Ethereum Taker Buy Volume Reaches $1.683 Billion in One Hour

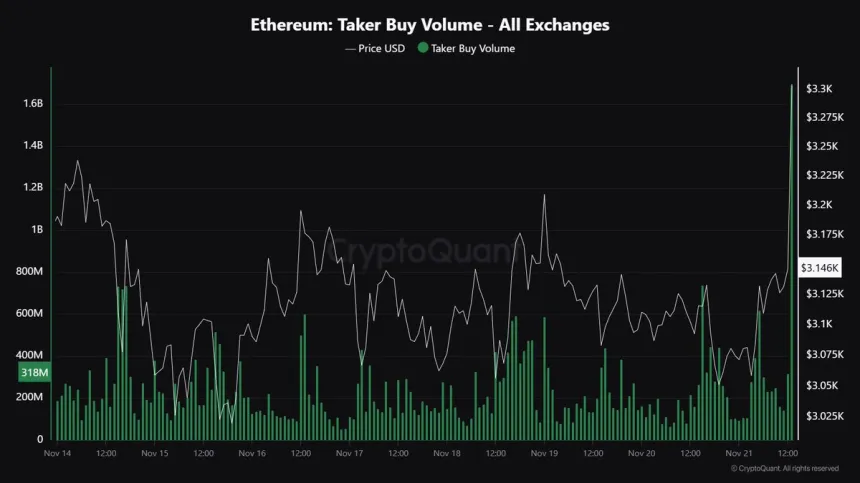

Ethereum surged over 10% recently, indicating a recovery that has revitalized investor optimism as it approaches yearly highs. Key data from CryptoQuant shows Ethereum's Taker Buy Volume reached $1.683 billion in an hourly candle, reflecting significant aggressive buying in the futures market.

The demand for Ethereum is driven by profits being cycled out of Bitcoin, with investors reallocating gains into ETH, enhancing its price. This trend emphasizes Ethereum's role as the second-largest cryptocurrency and its influence in the broader market.

Ethereum Bulls Waking Up

After eight months of bearish trends, Ethereum bulls are re-emerging, with prices increasing over 40% since November 5. This momentum aligns with the overall market rally, suggesting that Ethereum's recovery may be ongoing. The recent Taker Buy Volume highlights significant demand and high-volume trades.

This aggressive buying activity indicates increased confidence in Ethereum’s potential for a sustained rally. Strong demand at this level creates upward price pressure, reinforcing the bullish outlook for ETH.

However, Ethereum faces resistance at the $3,550 level, which has been a barrier since late July. The upcoming days are crucial; breaking above this resistance could signal continued upward movement, while failure to do so might lead to short-term consolidation. Ethereum's next moves will influence the altcoin market.

ETH Holding Above Key Levels

Currently trading at $3,333 post-surge, Ethereum is testing a critical supply zone below $3,450. This area needs to be reclaimed by bulls to confirm an uptrend and sustain momentum for new highs.

Breaking above the historical supply zone would indicate strong buying pressure and potential for a sustained rally. Maintaining above the 200-day moving average (MA) at $2,959 further supports the bullish case, as this benchmark is widely regarded for long-term price trends.

If Ethereum can hold above the 200-day MA and decisively surpass the $3,450 level, it may lead to a bullish rally targeting higher resistance zones. Conversely, failing to break through this supply area could result in short-term consolidation as bulls regroup for another attempt. The focus remains on Ethereum's ability to clear this critical resistance and continue its upward trajectory.

Featured image from Dall-E, chart from TradingView