Futures Trading Dominates Bitcoin Volumes, Overshadowing ETFs and Spot Markets

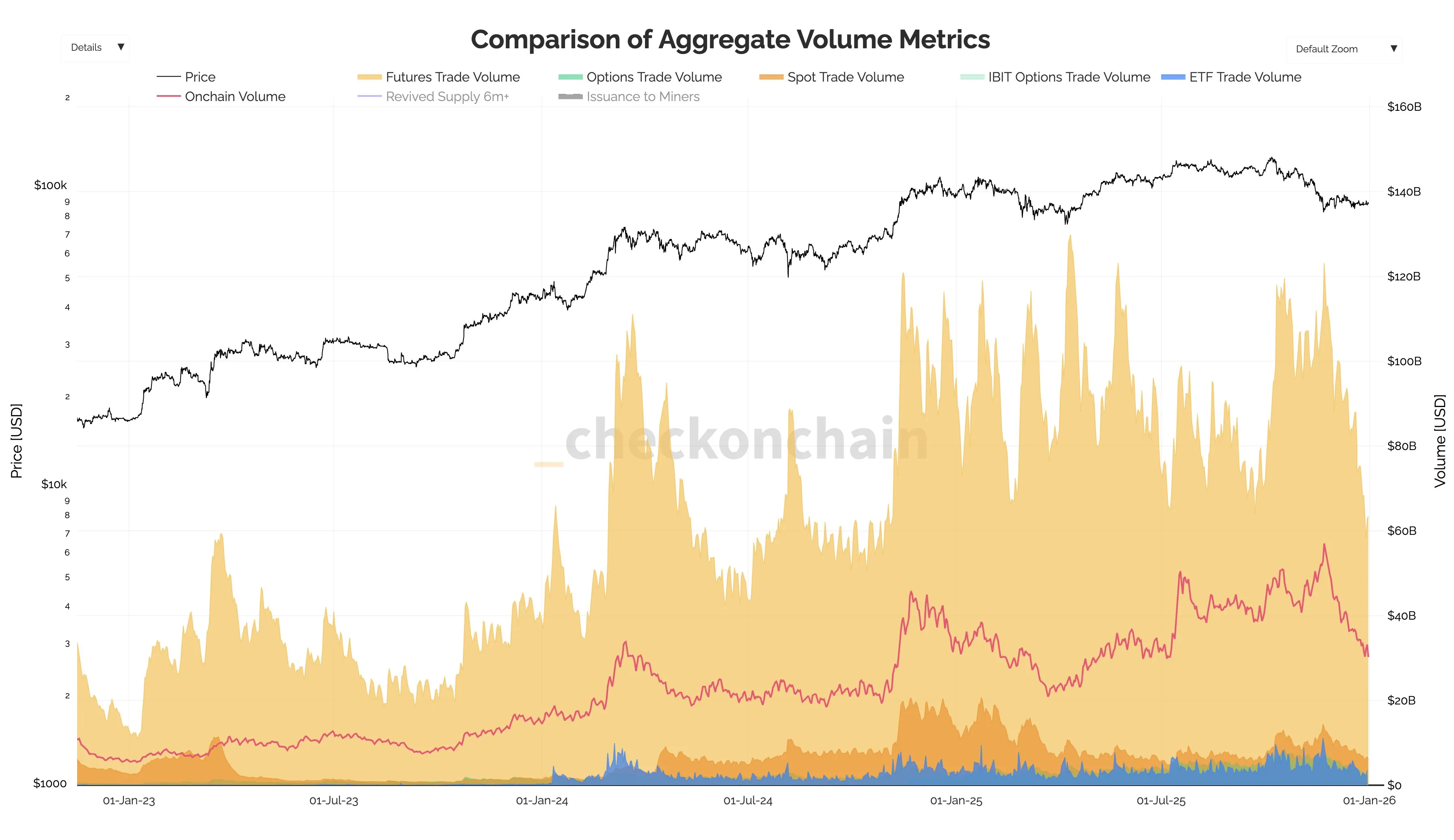

Bitcoin's recent trading stagnation is attributed more to derivatives activity than spot Bitcoin ETFs. CryptoQuant analyst Darkfost highlights:

- Bitcoin futures volumes have decreased from $123 billion to $63 billion since November 2022.

