Ethereum Faces Third Rejection at $4,000 Resistance Amid Market Downturn

Following a recent downturn in the crypto market, Ethereum (ETH) has faced rejection at the $4,000 resistance level three times since March 2024. Currently, it trades at $3,400, reflecting a 6.7% decline in the past 24 hours.

Factors Affecting Ethereum's Price Performance

Despite a 47% year-to-date gain, ETH has underperformed compared to Bitcoin (BTC), Solana (SOL), and XRP. Key factors influencing Ethereum’s price momentum include:

- Weaker brand recognition compared to Bitcoin: The launch of spot ETH exchange-traded funds (ETFs) in August did not generate significant price movement.

- Investor interest disparity: U.S. spot ETH ETFs hold $11.98 billion in net assets, while spot BTC ETFs have $109.66 billion.

- Large outflows: Over $60 million exited spot ETH ETFs in a single day, marking the largest outflow since November 19. Analyst Ali Martinez noted that social sentiment for ETH hit a one-year low, potentially indicating a bullish opportunity based on historical trends.

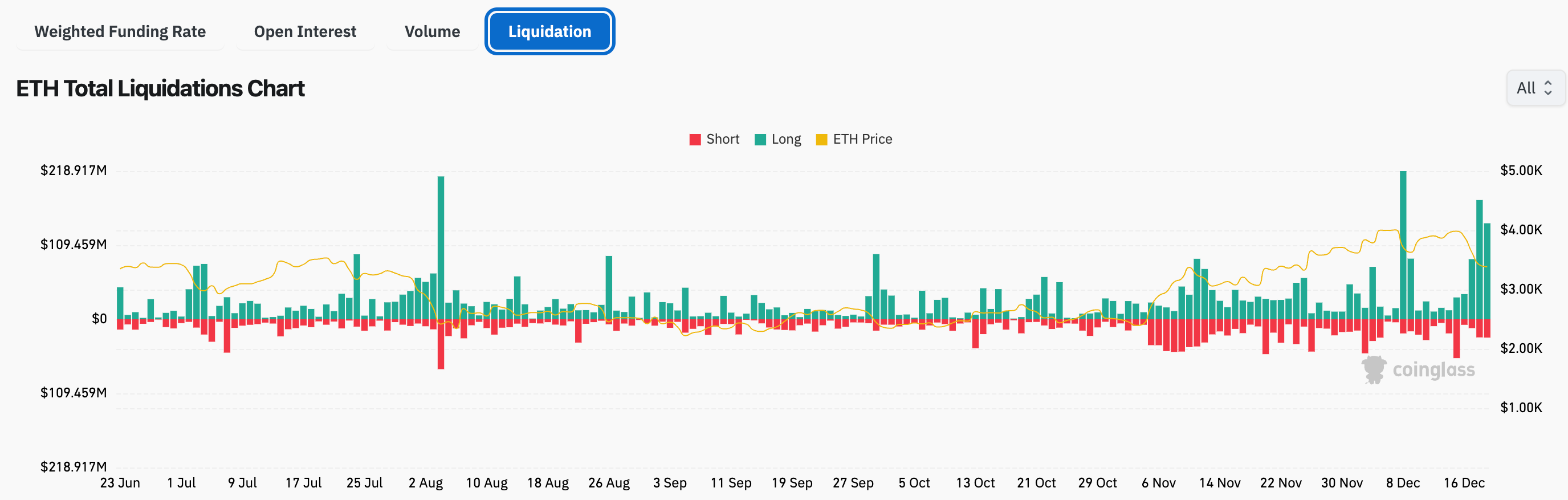

- Bearing futures traders: The aggregated premium for futures positions turned negative for the first time since November 6. A significant liquidation event occurred, with $299 million liquidated in one day, leading to increased volatility.

- Concerns about the Ethereum Foundation's selling practices: The foundation sold 100 ETH on December 17, after which ETH's price dropped by approximately 17%.

- Supply issuance skepticism: A Binance Research report questioned Ethereum's "ultrasound money" narrative due to its high issuance rate.

Potential for a Price Bounce

Analyst @Trader_XO reported purchasing spot ETH at $3,200 and anticipates a period of price consolidation before a potential upward movement. Trader @CryptoShadowOff identified a possible ascending triangle formation on ETH’s monthly chart, suggesting a further drop to the $2,800 range before targeting new all-time highs.

Market analyst @CryptoBullet1 highlighted that ETH is currently oversold on the 4-hour chart, indicating a potential bounce. As of now, ETH trades at $3,400, down 6% in the past 24 hours.