8 0

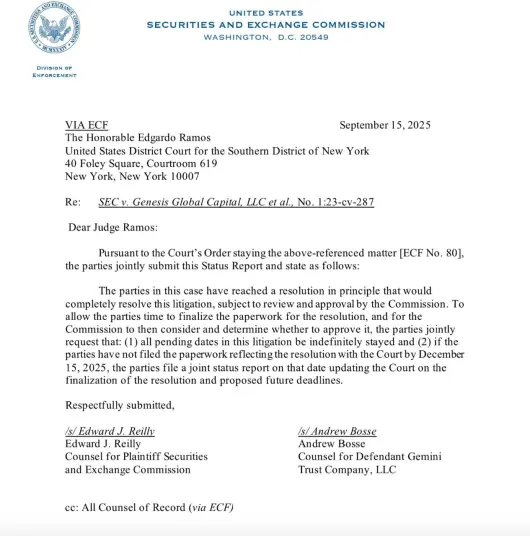

Gemini and SEC Reach $10-20M Settlement Over Earn Program

The crypto industry witnesses a potential turning point as Gemini and the SEC near a settlement regarding the Gemini Earn lending program:

- Gemini's Earn allowed users to lend assets like Bitcoin through Genesis Global Capital.

- In late 2022, $900M was frozen, affecting around 340K customers.

- The SEC accused Gemini of operating an unregistered securities scheme in early 2023.

- A $21M deal with Genesis and a planned $10–20M settlement for Gemini are underway.

Gemini recently completed a $425M IPO, suggesting strengthened market confidence.

As regulatory approaches soften, investor interest pivots towards new crypto projects:

Notable Projects:

- Best Wallet Token ($BEST): A utility token priced at $0.025645, integrated into an ecosystem combining wallets, NFTs, DeFi, and presales. Raised $15.8M during presale.

- SUBBD Token ($SUBBD): Focusing on AI-driven content creation and decentralized payments, supporting creators by reducing platform fees. Presale price at $0.05645, raising $1.1M.

- World Liberty Financial ($WLFI): Governance and utility token trading at approximately $0.2212, part of a multichain ecosystem with a USD-pegged stablecoin.

The settlement between Gemini and the SEC indicates potential growth and stability in the crypto market, highlighting these emerging tokens as possible areas of interest.