- Futures volumes remain significantly higher than spot Bitcoin ETFs and spot market volumes, contributing to low volatility.

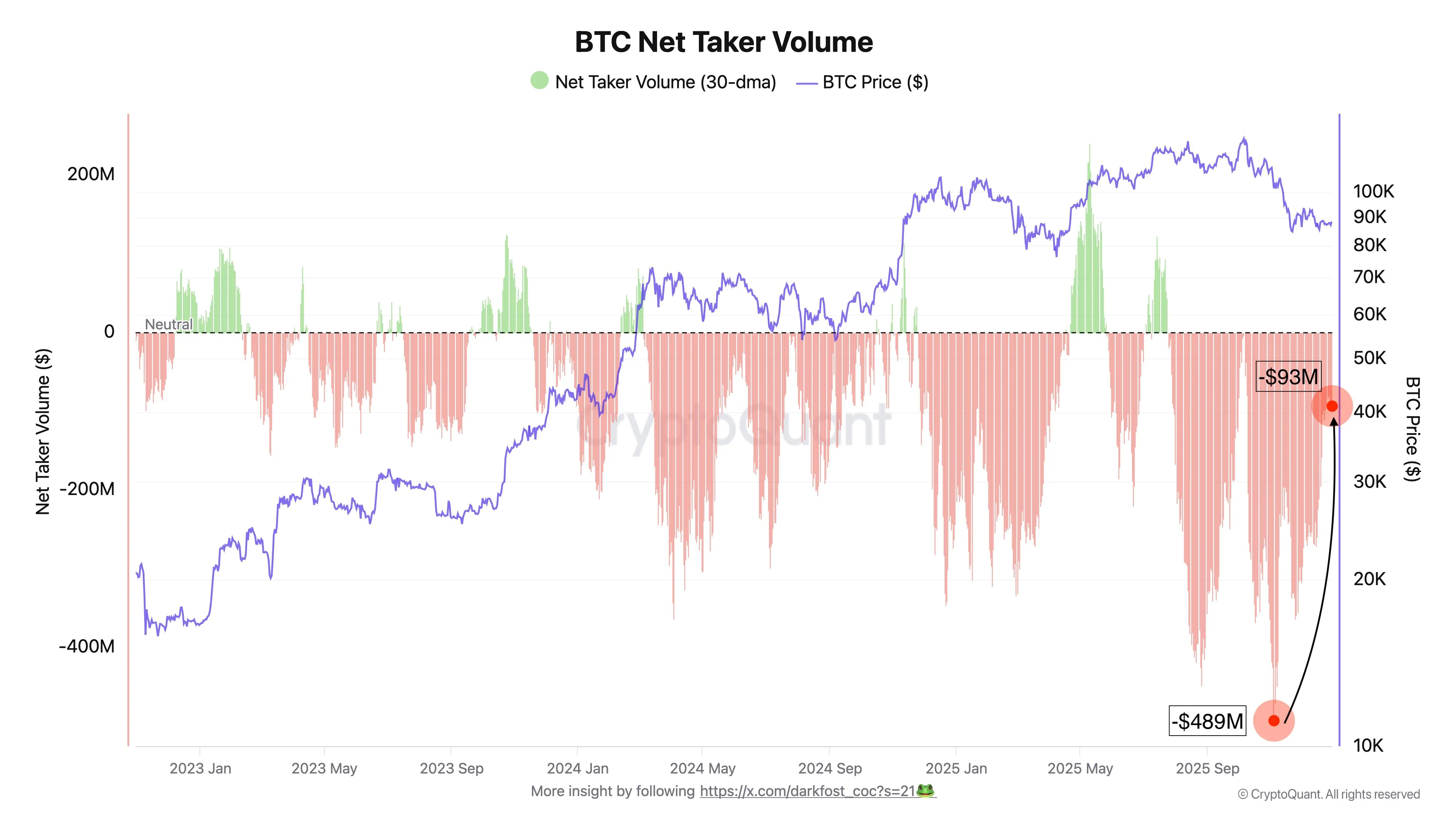

Net taker volume indicates ongoing selling pressure, with Bitcoin struggling to trend positively. Since July, net taker volume has mostly been negative, except for a brief slowdown in early October.

