72 1

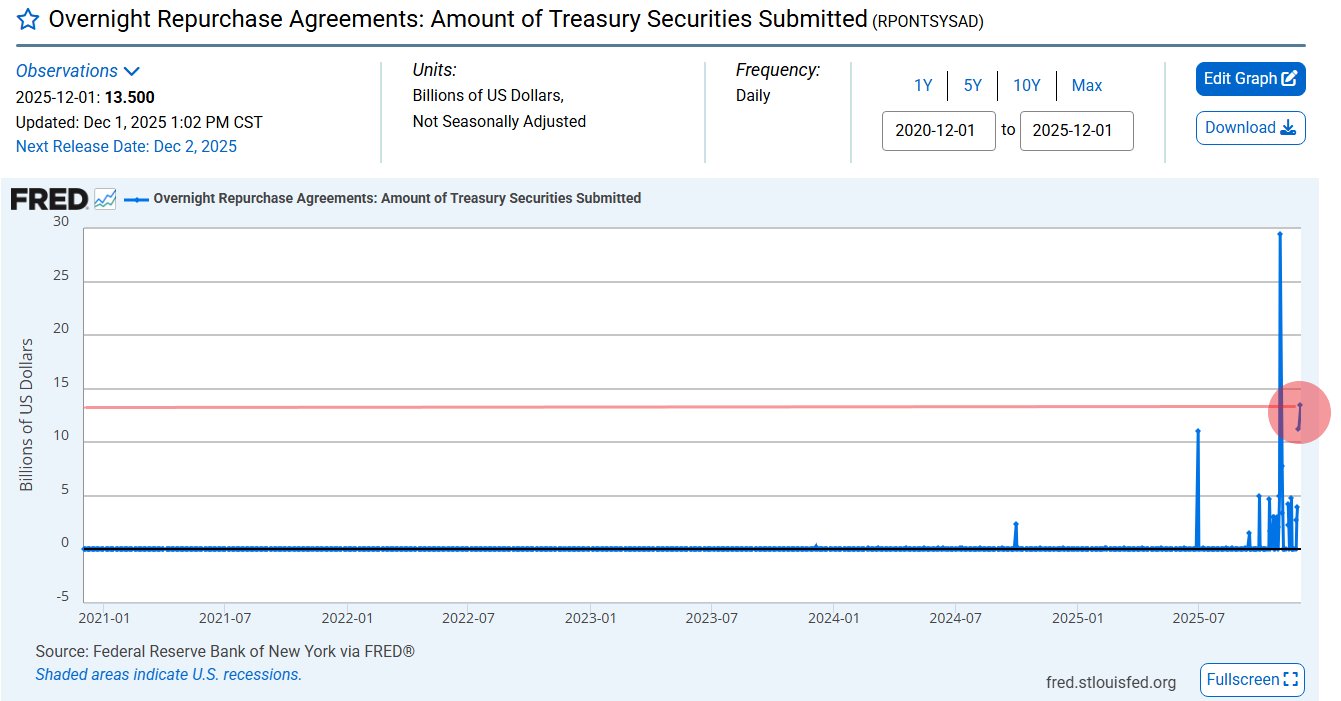

US Fed Ends QT with $13.5 Billion Liquidity Injection

The US Federal Reserve has ended its Quantitative Tightening (QT) on December 1, marking a shift towards liquidity expansion. The Fed injected $13.5 billion into the banking system through overnight repurchase agreements, the second-largest single-day liquidity operation since the COVID-19 crisis.

- This injection signals increased short-term funding demand in the banking sector, potentially benefiting risk assets like US equities and cryptocurrencies.

- Since June 2022, the Fed withdrew about $2.4 trillion from the financial system under QT.

Market experts have differing views on the impact on the crypto market:

- Tom Lee from Fundstrat suggests the end of QT could boost the crypto market, referencing a 17% market rally after the last QT halt. He anticipates stronger market conditions and a potential new all-time high for Bitcoin by late January.

- Upcoming Federal Reserve rate cuts are anticipated during the December FOMC meeting.

- Ted Pillows points out an 81% probability of a Bank of Japan (BOJ) rate hike in December, which historically led to Bitcoin and crypto market declines following previous hikes in March 2024, July 2024, and January 2025.