8 1

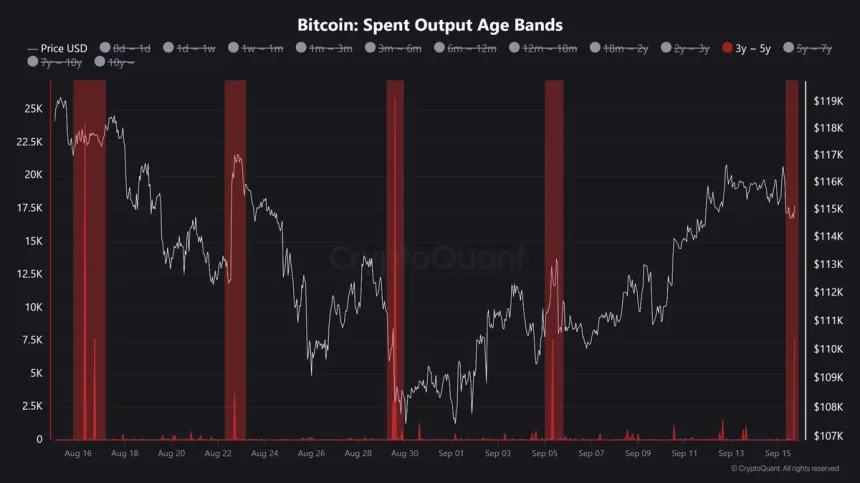

Dormant Bitcoin Shifts as 7,547 BTC Moves Amid Fed Decision

Bitcoin (BTC) is currently in a sideways consolidation phase after reaching an all-time high near $124,000. The price remains within a narrow range, indicating resilience but lacking a clear trend, suggesting a potential upcoming breakout.

- Analyst Maartunn notes increased movement of dormant whale coins, historically linked to major market reactions.

- The recent movement of 7,547 BTC aged 3–5 years aligns with historical patterns of significant market volatility.

- This activity coincides with the Federal Reserve's impending interest rate decision, potentially impacting investor sentiment and Bitcoin’s trajectory.

Currently, BTC is consolidating around $115,555, maintaining above key moving averages, indicating short-term bullish momentum:

- Support levels are at $114,000 and $112,000, aligning with 50-day and 100-day SMAs, respectively.

- Resistance is near $116,000; surpassing this could lead to testing the $123,217 level.

- Failure to break $116,000 may suggest exhaustion, especially with the Fed rate decision looming.

The convergence of long-term whale movements and macroeconomic uncertainty highlights the current market's fragility. Investors are watching closely as these factors could determine Bitcoin's next trend.