Ethereum Underperforms with 36% Gains, 10% Chance to Reach $4,000 By Year-End

Bitcoin and several altcoins have achieved nearly three-digit percentage returns in 2024, while Ethereum has gained only 36% year-to-date. This positions Ethereum as an underperformer compared to its peers.

Bitcoin and most altcoins reached new all-time highs in 2024, yet Ethereum remains approximately 40% below its all-time high of $4,841 from 2021. The launch of a spot Ethereum ETF this year has not significantly increased investor interest in Ethereum (ETH).

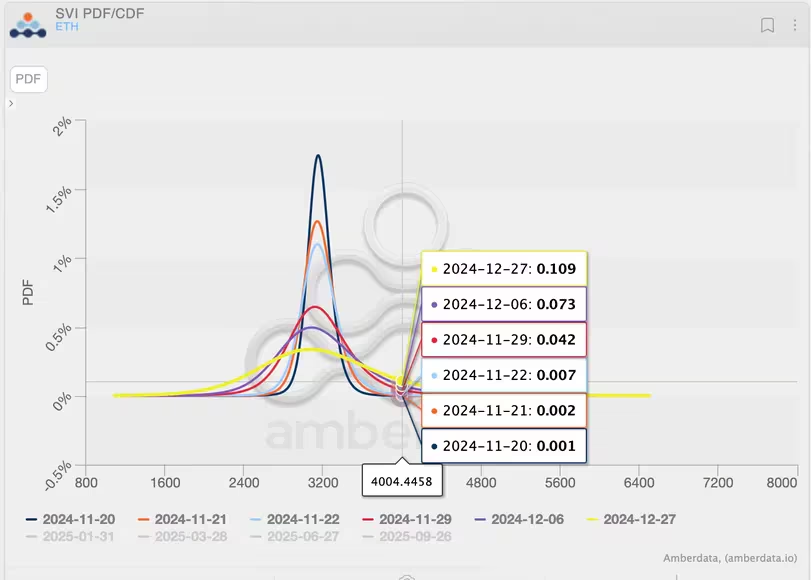

Research from Amberdata indicates that Ethereum's underperformance may persist until year-end. The data shows only a 10% chance of ETH surpassing the $4,000 mark by year-end, based on options-based probability density functions. In contrast, traders are betting on Bitcoin reaching $100K.

-

Courtesy: Amberdata

The accompanying chart illustrates the Probability Density Function (PDF) and Cumulative Distribution Function (CDF), highlighting the likelihood of Ether trading at various price levels over different timeframes, based on options trading activity on Deribit.

Why Ethereum Price Is Not Going to $4,000?

Current market sentiment suggests only a 10% probability of ETH exceeding $4,000 by December 27. This reflects insufficient investor confidence in ETH, despite expectations of regulatory changes under Trump's presidency positively affecting DeFi tokens.

Amberdata attributes Ethereum's poor outlook to weak fundamentals. Greg Magadini, Director of Derivatives at Amberdata, stated:

“ETH faces serious headwinds as the value proposition of ‘sound money’ has flipped to inflation supply due to most DeFi transactions occurring on L2s instead of ETH L1 itself, drastically dragging prices down.”

Moreover, inflows into spot Ethereum ETFs declined after a brief surge following Donald Trump's victory, with net flows turning negative again over the last three days.

$ETH: road to $13k

This could be a transformative cycle for #Ethereum.

$10k-$13k is conservative. pic.twitter.com/q3Er9EG9gS

— venturefounder (@venturefounder) November 19, 2024

Despite these challenges, some analysts maintain a bullish outlook for Ethereum, expecting not only a return to all-time highs but also potential threefold increases in price moving forward.