Fed Expected to Cut Rates on Sept. 17 Amid Inflation Concerns

Investors are anticipating the Federal Reserve's monetary policy decision on September 17, expecting a 0.25% rate cut. This could cause short-term volatility but might support long-term growth in risk assets.

- August CPI rose by 0.4%, with an annual rate increase to 2.9%, driven by shelter, food, and gasoline prices.

- Core CPI increased by 0.3%.

- PPI showed a slight decline of 0.1% in August but was 2.6% higher year-over-year, with core PPI up 2.8%.

The labor market shows signs of cooling:

- Only 22,000 jobs were added in August.

- Unemployment remained at 4.3%, and labor force participation at 62.3%.

- Average hourly earnings rose by 3.7% year-over-year.

Bond markets reflect these conditions, with a 93% likelihood of a rate cut. The 2-year Treasury yield is at 3.56%, and the 10-year at 4.07%.

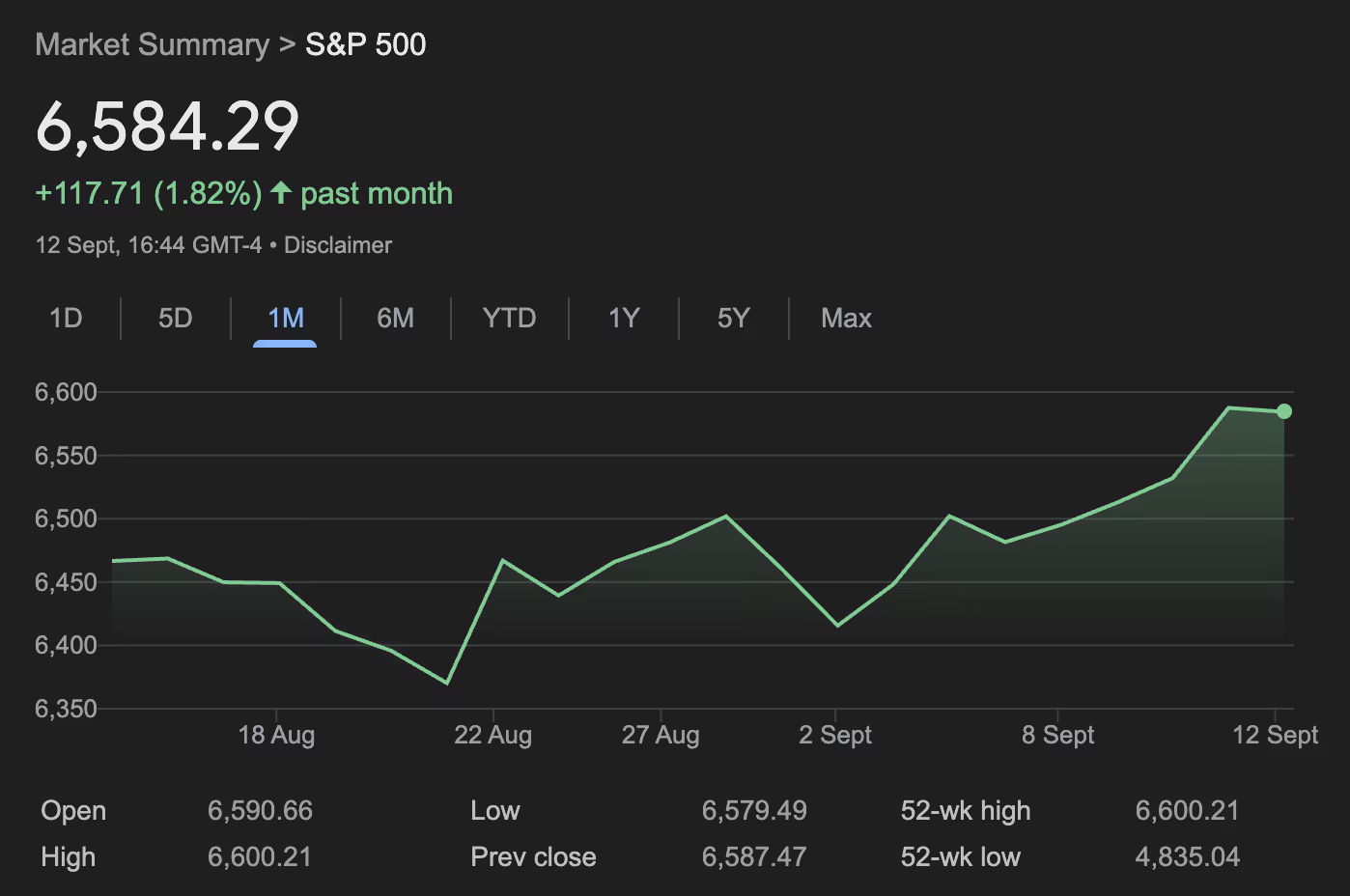

Equities are performing well:

- S&P 500 closed at 6,584, rising 1.6% over the week.

- Nasdaq Composite achieved five consecutive record highs, closing at 22,141.

- Dow Jones slightly declined but gained weekly.

Crypto and commodities also rallied:

- Bitcoin trades at $115,234, below its all-time high but significantly higher for the year.

- Gold surged to $3,643 per ounce, nearing record highs.

Historically, when the Fed cuts rates near S&P 500 highs, the index tends to rise over the following year, averaging nearly 14% gains. However, stocks often decline initially post-cut.

The Fed's upcoming decision will likely impact markets significantly, balancing between controlling inflation and maintaining credibility while supporting growth.