Ethereum Derivatives Market Sees 40% Increase in Open Interest

The Ethereum (ETH) market is undergoing a significant shift as its derivatives market experiences unprecedented growth. Although Bitcoin's price action remains influential, Ethereum's derivatives activity indicates potential upward momentum.

New Highs In ETH Open Interest And Leverage Ratios

Recent analysis by CryptoQuant’s EgyHash reveals that Ethereum's open interest has surpassed its previous all-time high, showing a 40% increase in four months and exceeding $13 billion. This rise reflects growing engagement among traders and institutions in Ethereum's market.

Funding rates are moderately positive, indicating long-position traders dominate, which aligns with sentiments favoring further price increases for ETH. Additionally, the estimated leverage ratio has reached a new all-time high of +0.40, calculated as the ratio of open interest to the exchange’s coin reserves.

The rising metrics indicate positive market sentiment toward ETH; however, elevated leverage and dominance of long positions could increase the risk of a long squeeze during sudden price volatility, potentially leading to market corrections.

Ethereum Market Performance

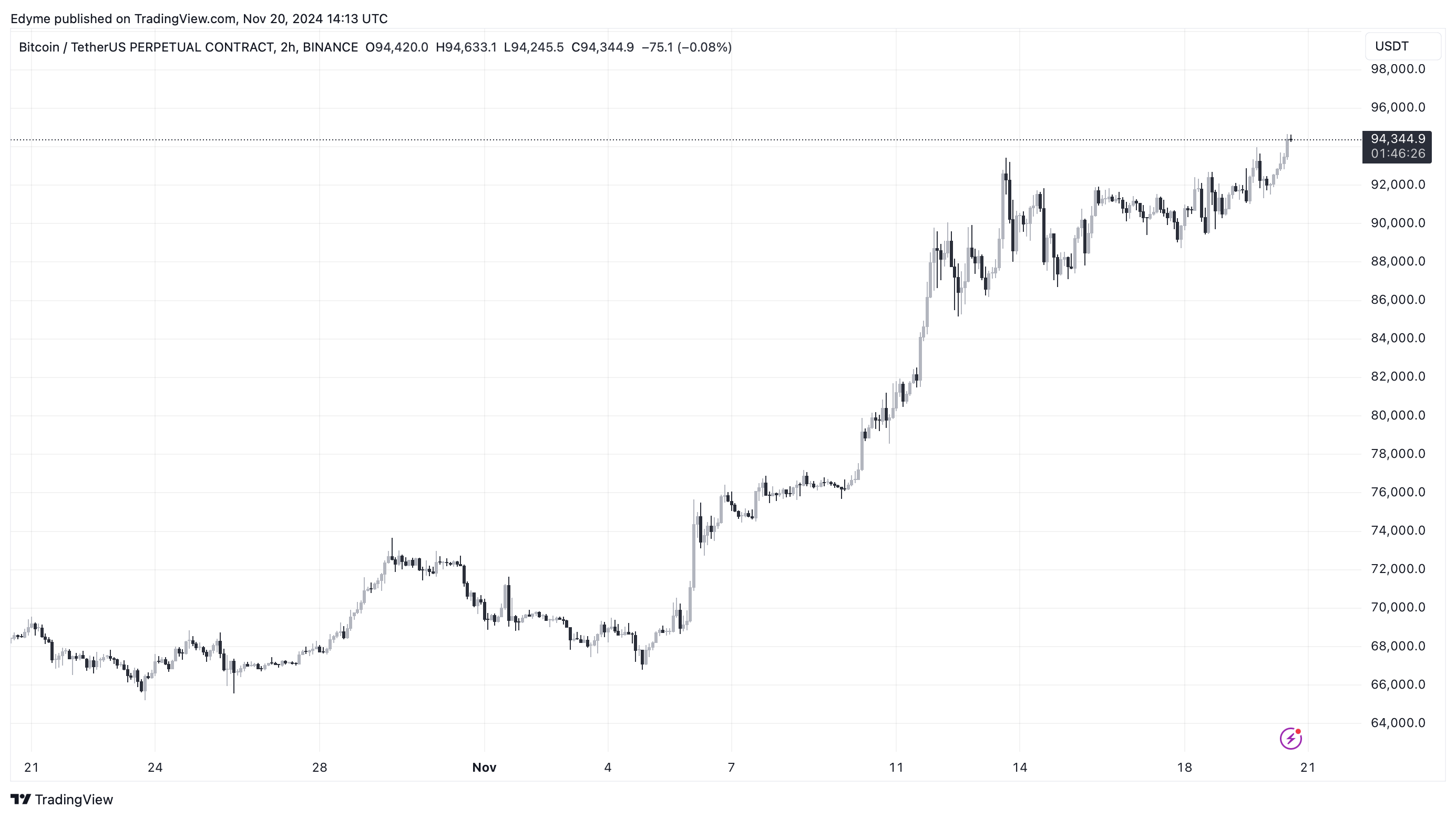

Despite these positive metrics, Ethereum underperforms compared to Bitcoin. While Bitcoin consistently breaches major resistance levels, ETH remains 36.2% below its all-time high of $4,878 from 2021.

Currently, Ethereum is trading at $3,112, having surged by 0.9% in the past day. Analyst Ali on X suggests Ethereum may soon outperform Bitcoin, citing various key metrics and trends.

Ali notes that the altseason indicator signals a buying opportunity, and ETH’s MVRV momentum approaches a key moving average, suggesting significant upside potential. He also highlights ETF inflows and increasing whale activity, projecting that Ethereum could test $4,000 and $6,000 levels based on an ascending parallel channel, with a bullish theory targeting $10,000.

But there is another bullish theory! #Ethereum could be mirroring the price action of the S&P500, which puts a $10,000 target on $ETH. https://t.co/ifn1zGnn9x

— Ali (@ali_charts) November 19, 2024

Featured image created with DALL-E, Chart from TradingView