6 0

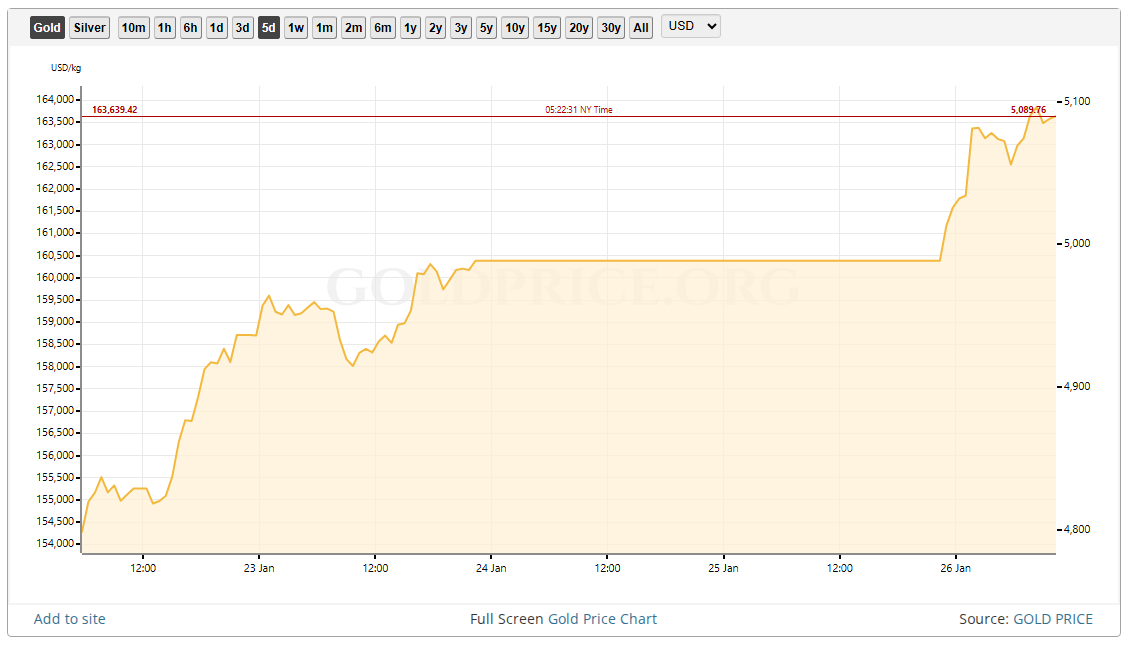

Gold Reaches $5K as Bitcoin Lags Behind in Market Shift

Gold reached new peaks, surpassing $5,000 per ounce, driven by safe-haven demand and geopolitical tensions. Silver also climbed to about $107/ounce.

- Gold's rise fueled by geopolitical tensions and potential trade moves from the US government.

- A weaker dollar increased gold's attractiveness globally, alongside central bank purchases.

Bitcoin Performance

- Bitcoin remained in the mid-$80,000s, approximately 30% below its October 2025 peak.

- Volatility and risk perception shifted investor preference towards safer assets like gold.

- Funds are reducing crypto exposure amid market uncertainty.

Investors are gravitating toward stable assets due to fears of a US funding crisis and tariff announcements. This shift is reflected in options and futures trading trends favoring metals.

Market Outlook

- Key indicators include the dollar's trajectory, central bank actions, and US political developments.

- For Bitcoin, network activity, large transactions, and regulatory updates will be crucial.

- While some anticipate a crypto rebound, it remains dependent on broader policy and macroeconomic factors.