BEARISH 📉 : Ethereum struggles to reclaim $2,550 amid market headwinds

Key Points:

- Ethereum needs to surpass the $2,550 resistance with high volume to confirm a bullish reversal toward $2,800.

- A drop below the $2,250 support may lead to a decline to $1,850.

- Macroeconomic factors and the upcoming Pectra upgrade might influence Ethereum's price movement.

- LiquidChain integrates liquidity from Bitcoin, Ethereum, and Solana, aiming to solve cross-chain liquidity issues.

Ethereum is facing challenges breaking the $2,500 level due to muted ETF inflows and a cautious global market. Long-term holders are accumulating, which may hint at a future supply squeeze. Analysts believe reclaiming $2,550 could lead to rapid gains towards $2,800.

Technical Outlook

- Ethereum is near a critical demand zone, showing potential for recovery rallies.

- A 'higher low' pattern on the weekly chart suggests possible seller exhaustion.

- The Pectra upgrade and potential macro liquidity injections could contribute to a price increase.

- Boredom from prolonged consolidation may cause capital outflow unless volume confirms a breakout.

Price Scenarios for Q4, 2026:

- Bull Case ($2,800 - $3,200): ETH breaks $2,550, leading to a short squeeze and a rise to $3,000.

- Base Case ($2,300 - $2,550): ETH remains range-bound as the market processes macroeconomic data.

- Bear Case ($1,850 - $2,100): Failure to maintain $2,250 support triggers a drop to $1,850.

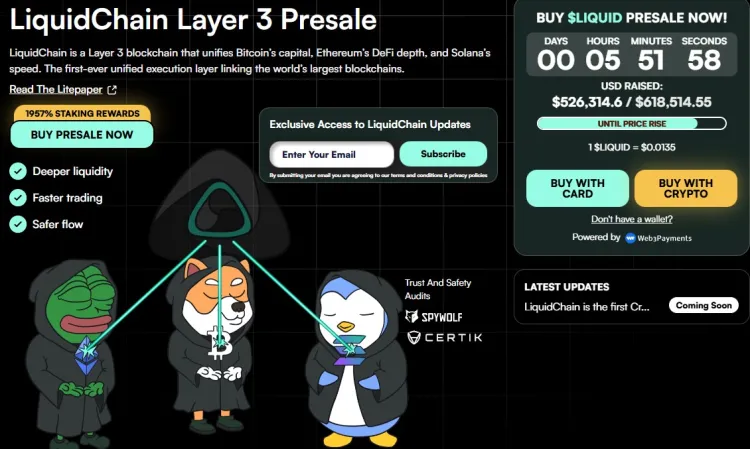

LiquidChain's Role

LiquidChain offers a solution to liquidity fragmentation by combining BTC, ETH, and SOL into one environment. This approach reduces friction for DeFi users and allows developers to access liquidity across major chains.

The LiquidChain presale has raised over $527k, with tokens priced at $0.0135. Moving funds from established assets like ETH to new ventures like $LIQUID involves substantial risk due to regulatory and technical challenges.

Note: Cryptocurrency investments carry significant risks. Conduct thorough research before making financial decisions.