- Recent improvement in net taker volume suggests declining futures-driven selling pressure, although liquidity remains weak.

Demand Dynamics

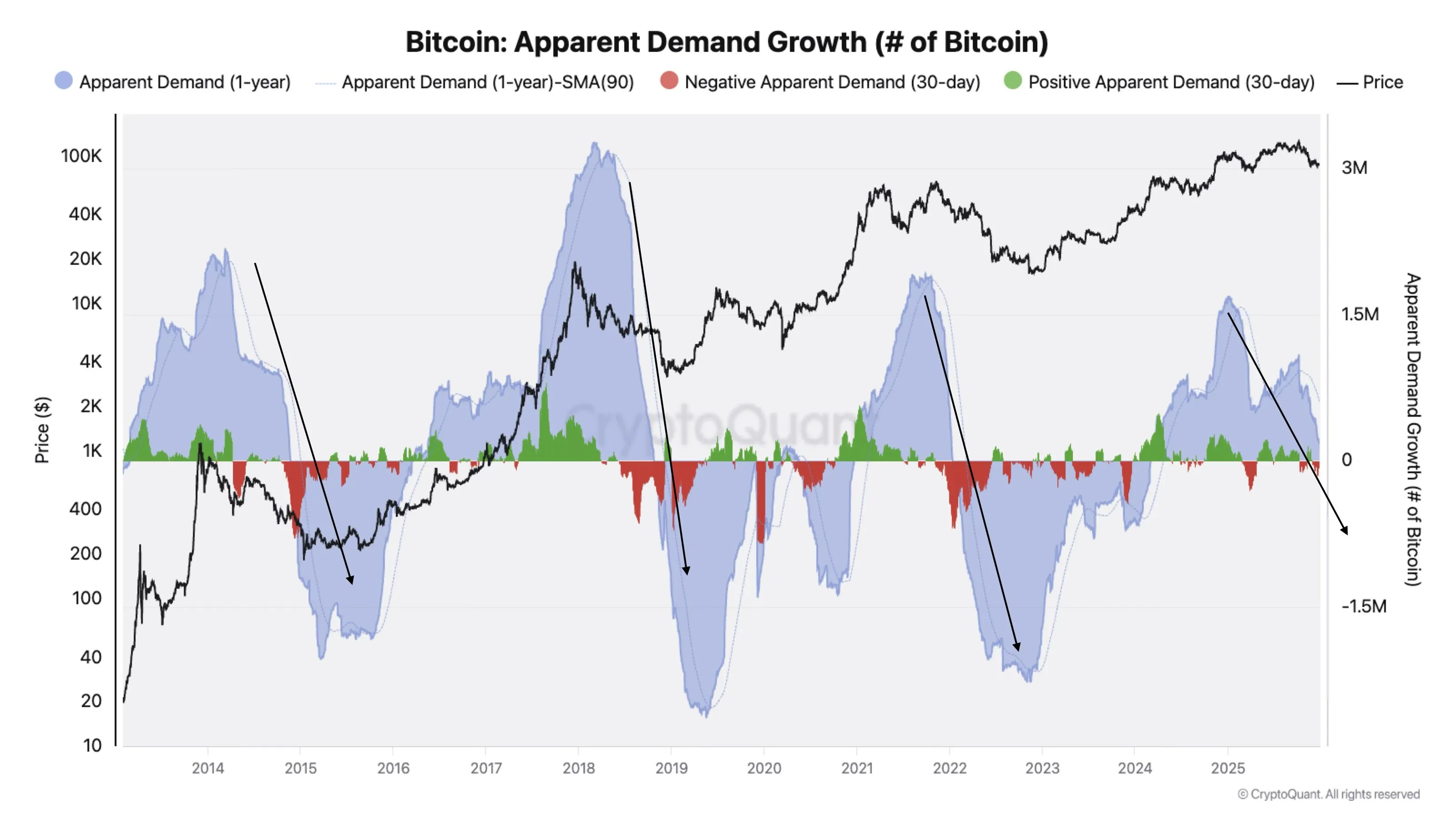

CryptoQuant’s Julio Moreno emphasizes the importance of demand over price cycles. Bitcoin's demand is contracting both monthly and annually, nearing negative territory.

