Glassnode’s Bitcoin Seller Exhaustion Indicator Signals Potential Market Bottom

A Bitcoin indicator from the on-chain analytics firm Glassnode has indicated a potential reduction in selling pressure.

Bitcoin Seller Exhaustion Spike

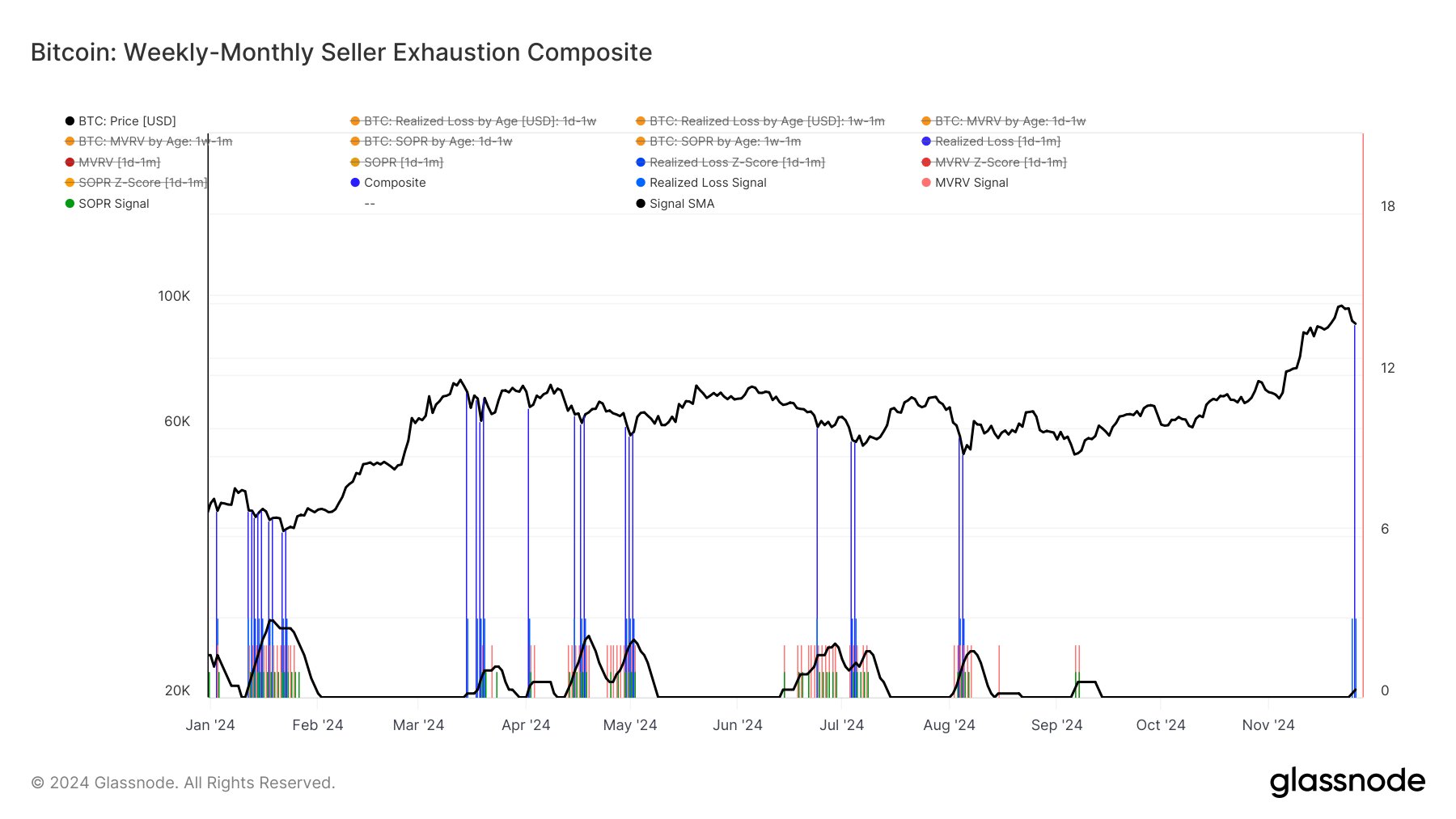

Glassnode's recent post on X highlights the Seller Exhaustion Composite for Weekly-Monthly Bitcoin traders, which assesses whether market selling has reached exhaustion. This metric incorporates several on-chain indicators, notably the Realized Loss, measuring the total losses locked in by BTC investors.

Historically, Bitcoin prices have typically formed bottoms during periods of high holder capitulation. During these events, coins shift from less resilient holders to more committed entities, decreasing the likelihood of further selling and enabling price rebounds.

