Ethereum Killers Still Struggle to Compete with Ethereum’s Market Presence

Nobody questions what the next Bitcoin will be: Bitcoin has established itself as the leading cryptocurrency. The focus has shifted to identifying potential alternatives to Ethereum.

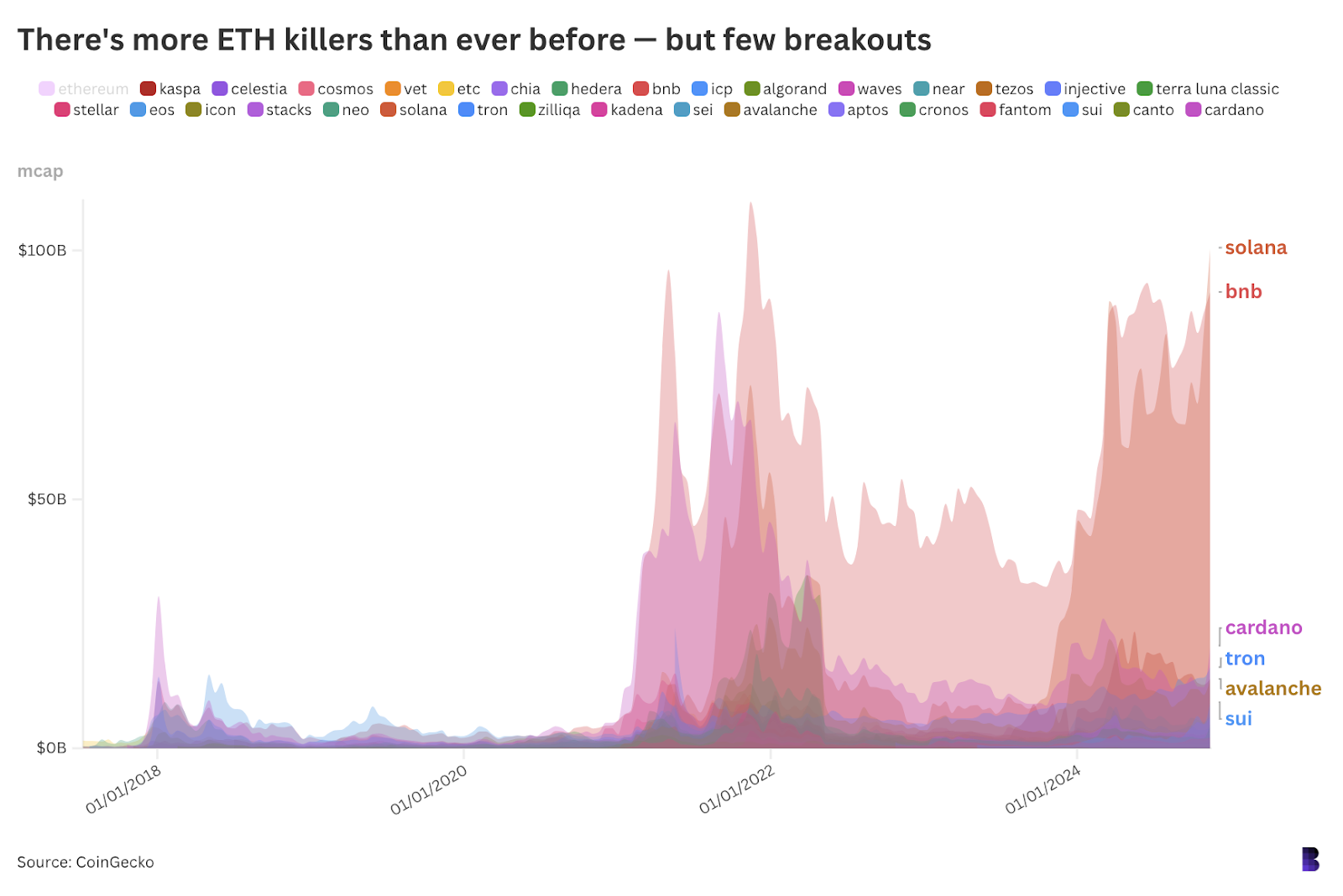

Over nearly a decade, more than 30 smart contract platforms have emerged as contenders against Ethereum. This includes newer chains like Sui, Sei, Celestia, and TON, alongside older networks such as Cronos, Cardano, Fantom, and EOS.

In the past three years, only 10 of these have outperformed Ethereum (ETH). TRON’s ETH ratio increased by approximately 140%, while TON’s doubled. Solana (SOL) has risen by 26% against ETH since 2021, with a 140% increase over the past year.

Solana is viewed as a strong contender to potentially surpass Ethereum in the future. However, current market indicators suggest otherwise.

