8 1

Fed Expected to Cut Rates by 25 Bps, Crypto Markets Steady

Market Overview

- Global markets are stagnant as investors await the Federal Reserve's decision on interest rates. A 25 basis points cut is expected.

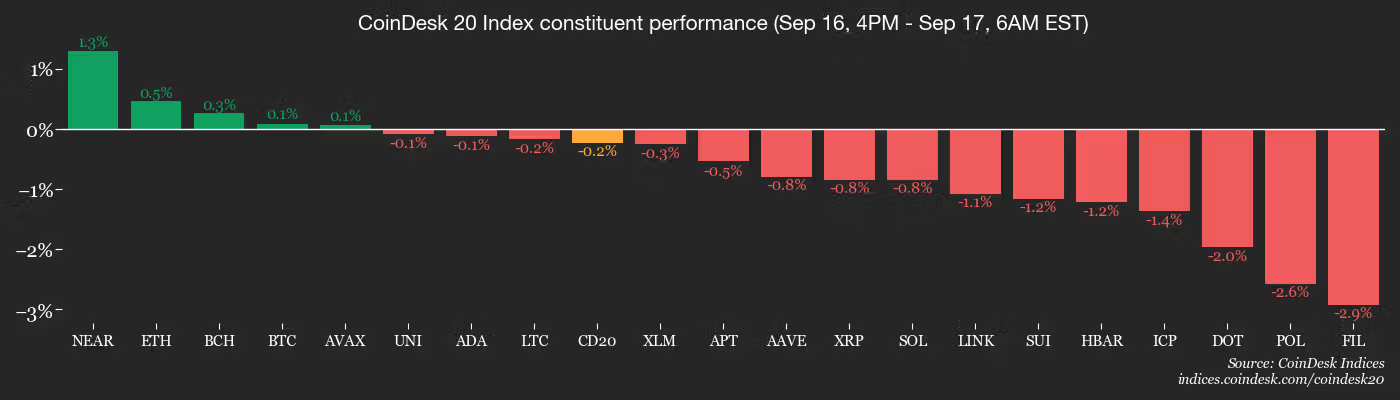

- The CoinDesk 20 index is up 0.2%; Bitcoin increased by 1% over the past 24 hours.

- Gold declined by 0.5% after hitting a record high this week, while the U.S. dollar index rose by less than 0.2%.

- Equities markets show minimal movement; U.S. stocks dropped slightly, while European equities edged higher.

- Over the last 30 days, global equities outperformed cryptocurrencies, with the FTSE All-World Index rising by 2.78%, CoinDesk 20 by 2.6%, and BTC by 1.6%.

- Investors anticipate six interest rate cuts within the next two years.

Cryptocurrency Market Dynamics

- Spot crypto ETFs saw strong demand, with net inflows of $550 million for Bitcoin ETFs and nearly $300 million for Ethereum ETFs.

Notable Events

- MantleDAO is voting on maintaining its budget at $52 million USDc and 200 million MNT; voting ends on September 18.

- ZKsync plans to unlock 3.61% of its circulating supply, valued at $10.54 million, on September 17.

Token Performance and Trends

- Bitcoin remains stable, trading at $116,000 but lacking momentum for a breakout.

- Altcoins benefited from reduced volatility in Bitcoin, leading to lower Bitcoin dominance at an eight-month low of 57%.

- The average crypto token relative strength index (RSI) suggests altcoins are moving into oversold territory, indicating potential for growth.

Derivatives and Market Sentiment

- BTC futures open interest reached $32 billion, though the narrowing basis suggests weakened bullish sentiment.

- BTC Implied Volatility Term Structure indicates long-term volatility expectations, contrasting with short-term bearish positioning.

- BTC funding rates suggest growing bullish conviction if the trend continues.

Current Market Movements

- BTC stands at $116,637.44, up 1.01% over 24 hours.

- ETH remains unchanged at $4,498.24.

- CoinDesk 20 index declined by 0.58% to 4,272.21.

Technical Analysis

- Bitcoin has risen from $107K to $117K, trading above key daily exponential moving averages.

- A decisive reclaim of the $117K-$119K range could indicate continued bullish momentum.

Crypto Equities

- Coinbase closed at $327.91 (+0.27%); pre-market at $326.19 (-0.52%).

- Circle ended at $134.81 (+0.57%), rising to $136.25 (+1.07%) in pre-market.

ETF Flows

- Spot BTC ETFs saw daily net flows of $292.3 million, totaling $57.34 billion.

- Spot ETH ETFs experienced a daily outflow of $61.7 million, totaling $13.68 billion.

Developments While You Were Sleeping

- Metaplanet established U.S. and Japan subsidiaries and acquired the Bitcoin.jp domain.

- 21Shares launched new ETPs focused on AI and Raydium protocols.

- Hex Trust expanded institutional access to Ethereum rewards through Lido’s stETH custody and staking services.