite amount of USD," drawing parallels to the hyperinflation of the Confederate dollar during the Civil War.

- He believes individuals will move their funds to secure assets during uncertain times, with Bitcoin emerging as a preferred option due to its digital nature and convenience.

Civil War Analogy

- Draper referenced the Confederate dollar's devaluation from 1:1 with the US dollar to over 10 million to 1.

- This historical example underscores how quickly trust in a currency can erode, suggesting similar risks for current fiat currencies.

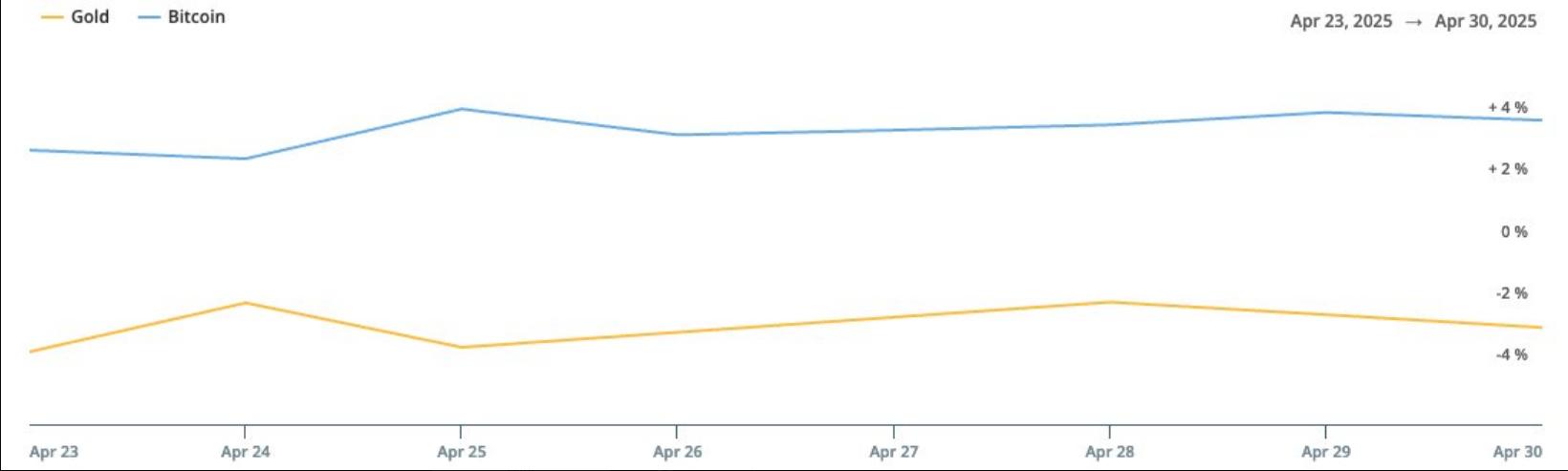

Bitcoin vs. Gold

- Draper argues that Bitcoin is becoming a more attractive safe haven than gold, citing issues like storage fees and physical transfer of gold.

- Bitcoin's limited supply and independence from central banks enhance its appeal amidst financial instability.

Government Interest

- Some governments are evaluating the potential of holding Bitcoin reserves, indicating a shift in sentiment towards cryptocurrencies among public institutions.