10 2

Fidelity’s Timmer Analyzes Bitcoin and Gold in Current Market Landscape

Jurrien Timmer, Director of Global Macro at Fidelity Investments, analyzes potential impacts on markets, central bank policies, and the trajectories of Bitcoin and gold in a recent note. Key points include:

- The S&P 500 has reached new highs, but market sentiment is mixed.

- Bitcoin leads in three-month returns, followed by gold, Chinese equities, commodities, and European markets.

- The equal-weighted index shows only 55% of stocks above their 50-day moving averages, indicating underlying market indecision.

- Federal Reserve policy will likely remain unchanged, with core inflation at 3.5% suggesting a pause in rate changes.

- Timmer warns against a “premature pivot” by the Fed, recalling past policy errors that allowed inflation to rise.

- Future interest rate direction may be influenced by government spending and employment data.

- Commodities could see renewed interest if inflation remains high.

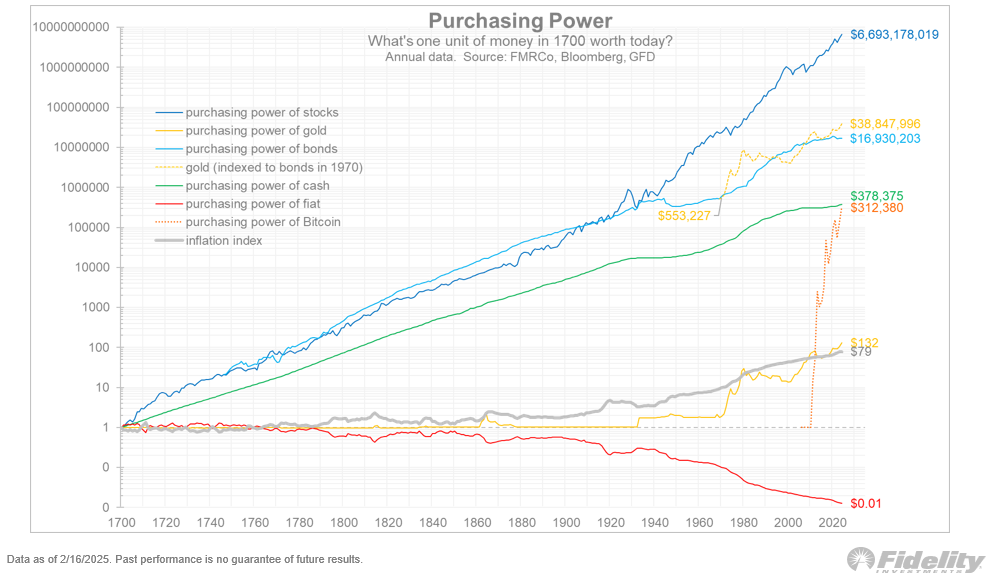

- Gold outperformed expectations since 2020, potentially testing the $3,000 level due to increased money supply and declining real yields.

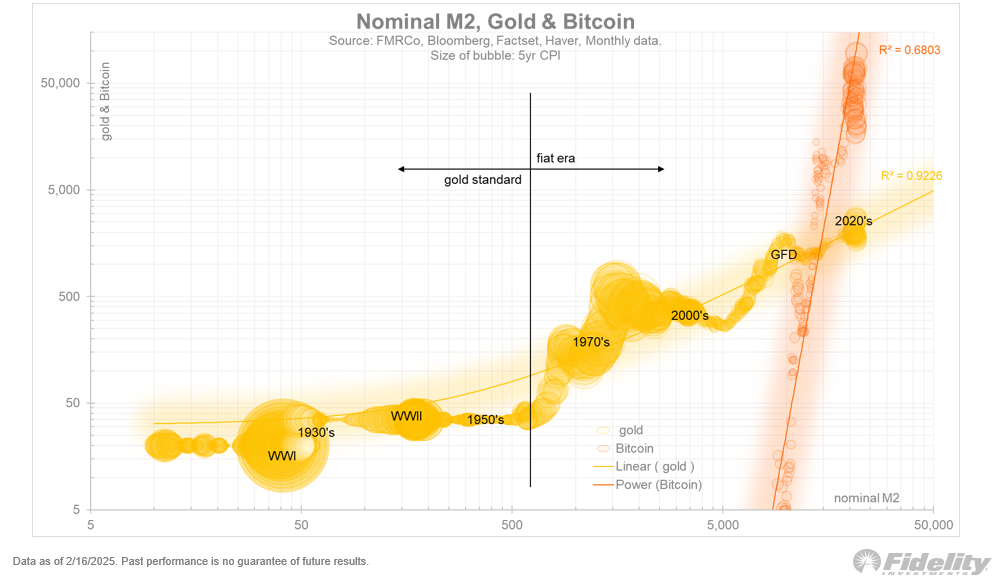

- Both Bitcoin and gold show strong correlations to money supply (M2), but impact asset prices differently.

- Gold serves as a hedge against bonds, particularly in a climate of sovereign debt pressures and rising rates.

At the time of writing, Bitcoin is priced at $95,700.