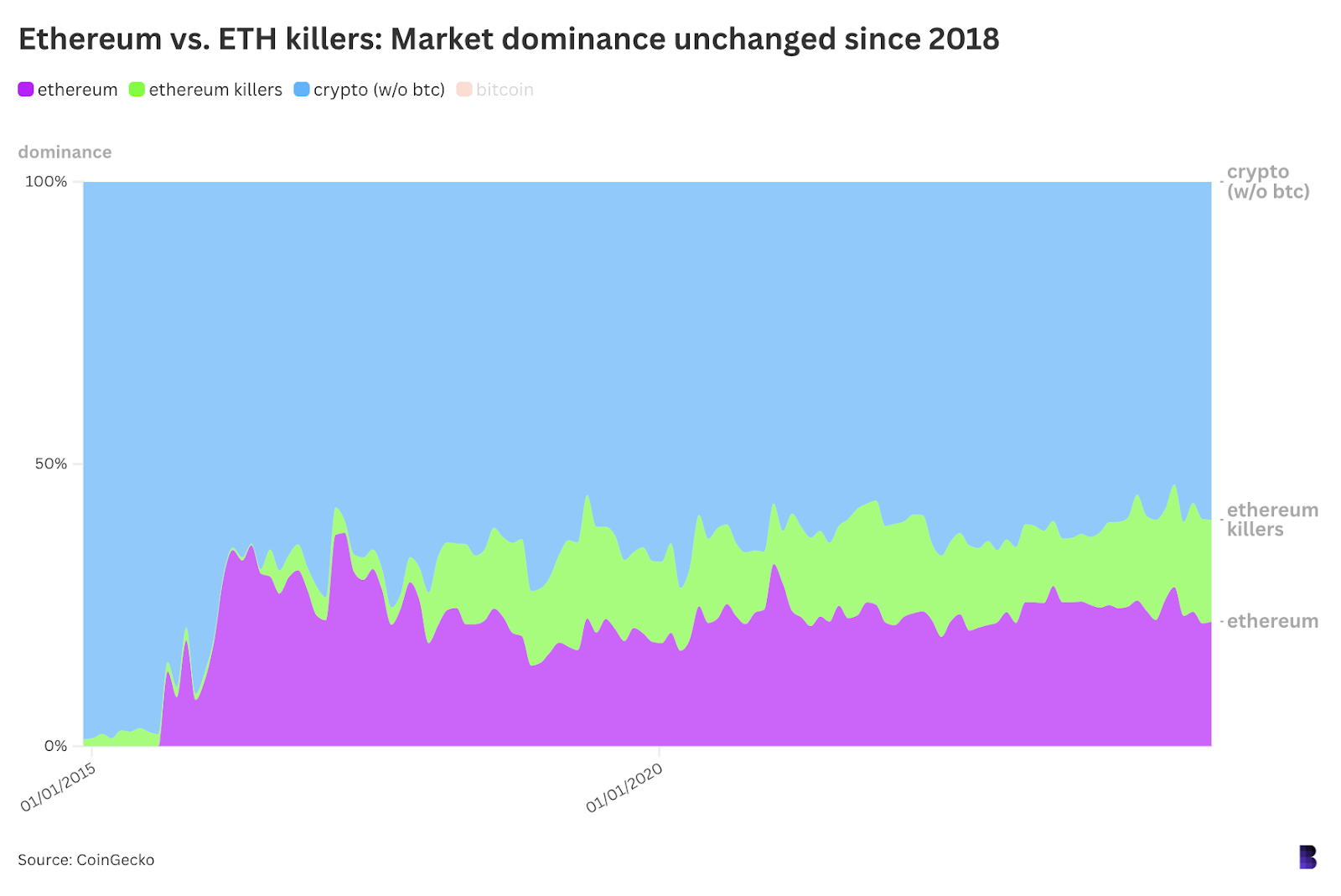

The first step is eliminating distractions, particularly Bitcoin, which does not compete directly with Ethereum or other smart contract platforms.

Next, we can categorize the market into three segments: Ethereum, Ethereum killers, and cryptocurrencies excluding Bitcoin.

This chart illustrates the market dominance of each category over the past decade, starting just before Ethereum's launch in 2015. Ethereum's share of the crypto market, excluding Bitcoin, has remained stable at around 22%. It was under 20% midway through 2022 and below 15% five years ago.

Ethereum killers collectively represent 18% of the non-Bitcoin crypto space, consistent with their standing in late 2018 and 2021. This indicates that Ethereum's market position remains relatively unchanged, growing at a similar rate to other non-Bitcoin cryptocurrencies.

Smaller coins are experiencing varied performance, with most losing ground against ETH over different timeframes. The chart compares all ETH killers, highlighting SOL and BNB as the primary challengers to Ethereum, both holding market caps around $100 billion. Cardano follows with a market cap of $20 billion, while ETH approaches $400 billion amidst ongoing development for its next major upgrade, Beam Chain.

Similar to Bitcoin's separation from the broader crypto market, Ethereum may also follow this trajectory, suggesting limited potential for significant changes in its market position.