7 0

Ethereum May Have Completed Capitulation Phase, Analyst Reports

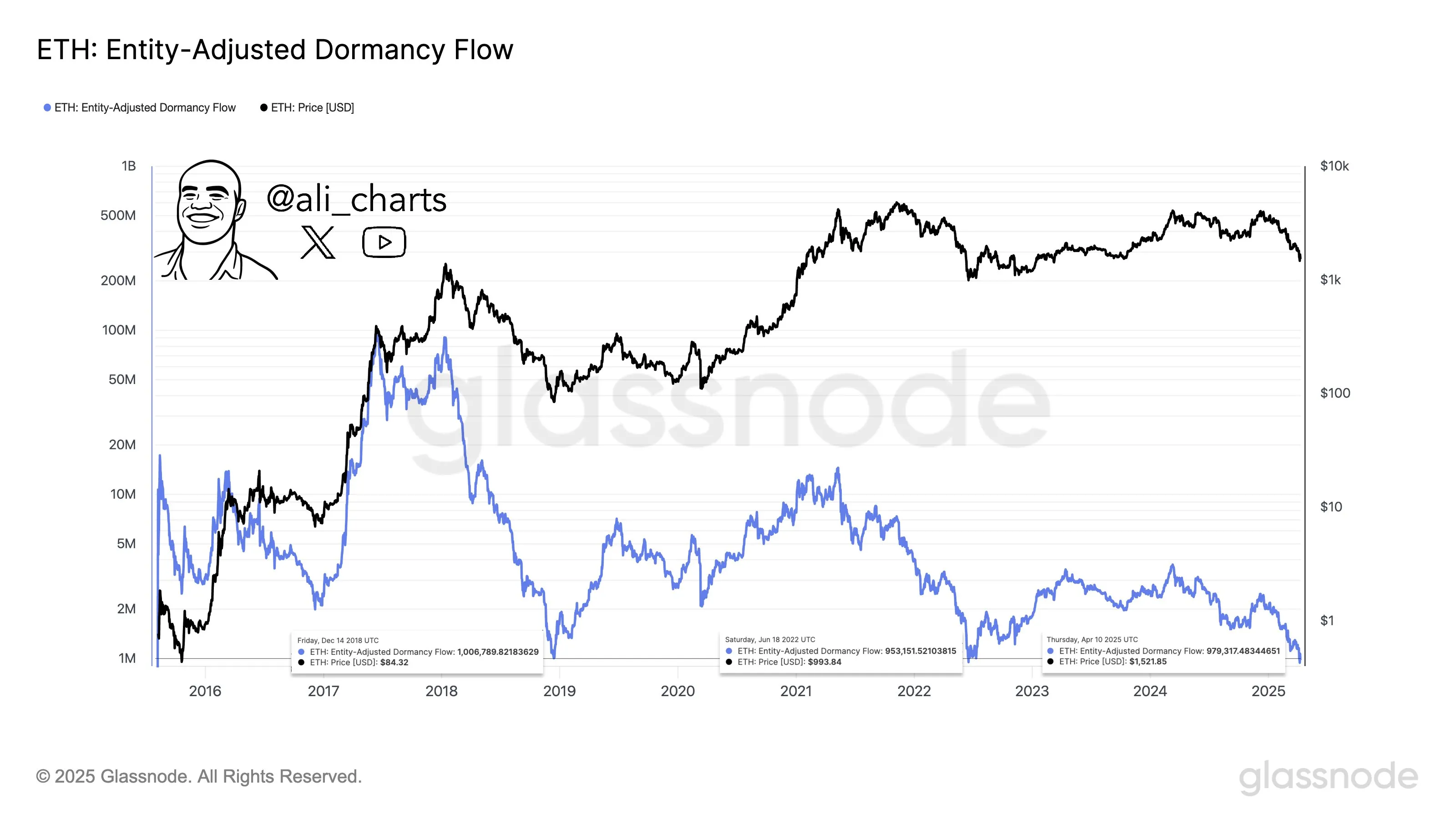

Recent analysis by crypto expert Ali Martinez suggests Ethereum (ETH) may have completed its capitulation phase, despite a 55% decline in value over the past year. Currently, ETH is priced around $1,560, down 17% from $1,892 two years ago.

Current Market Context

Key points include:

- Ethereum has underperformed compared to Bitcoin (BTC), which has nearly doubled in value from $41,000 to $82,127 over the same period.

- Sentiment towards ETH is low among both retail and institutional investors.

- Martinez noted that "smart money" might be accumulating ETH, suggesting it could be undervalued.

- Ethereum's Entity-Adjusted Dormancy Flow metric indicates potential market bottoming conditions.

The current Bitcoin Dominance (BTC.D) stands at 63.5%, indicating possible capital shifts into altcoins. A pivot to quantitative easing by the US Federal Reserve could further influence market dynamics.

Outlook for ETH

While some indicators show potential for ETH to rebound, there are concerns about continued weakness:

- Martinez warns ETH could drop to $1,200 if selling pressure persists.

- Ongoing outflows from US-based Ethereum ETFs pose risks to short-term price stability.

- Analyst NotWojak indicates a potential breakout with a target of $1,835, but ETH is currently trading at $1,557, down 2.3% in the last 24 hours.