12 1

– Four-year cycle end signals extended Bitcoin bull run until 2027 – Global liquidity shifts and stablecoin activity drive current market dynamics – US Treasury policies and global monetary easing boost risk asset appeal – Political support for crypto and potential policy changes enhance growth prospects

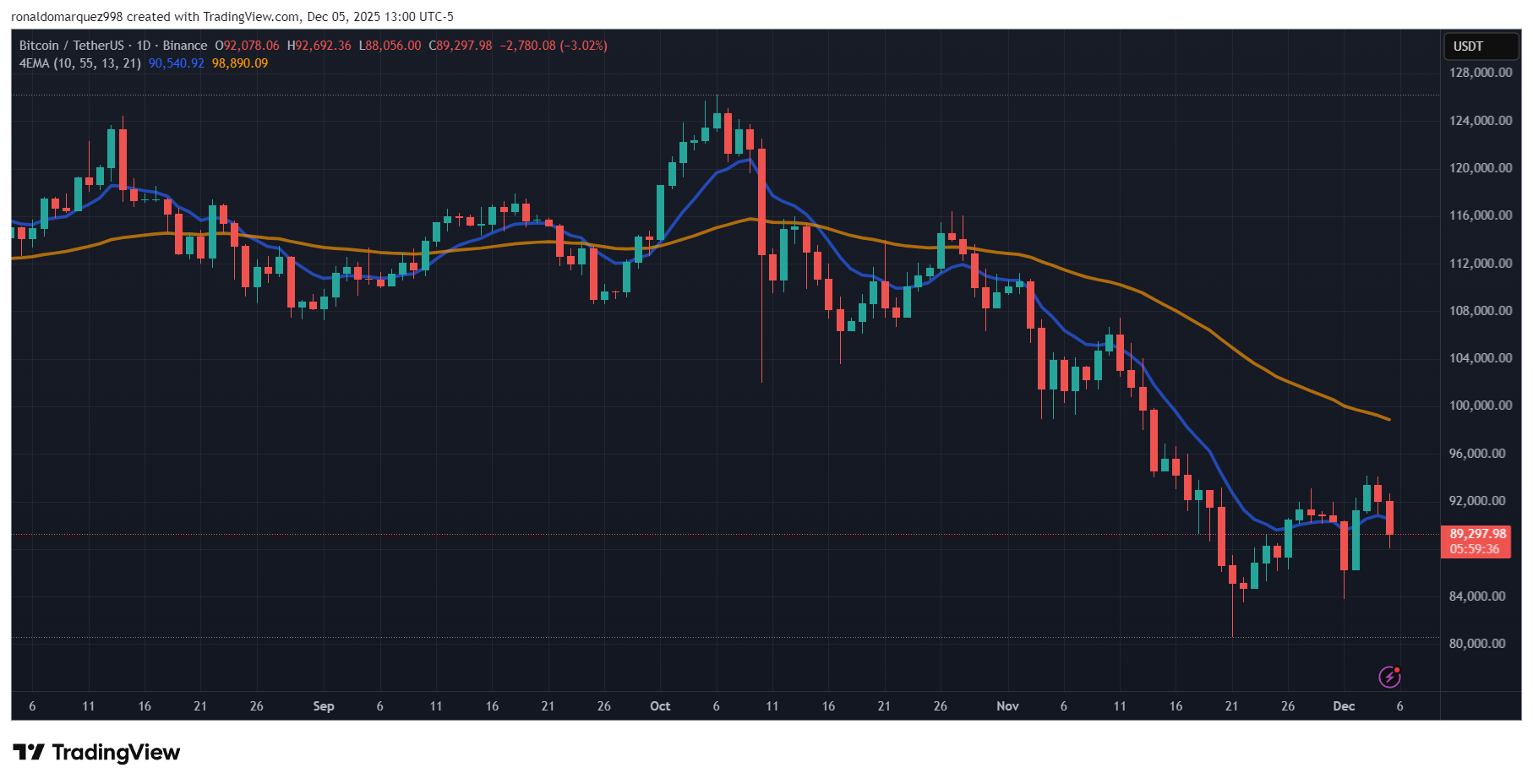

Recent discussions in the crypto community suggest the traditional four-year Bitcoin market cycle may be ending. Analysts from Bull Theory argue this cycle is not dead but delayed, projecting a Bitcoin bull run extending until 2027.

Factors Influencing the Shift

- The four-year cycle's relevance is diminishing; past significant price movements were influenced more by global liquidity shifts than just Bitcoin Halving events.

- Stablecoin liquidity remains high, indicating continued large-scale investor engagement.

- US Treasury policies, with a current Treasury General Account (TGA) balance of $940 billion, are expected to inject surplus cash into the financial system, boosting liquidity and risk asset appeal.

- Globally, China is adding liquidity, Japan has introduced a $135 billion stimulus package, Canada is easing monetary policy, and the US Fed has paused quantitative tightening measures.

Political and Monetary Conditions Favoring Bitcoin

- Expansive monetary policies by major economies often cause rapid responses in risk assets like Bitcoin compared to traditional markets.

- Potential reimplementation of the Supplementary Leverage Ratio (SLR) exemption could increase credit creation and market liquidity.

- Political factors include potential US tax reforms and a new Federal Reserve chair favoring cryptocurrency support.

The cumulative effect of increased stablecoin liquidity, Treasury injections, global quantitative easing, and easing monetary policies suggests an extended Bitcoin uptrend rather than a typical sharp rally followed by a bear market. This indicates a prolonged growth phase potentially lasting through 2026 and into 2027.