5 0

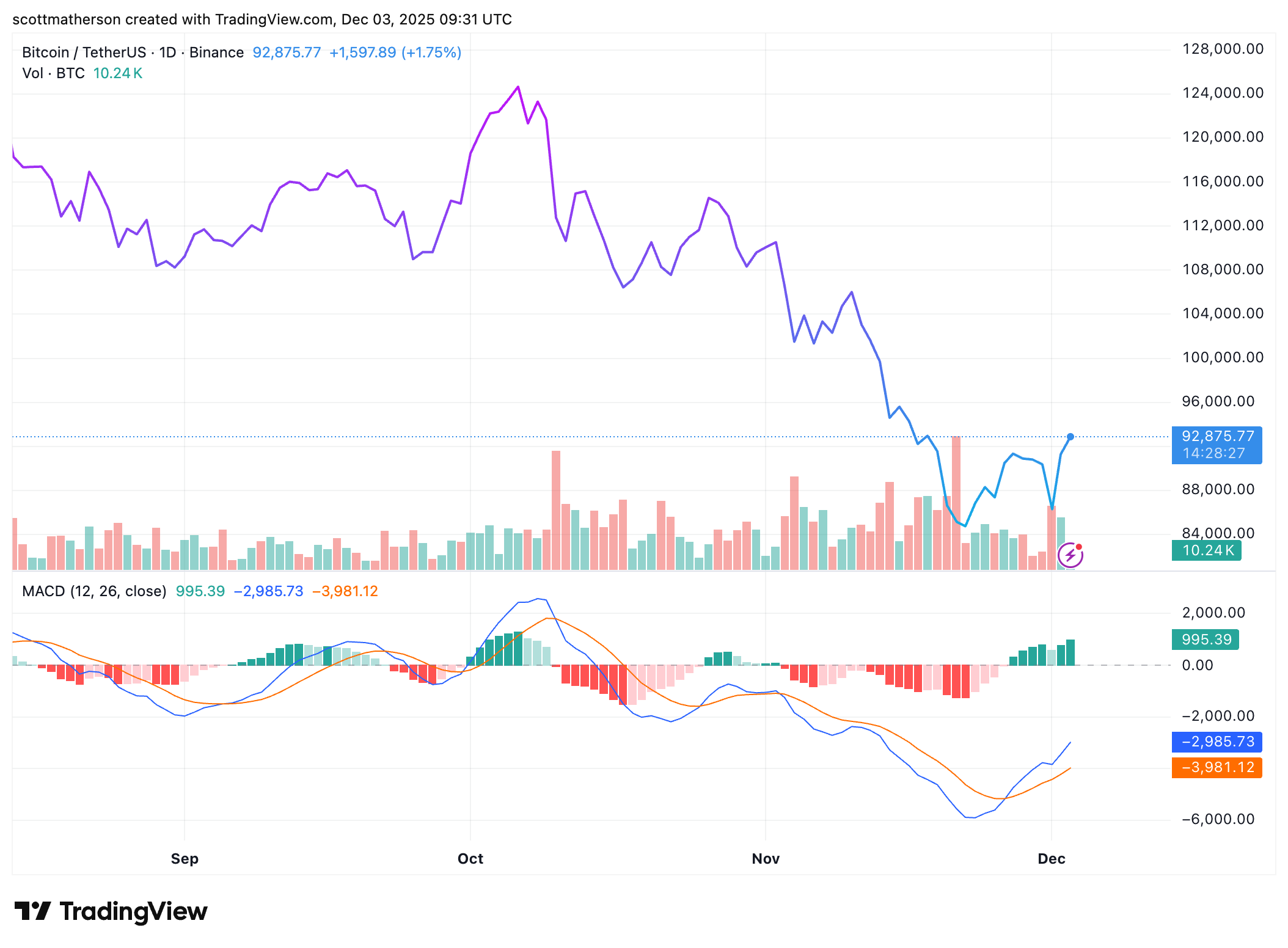

US Fed Ends Quantitative Tightening, Bitcoin Price Remains Under $100,000

The Federal Reserve has ended its quantitative tightening program, freezing its balance sheet at approximately $6.57 trillion after draining over $2.3 trillion since 2022. This decision is anticipated to improve liquidity in the crypto market, potentially pushing Bitcoin above $100,000 soon.

Market Implications

- The Fed's halt on balance-sheet reduction may relieve selling pressure in the crypto industry.

- In historical context, when QT ended in 2019, digital assets rebounded strongly, with Bitcoin rising significantly.

- Currently, the crypto market has risen by 7.2% in the last 24 hours, led by Bitcoin, indicating short-term bullishness.

Delayed Reaction for Bitcoin

- Ending QT does not immediately increase liquidity; it could take weeks for significant changes to occur.

- Past experiences suggest a lag between QT ending and noticeable gains in Bitcoin price.

- The first major liquidity uptick might not appear until early 2026, delaying potential Bitcoin price surges above $100,000.