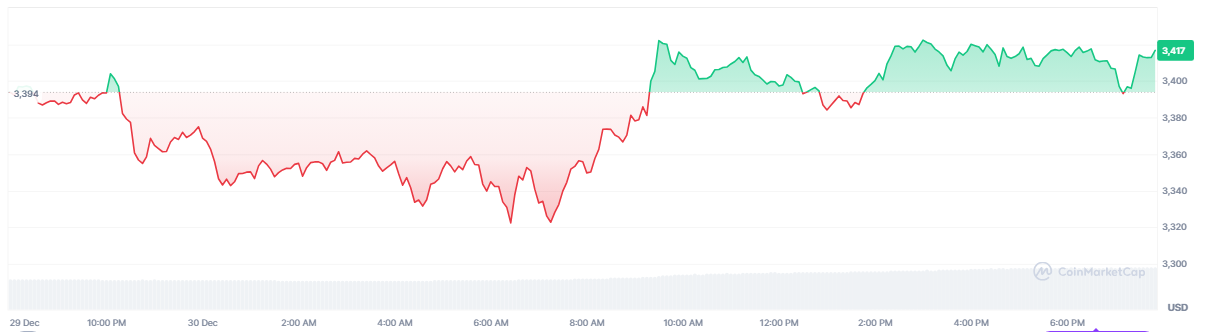

Ethereum Price Drops to $3,400 Amid Record Staking and ETF Inflows

Recent Ethereum market fluctuations show a disparity between price and network activity. Staking has increased while ETH price fell to $3,400, a 16% decline from December's peak.

Record amounts of ETH are being staked, surpassing expectations. Despite short-term price drops causing skepticism about Ethereum's viability, the rise in staking indicates growing confidence in its long-term value.

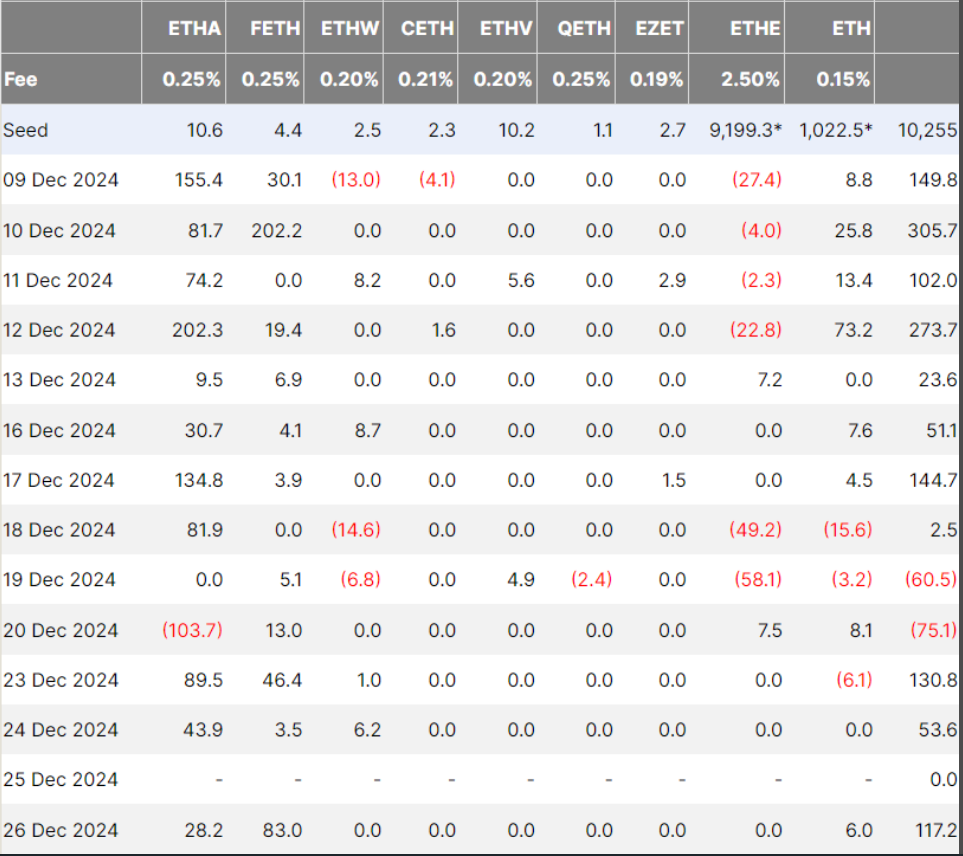

Investor Confidence Indicated By ETF Inflows

Exchange-traded funds (ETFs) focused on Ethereum have seen significant growth, accumulating $2.68 billion over the past 25 days with inflows recorded on 23 days. As of December 27, total net assets in these ETFs exceeded $12 billion due to nearly $48 million in daily inflows, primarily driven by BlackRock's Ethereum ETF, indicating strong institutional interest despite recent price declines.

The popularity of the Ethereum spot ETF reflects a broader trend in the crypto market where ETFs are becoming a preferred investment vehicle for both institutional and retail investors. Additionally, large inflows into Bitcoin ETFs suggest traditional financial markets are increasingly embracing digital assets.

Price Action And Broader Market Dynamics

The decline in Ethereum’s price likely stems from profit-taking after a recent rally and macroeconomic uncertainties affecting the cryptocurrency market. Regulatory pressures and potential interest rate increases have created a cautious trading atmosphere.

Some analysts view the current price drop as a consolidation phase rather than a cause for concern, pointing to strong staking and ETF inflows as indicators of long-term market confidence.

Broader Perspective

Recent developments in Ethereum occur within an optimistic context regarding its ecosystem. Enhancements such as the transition to proof-of-stake and ongoing scalability improvements support Ethereum's leadership in non-fungible tokens (NFTs) and decentralized finance (DeFi).

Investors should maintain a long-term perspective while managing short-term volatility. The shift towards ETFs and increased staking usage illustrates the evolving landscape of crypto investing. Although Ethereum's price may fluctuate, its network and use cases remain robust.

Featured image from Infobae, chart from TradingView