Ethereum Sees $1.4 Billion in Institutional Purchases Amid Rising ETF Interest

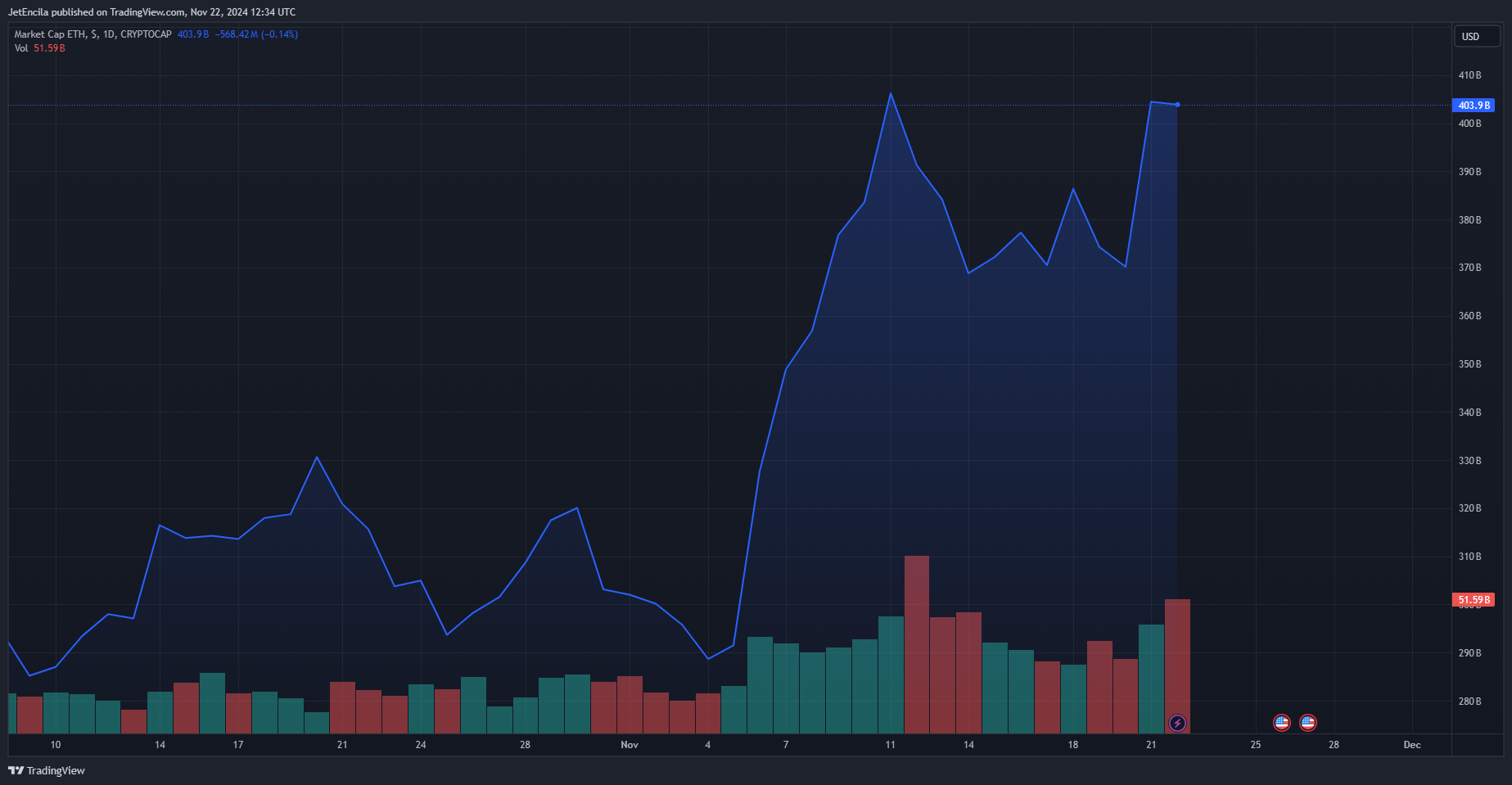

Ethereum (ETH) is gaining prominence as Bitcoin maintains recent highs. Currently, ETH is 36% below its all-time high of $4,878 from 2021, but analysts anticipate a significant shift for the second-largest cryptocurrency by market capitalization.

Ethereum's ecosystem is experiencing increased activity, highlighted by a surge in institutional investments, rising ETF interest, and growing transaction volumes. Daily transaction volumes have climbed to 1.22 million, up from 1.1 million three months ago, according to IntoTheBlock.

Bitcoin has been the star of this rally, but what about Ethereum?

Historically, Ethereum has been one of the first assets to benefit from profit rotations after Bitcoin's move.

Currently, Ethereum's on-chain activity shows evenly spaced potential resistance levels, but in… pic.twitter.com/amkbZmtEyo

— IntoTheBlock (@intotheblock) November 21, 2024

This increase in activity indicates consistent network usage, which underpins Ethereum's long-term value and ongoing significance in the crypto sector.

Institutional Investors Place Bets

In the past week, institutional buyers purchased over $1.4 billion worth of Ethereum (ETH). During the same timeframe, $147 million was invested in Spot Ethereum ETFs, reflecting growing optimism about ETH's future.

#Ethereum whales have bought over 430,000 $ETH in the last two weeks, worth over $1.40 billion! pic.twitter.com/n7iTTADuax

— Ali (@ali_charts) November 14, 2024

Trading volumes for Ethereum ETFs reached a record $1.63 billion last week, marking a 44% weekly increase. Analysts note that this trend mirrors patterns observed in Bitcoin ETFs, which often experience initial stagnation followed by growth.

Consequently, Ethereum's price rose by 25%, marking its largest weekly gain in six months, indicating that Ethereum may be gaining momentum.

Shifting Landscape: Layer 2 Solutions

Despite positive trends, Ethereum's network growth presents mixed signals. New ETH addresses created are lower than those seen during previous bull markets. Experts attribute this to Layer 2 solutions like Base, which enable faster and cheaper transactions without requiring direct connections to the main Ethereum chain.

Nonetheless, Ethereum's importance remains intact amid Layer 2 growth. Tokens continue to play a crucial role in decentralized finance (DeFi) and NFT ecosystems, reinforcing Ethereum's fundamental function while enhancing scalability and accessibility.

ETH is becoming less correlated with BTC.

The 180-day BTC-ETH Pearson correlation is at a three-year low. A 10% rise in #Bitcoin could result in only a 3% gain for #Ethereum.

Just because BTC is strong doesn't mean you should buy ETH. Each asset is now following its own path. pic.twitter.com/4Dn4QoInXo

— Ki Young Ju (@ki_young_ju) November 19, 2024

Ethereum Dissociates From Bitcoin

Ethereum's independence from Bitcoin is increasingly evident as the 180-day correlation between the two cryptocurrencies has dropped to a three-year low, falling below 0.5. This shift suggests that Ethereum is now influenced more by its unique market conditions than by Bitcoin's price movements.

Assessing Ether's potential independently is becoming essential as it carves its own path in the crypto landscape through Layer 2 adoption, institutional interest, and increasing ETF activity.

Featured image from DALL-E, chart from TradingView