7 0

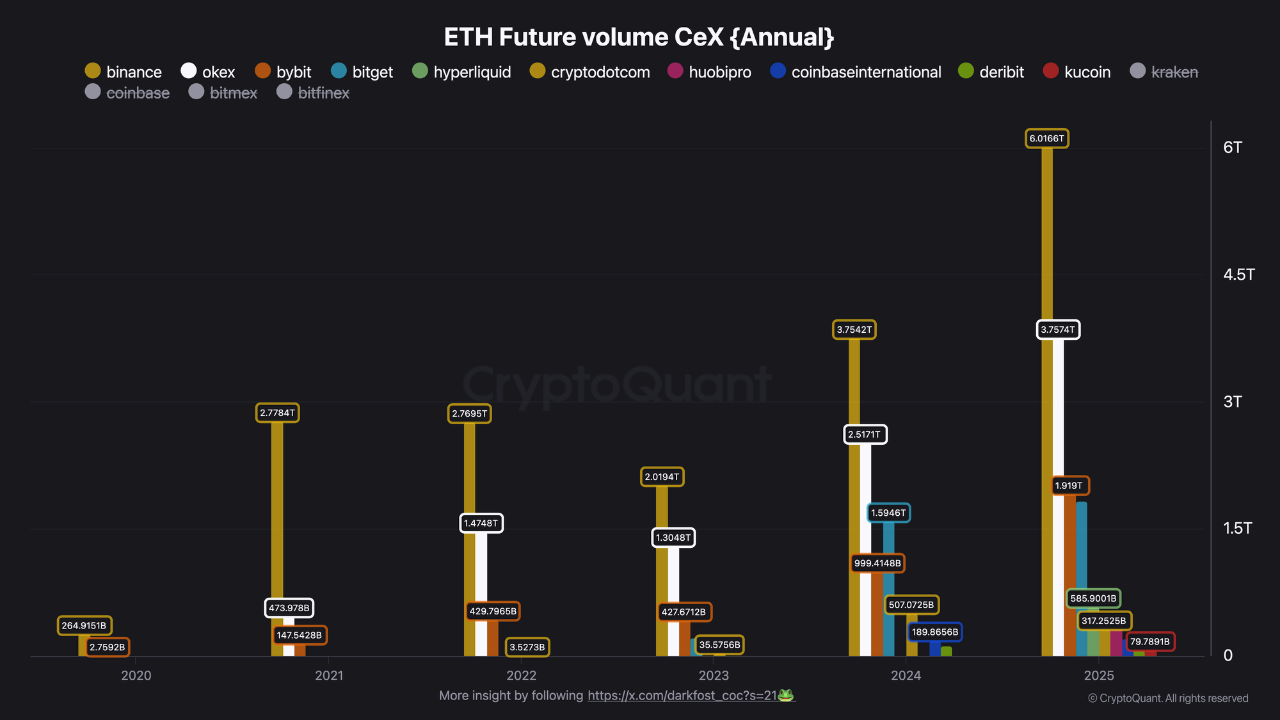

Ethereum Trading Volume on Binance Reaches $6 Trillion in 2025

Ethereum has reclaimed crucial price levels after a volatile weekend, emerging as a strong performer in the market rebound. As Bitcoin remains stable near $100K, altcoins are gaining momentum, with ETH leading the charge. This recovery is amid renewed optimism, following recent corrections and fear-driven selling.

- Ethereum trading volume on Binance has reached record highs, indicating a speculative market.

- Current rallies are heavily fueled by leverage and short-term speculation, increasing market volatility and instability.

- Centralized exchanges (CeX) report historic highs in trading volumes and open interest for ETH.

- On Binance, Ethereum trading volumes surpassed $6 trillion in 2025, dominating the speculative trading market.

- ETH open interest on Binance exceeded $12.5 billion in August 2025, highlighting a shift towards a speculative environment dominated by short-term positions.

The market structure now relies more on derivatives than spot buying, making Ethereum's price dynamics fragile and reactive to liquidity changes.

Testing Key Resistance After Sharp Sell-Off

Ethereum is showing signs of recovery from last week’s decline, rebounding from lows of $3,200 to around $3,590. Buyers reacted strongly after days of selling pressure, indicating renewed market confidence.

- Technical analysis shows ETH forming higher lows, but facing resistance at the $3,650–$3,700 zone.

- A decisive close above this level may lead to a move toward $3,850–$3,900.

- Increased buying activity accompanied the recent bounce, reinforcing $3,200 as a strong demand zone.

- Overall trading conditions remain volatile and speculative.