10 0

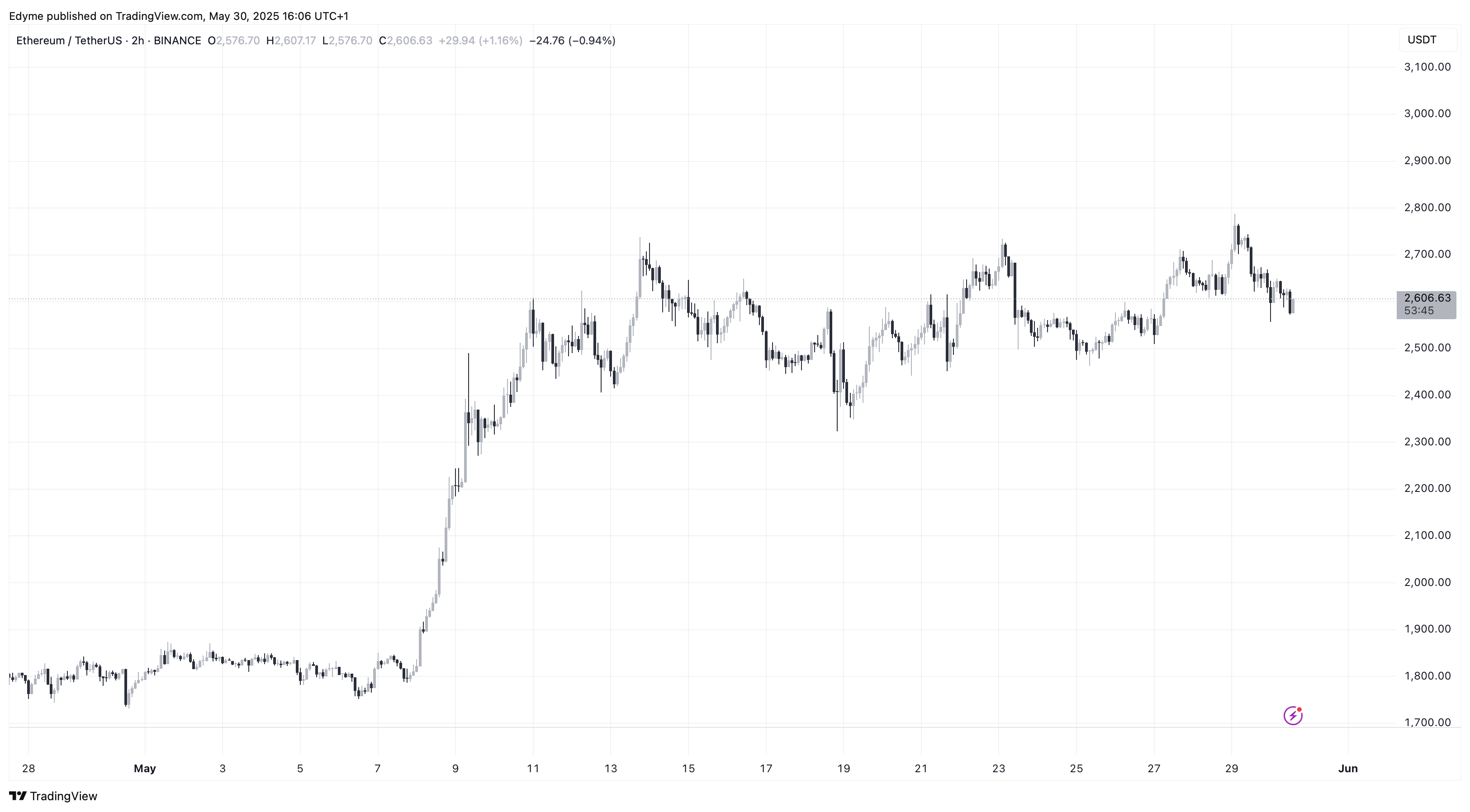

Ethereum Price Drops 3.2% Amid Large Inflows to Binance

Ethereum's price has declined by 3.2% over the last 24 hours, trading at $2,621. This drop follows reports of a federal court reinstating US tariffs, leading to risk-off sentiment in the crypto market. Despite this, ETH is up approximately 45% over the past month.

