21 0

Ethereum Drops 14% as BlackRock Sells $80M, Bitcoin Gains

Key Points:

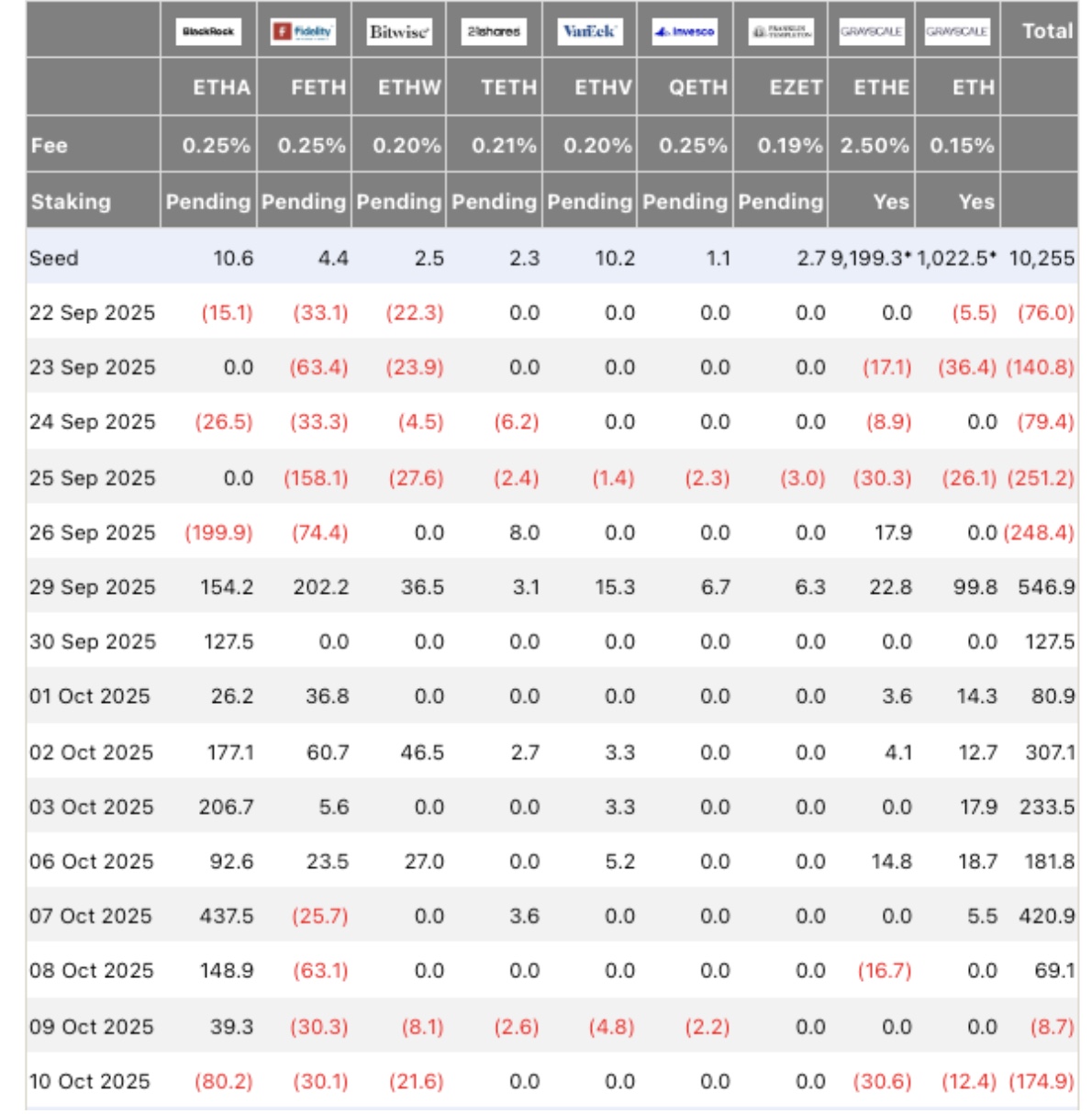

- Ethereum price fell 14% to $3,800, doubling Bitcoin's 7% losses due to ETF trading data.

- BlackRock led Ethereum sell-offs with $80.2 million in net withdrawals while adding more BTC, affecting investor sentiment.

- Aggregate Ethereum ETF outflows reached $174 million on Friday; Bitcoin ETFs showed relative strength with $74 million net inflows into BlackRock's IBIT ETF.

- Ethereum derivatives saw $3.64 billion in liquidations over 24 hours, with a long/short ratio dropping to 0.94.

- On-chain data reveals a shift towards staking yields, with the entry queue increasing by 1,356,688 ETH and exit queue decreasing, indicating fewer validators unstaking.

- Staking deposits increased by 29,826 ETH (approx. $114 million), aligning with BlackRock’s ETF withdrawals.

- Ethereum's price rebounded to $3,823, supported by steady inflows into Beacon Chain staking contracts.

Additional Information:

- The Best Wallet presale surpassed $16.5 million, offering multi-chain support and security features as an attractive yield alternative.

- The crypto market consolidates after a $19 billion liquidation event.