7 0

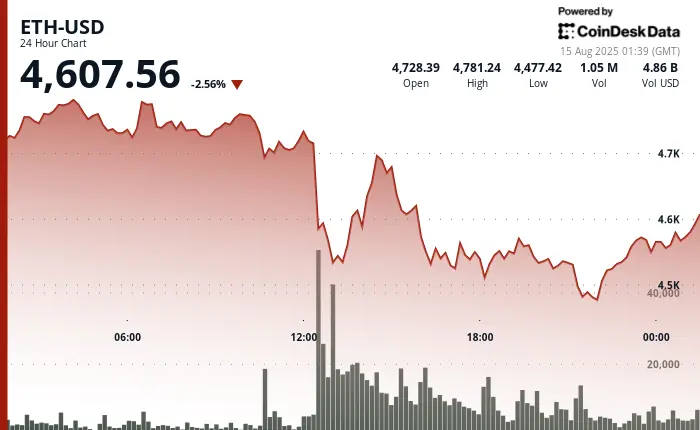

ETH Experiences 3% Dip Amid Early Signs of Profit-Taking

Market Overview

As Hong Kong starts trading, ETH is priced above $4600, down 3% on the day but up nearly 16% in the past week and 45% over the last month.

Key points:

- ETH/BTC ratio surpassed its 365-day moving average, indicating potential extended ETH outperformance.

- Recent data suggests near-term cooling; ETH inflows to exchanges have exceeded Bitcoin's, signaling profit-taking by holders.

- ETH's MVRV ratio against BTC rose from 0.4 in May to 0.8, nearing historical overvaluation levels.

- FlowDesk reported $1 billion in single-day ETH ETF inflows but noted increased call overwriting in ETH options, suggesting capped upside expectations.

- Macro indicators show softer CPI and potential for a Fed rate cut, but upcoming economic prints could impact sentiment.

- Profit-taking signs are emerging amid strong structural drivers like ETF demand and institutional participation.

Market Movers

BTC: Decreased over 3% following U.S. inflation data that diminished rate cut prospects.

ETH: Dropped 3.3% as traders take profits after recent highs.

Gold: Fell 0.62% to $3,336.6 due to strengthening dollar and yields impacting rate cut expectations.

Nikkei 225: Opened higher with Japan's economy growing an annualized 1.0% in Q2, despite warnings of potential growth slowdowns from U.S. tariffs.

S&P 500: Stalled as hotter-than-expected PPI impacted rate cut hopes; Goldman Sachs indicates increased risk of a drop due to low volatility and tariff concerns.