8 2

Ether Gains Favor Among Investors as Futures and Options Show Bullish Sentiment

The futures and options market shows a notable shift towards ether (ETH) over bitcoin (BTC), indicating increased institutional interest.

- Bitcoin reached record highs of over $110,000 and gained over 16% this year.

- Ether dropped 20% this year despite Ethereum's dominance in DeFi and tokenization.

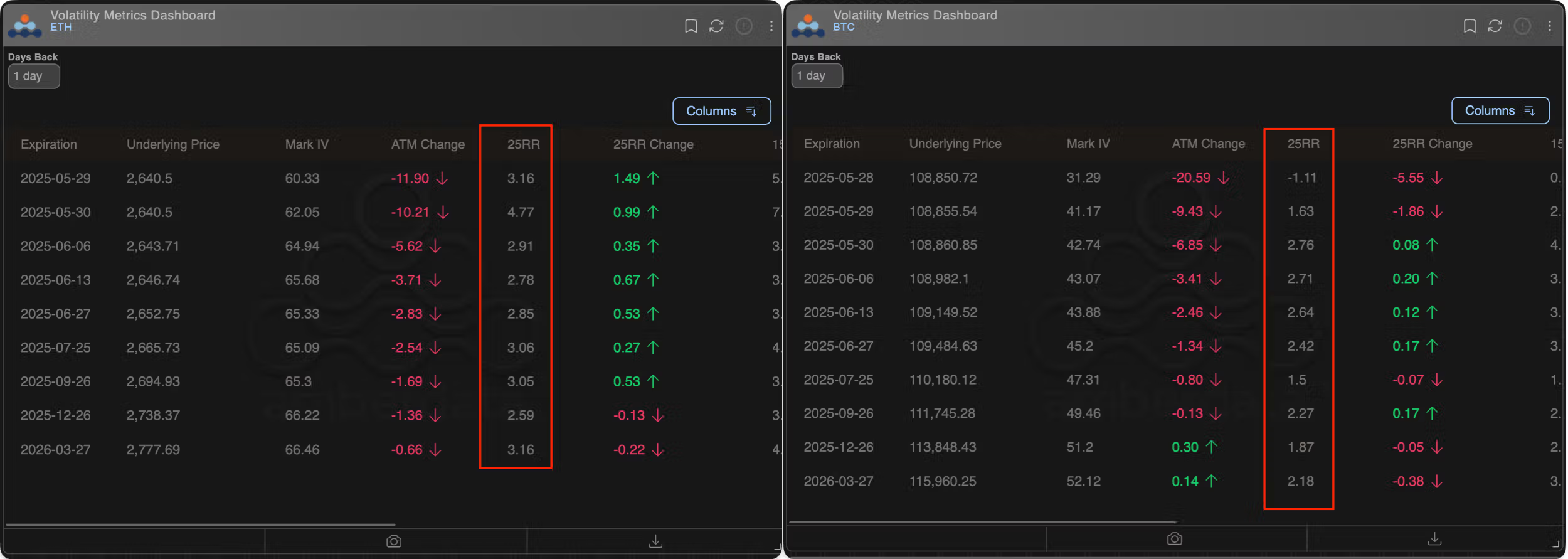

Options indicate bullish sentiment for ether

- Options on Deribit show stronger bullish positioning for ether compared to bitcoin.

- Both BTC and ETH have positive 25-delta risk reversals, but ETH's are more expensive, indicating greater bullish sentiment.

CME futures open interest

- CME bitcoin futures open interest rose by 70% to over $17 billion since early April but has stalled recently.

- Ether's open interest increased by 186% to $3.15 billion, showing accelerated growth and preference among institutions.

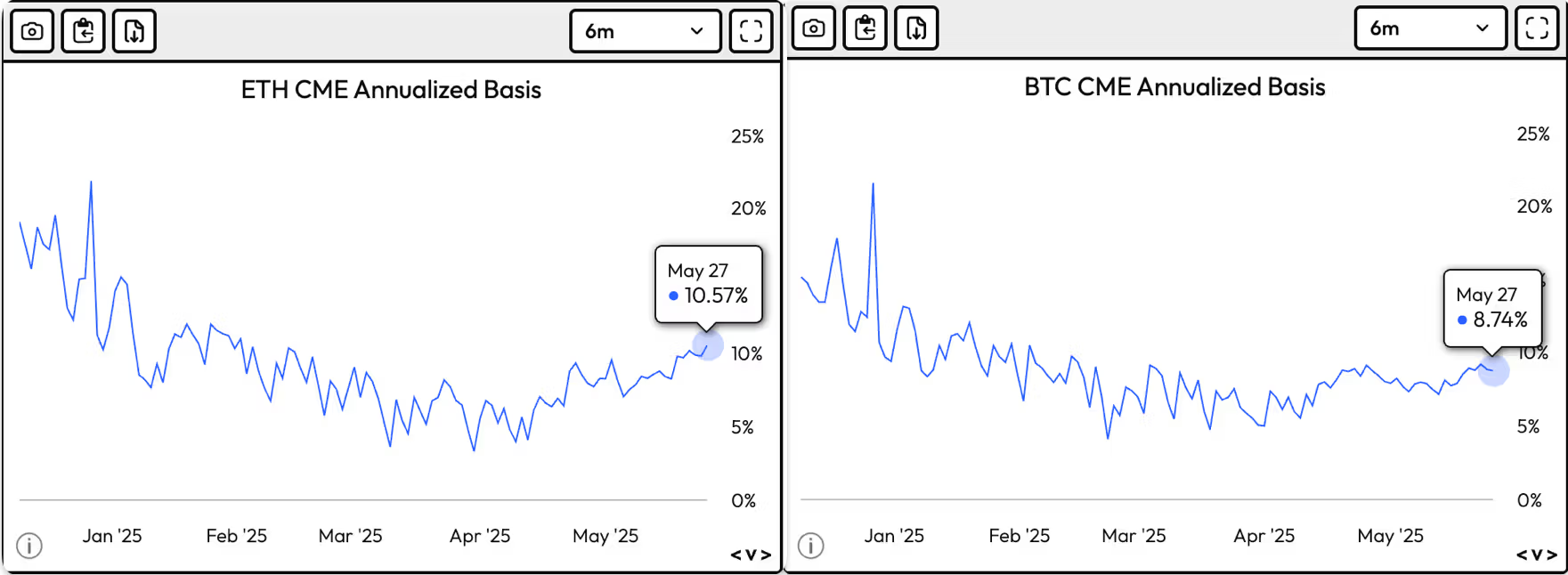

Futures premiums and perpetual funding rates

- One-month ether futures have an annualized premium of 10.5%, higher than bitcoin's 8.74%.

- This indicates strong buying interest and optimism for ether, which remains 84% below its 2021 record highs.

- Annualized funding rates for ETH perpetual futures are nearing 8%, while BTC's are below 5%.