Ethereum Spot ETFs Record $295 Million in Daily Inflows

Ethereum (ETH) has surged nearly 37% in the past week, following Bitcoin’s (BTC) all-time-high rally. As the second-largest cryptocurrency with a market cap of approximately $404 billion, ETH's recent performance indicates growing momentum.

Spot Ethereum ETFs Record Daily Inflows

Spot ETH ETFs experienced record daily inflows, attracting $295 million on November 11, surpassing the previous peak of $106 million from July 2024. Fidelity’s FETH ETF led the inflows with $115.48 million, followed by BlackRock’s ETHA at $101.11 million, Grayscale’s ETH at $63.32 million, and Bitwise’s ETHW at $15.57 million.

The total net assets across various spot ETH ETFs currently amount to $9.72 billion, representing over 2.41% of Ethereum’s total market cap. Cumulative net outflows from all spot ETH ETFs stand at $41.30 million.

ETH Price Action and Resurgence in DeFi

Institutional interest in Ethereum ETFs is positively impacting ETH’s price action. Throughout 2024, ETH lagged behind major cryptocurrencies such as BTC and Solana (SOL), but Q4 2024 shows potential for recovery.

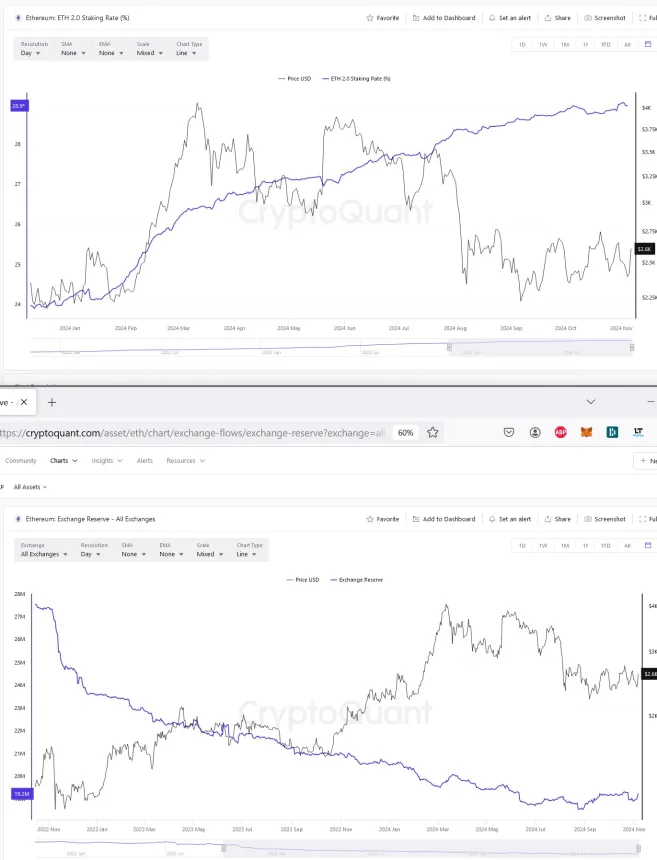

Analysis by Leon Waidmann indicates that ETH staking levels are at an all-time high while reserves on exchanges are declining, suggesting a possible supply squeeze that may lead to significant price increases.

The ETH/BTC trading pair is recovering after prolonged losses, moving from 0.034 to 0.040 before settling at 0.037. The next resistance level is around 0.040, which could drive further gains for ETH if surpassed. Currently, ETH is about 32% below its all-time high of $4,878 recorded in November 2021.

Additionally, Ethereum’s decentralized finance (DeFi) activity is increasing. Total value locked (TVL) across Ethereum-based DeFi protocols is now $62.36 billion, up from approximately $24 billion in November 2023. Over half of this TVL is associated with the ETH staking platform Lido, holding close to $33 billion, followed by Aave at $15.21 billion and EigenLayer at $14.57 billion.

Concerns regarding ETH’s issuance rate may affect its narrative as “ultrasound money.” As of now, ETH trades at $3,291, reflecting a 3.1% increase in the past 24 hours.