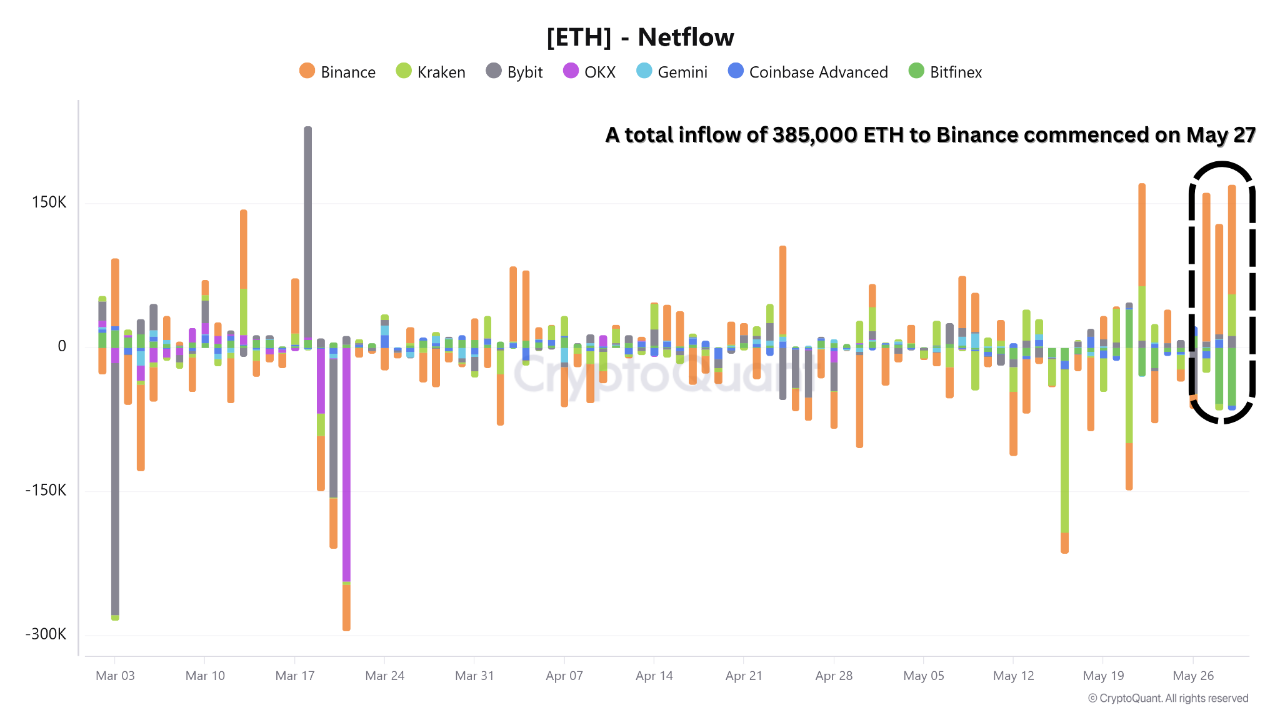

Large Ethereum Inflows to Binance

- Notable increase in Ethereum transfers to exchanges observed.

- On May 27, approximately 385,000 ETH transferred to Binance, one of the largest daily inflows in recent months.

- Such inflows often indicate increased selling intent, particularly among larger holders or institutional investors.

- Bitcoin’s Net Unrealized Profit/Loss (NUPL) metric has approached 0.6, historically associated with market cooling phases.

High inflows may reflect preparations for liquidity provision or anticipated volatility. Previous occurrences of NUPL at similar levels led to price pullbacks in Bitcoin, affecting broader market direction.

Potential Consolidation Phase

- Market participants are adjusting positions amid uncertainty.

- The recent inflow and rising NUPL are noteworthy indicators, though not definitive sell signals.

- Past cycles show that such patterns coincide with reduced exposure or asset rotation by investors.

- Short-term correction or sideways movement is possible as ETH remains near local highs.

Investors should monitor exchange inflows, NUPL, and other on-chain metrics for sentiment shifts. Developments in regulatory or macroeconomic factors could further impact crypto price dynamics. Recent signals suggest a phase of caution and strategic reassessment ahead.