12 0

Ether’s 7% Plunge Leads Crypto Liquidations in $600M Carnage

Crypto markets experienced significant declines on Friday due to heightened U.S.-China trade tensions. The U.S. threatened increased tariffs on Chinese goods, impacting the crypto market.

- Ethereum (ETH) saw a 7% drop, hitting its lowest price since September below $4,100.

- Bitcoin (BTC) fell by 3.5%, dipping below $118,000.

- The CoinDesk 20 Index plunged by 5%.

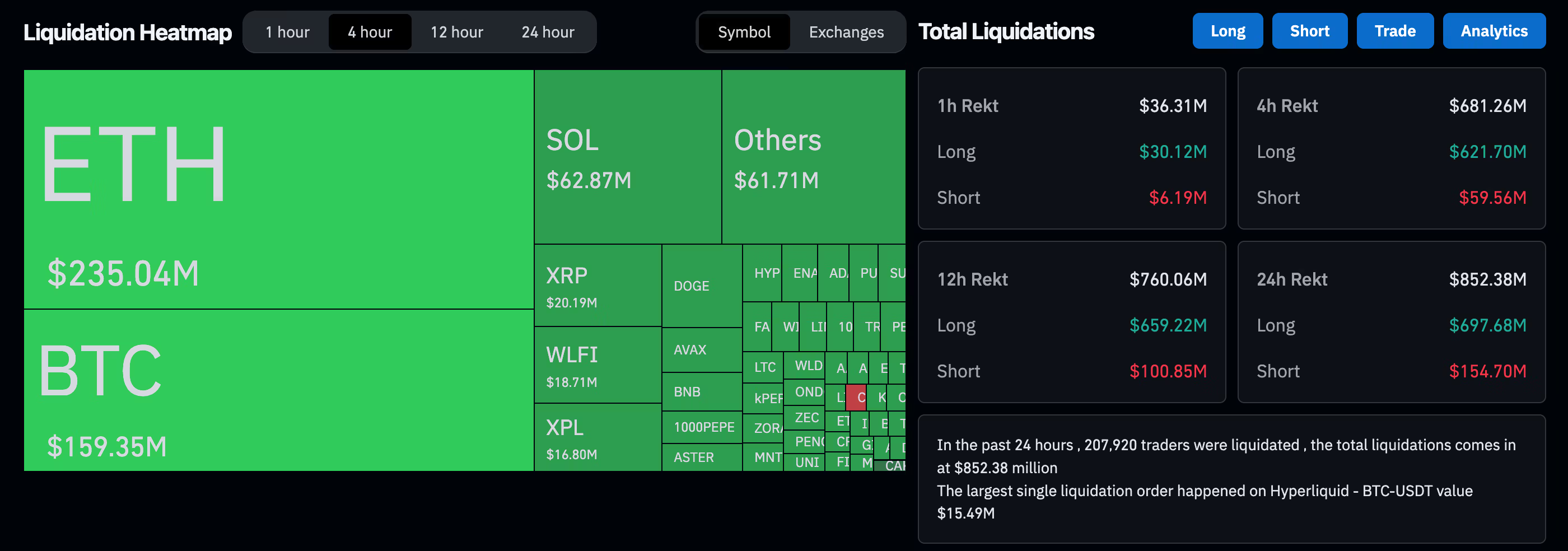

The market downturn triggered a liquidation cascade across crypto derivatives, resulting in over $600 million worth of leveraged trading positions being wiped out.

- ETH led in liquidations with over $235 million in long positions eliminated.

Technical Breakdown

- ETH's critical support levels broke down, driving the liquidation cascade.

- Selling pressure increased at 14:00 UTC with a volume of 372,211 units, nearly double the 24-hour average.

- Volume-based resistance was noted around $4,287.

- Primary resistance occurred at $4,141 during recovery attempts.

- Potential support observed just below $4,100 where buyers emerged.