The focus here is on the Seller Exhaustion Composite specifically for investors who acquired their coins within the last month. This group tends to sell more readily compared to long-term holders, who rarely capitulate except during major downturns. In contrast, newer buyers may panic sell at any point in the cycle, including bull markets.

The chart below illustrates the trend in the Bitcoin Seller Exhaustion Composite among new market buyers:

The graph indicates that the Seller Exhaustion Composite for Weekly-Monthly traders has signaled high locked-in losses, as noted by Glassnode. This latest capitulation aligns with a price decline following Bitcoin's all-time high above $99,000.

Past patterns show that high loss-taking instances often corresponded with price bottoms over the last year, suggesting a possible bottom formation following the current capitulation.

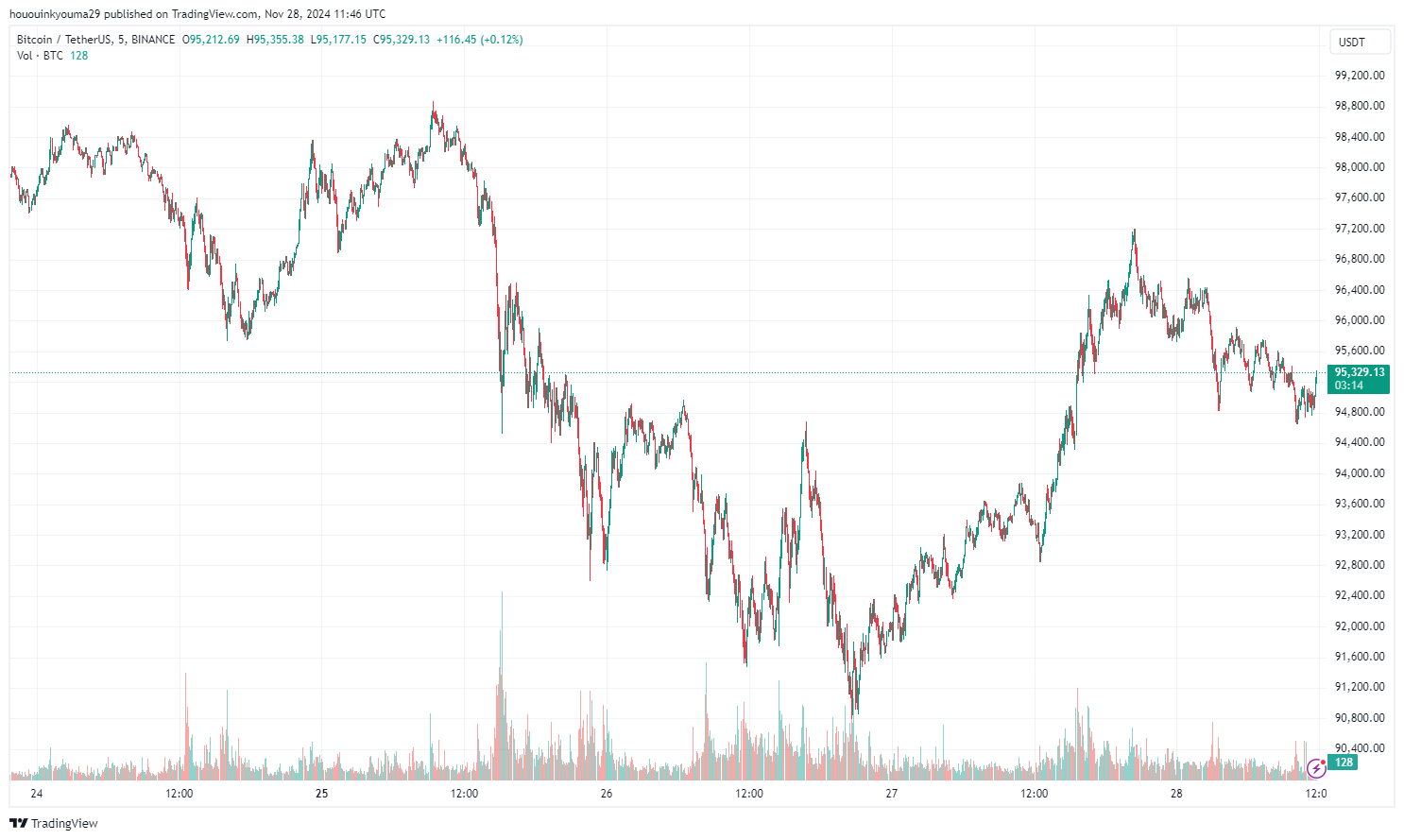

BTC Price

Bitcoin recently dropped to approximately $90,000 but has since recovered to around $95,400.