Ethereum ETF Assets Reach $14B Amid Price Volatility

The crypto market experiences volatility as Bitcoin slips below $104,000, impacting Ethereum, which dropped close to $3,800. Over $400 million in liquidations occurred in the past 24 hours, and Ethereum's market cap stands at $466 million with a 30-day return of 24.22%.

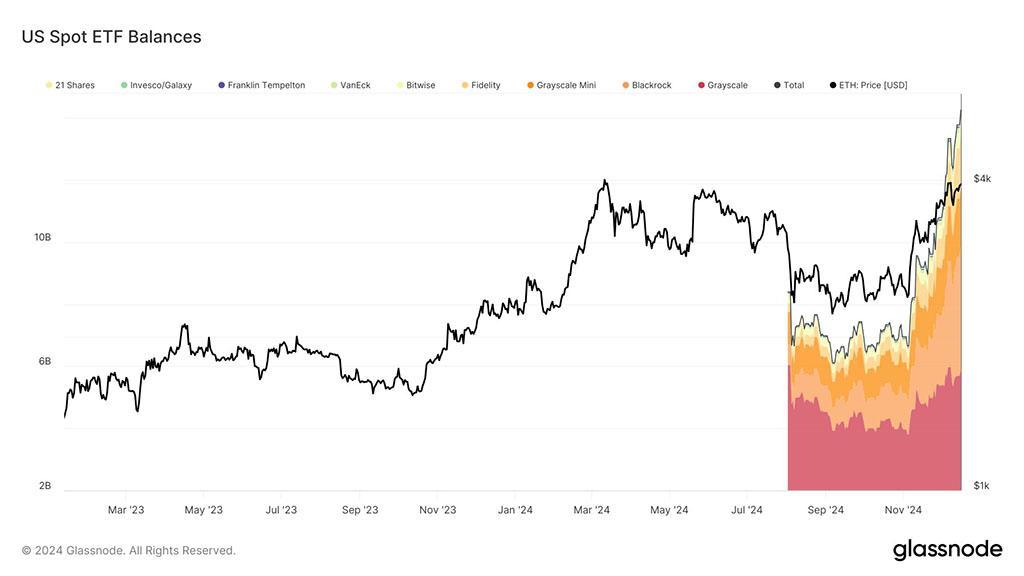

Explosive Inflows in Ethereum ETFs

Institutional buying continues despite Ethereum's short-term bearish trend. US spot Ethereum ETFs saw a significant daily net inflow of $144.7 million. BlackRock led purchases with $134.8 million in ETH, followed by Fidelity with $3.9 million. The total net inflow since November 2024 exceeds $6 billion, bringing total ETF net assets to $14 billion, representing 2.96% of Ethereum's market cap.

Despite market fluctuations, institutional interest is rising, and upcoming staking yields may catalyze Ethereum's next upward movement.

Ethereum Price Analysis Targets $4,420

The two-hour price chart indicates Ethereum's struggle to maintain dominance above $4,000, reversing from a high of $4,109 as Bitcoin declined. Ethereum fell below the $3,900 support level, facing selling pressure after a rejection near the 50% Fibonacci level at $3,795.

A minor reversal above the 61.80% Fibonacci level at $3,861 suggests potential bullish momentum following the recent drop. MACD and Signal lines indicate possible bullish crossover, while RSI shows signs of recovery from oversold conditions.

ETH Price Targets

If the uptrend persists, breaking the 78.60% Fibonacci level and reclaiming the $4,000 mark could lead to an increase towards the 1.61% Fibonacci level at $4,420. Conversely, a bearish close below the 50% Fibonacci level might retest $3,647.

In summary, despite recent challenges testing critical support levels, bullish indicators and institutional inflows into Ethereum ETFs suggest strong potential for a bullish recovery by the end of 2024.