3 0

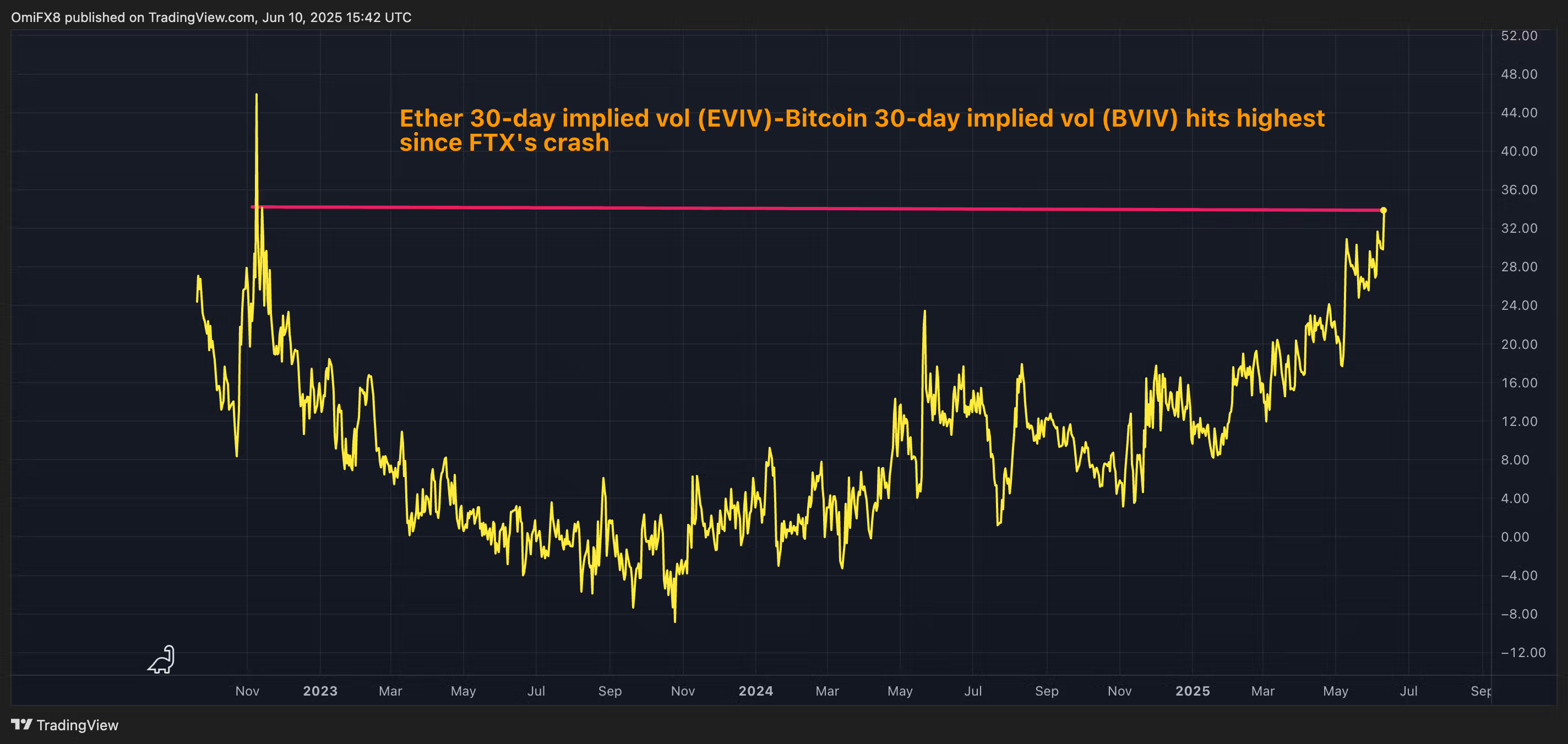

Ether Gains Popularity as Volatility Spread with Bitcoin Reaches 34%

Ethereum's ether (ETH) is gaining traction, outperforming bitcoin (BTC) significantly. Key points include:

- The spread between Volmex's ether implied volatility index (EVIV) and bitcoin's (BVIV) has reached 34%, the highest since November 2022.

- Market expectations indicate larger price swings for ether compared to bitcoin in the near term.

- ETH rose by 8% to $2,728 in 24 hours, while BTC gained only 1%.

- Ethereum ETFs attracted $812 million in the past two weeks, marking the largest inflow this year.

- In contrast, BTC ETFs drew less than $400 million during the same period.

- Macro factors support bullish sentiment for ether, including the advancing GENIUS Act and stablecoins gaining regulatory traction.

- On Deribit, ETH call options trade at a premium of 2%-3% over puts, while BTC calls are at a 0.5%-1.5% premium.

- ETH options markets show strong activity with a 30-day call skew of 6.24% and funding rates at 0.009%.