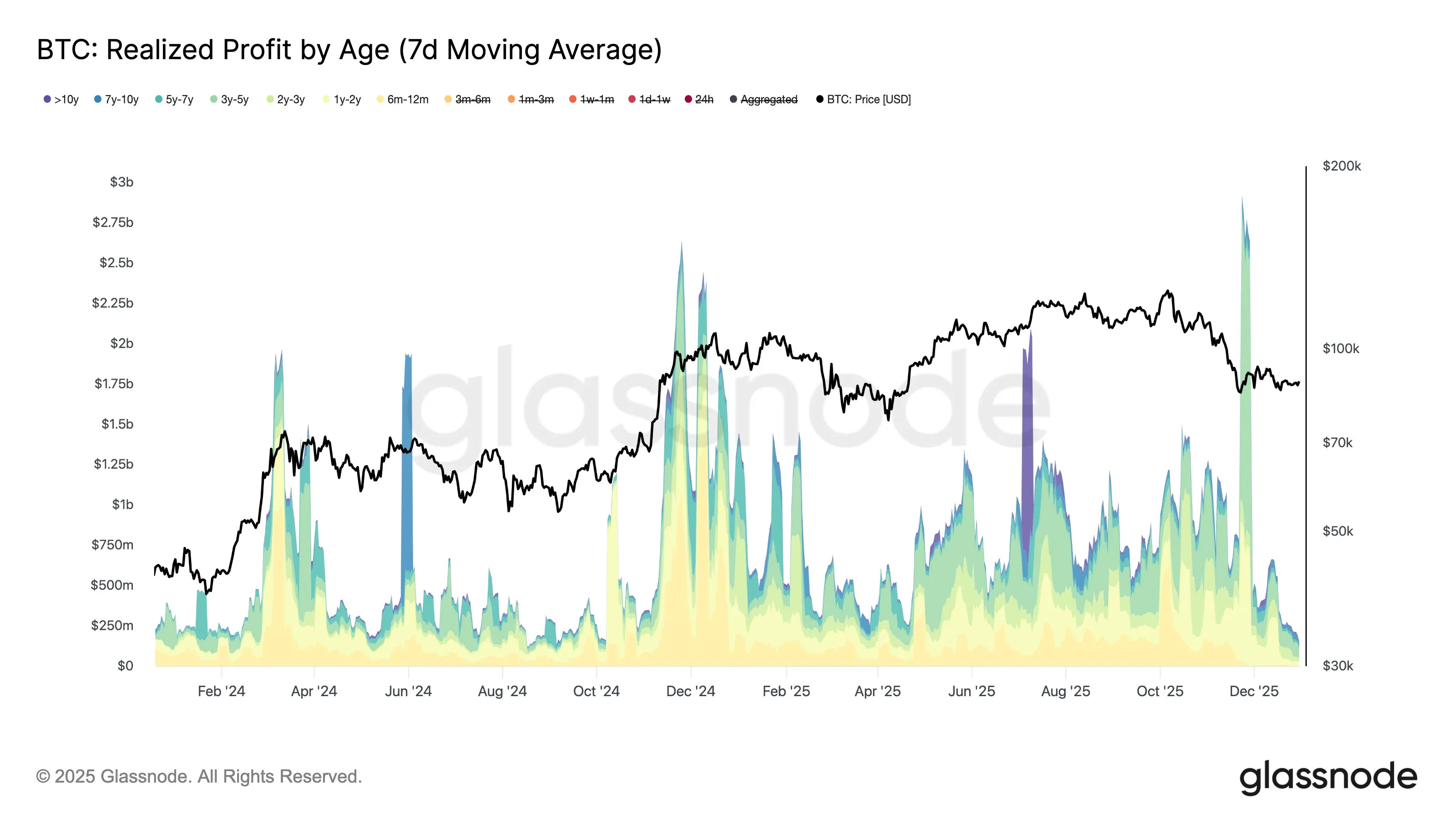

Long-term holders (LTHs) have recently contributed to Bitcoin's underperformance against stocks and gold. Although LTH selling appears to have slowed, it continues at ~7.3k BTC/day, indicating a cooldown rather than a shift to accumulation.

Currently, Bitcoin trades at $87,972.