9 0

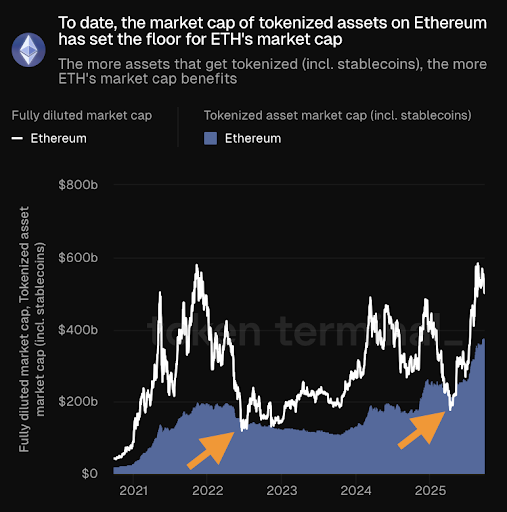

Ethereum’s Market Cap Driven by Stablecoins and Tokenized Assets

The narrative around Ethereum has shifted, establishing it as a key settlement layer for traditional finance due to stablecoins and tokenized real-world assets (RWAs).

Impact of Stablecoins and RWAs on Ethereum

- Stablecoins and RWAs are essential for Ethereum's market cap, forming a base for its valuation.

- The increase in tokenized assets on Ethereum enhances the total value locked and boosts Ethereum's market cap.

Stablecoins have gained credibility, aiding Ethereum and DeFi. These assets offer practical utility and potential yields of 5–10% on-chain, contrasting with the volatility often associated with Bitcoin.

Future Developments

- The release of Go-Pulse v3.3.0 will enhance Ethereum's speed and robustness.

- This update from GETH v1.13.13 to v1.16.3 brings significant performance improvements.